-

There are no signs of any sequential moderation in food prices in August…we expect Consumer Price Index (CPI) inflation prints to remain elevated in the next couple of months, and then start easing in Q4 2023-24

Rahul Bajoria, Chief India economist, Barclays

The real worry, however, may not be with the kharif crop. Farmers may be able to salvage it with one more shower or even the available moisture. Instead, problems may occur with the wheat, mustard, onion, potato and other crops to be planted in the upcoming rabi season, according to experts. Then there is the possibility of water shortage: the Central Water Commission’s latest data on water in 146 major reservoirs show these at 78.6 per cent of last year’s and 93.9 per cent of the 10-year average levels for this time.

Inflation breach

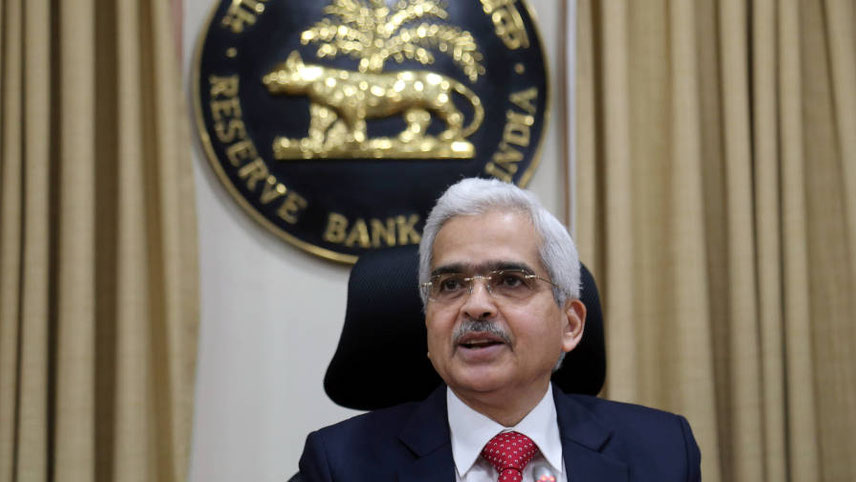

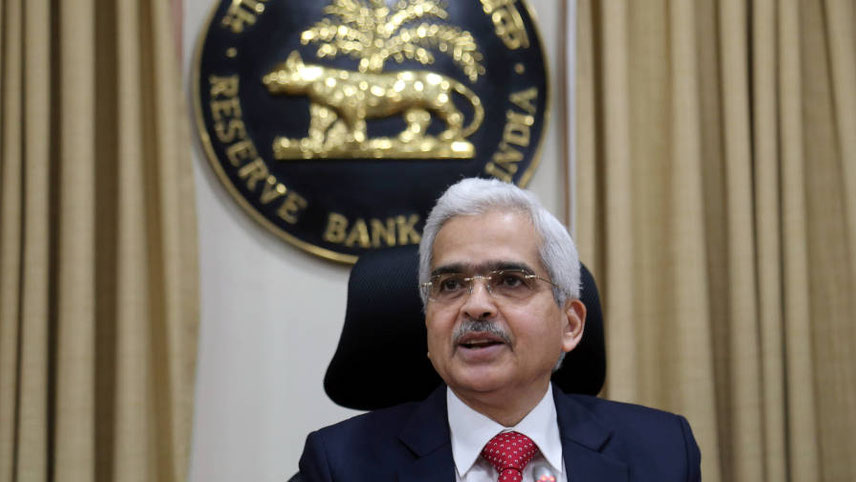

This inflation breach has followed a prolonged comfort zone. RBI Governor Shaktikanta Das recently acknowledged potential high inflation for a few months before an expected decline. While the contrasting narratives – relatively reasonable growth rate and high prices – reflect our complex economic landscape, they also underline the new political and economic challenge that confront the Modi government in the runup to an election year.

It isn’t all that bad but inflation could spoil the party. With the National Statistics Office set to release the first quarterly GDP data on 31 August, the government is optimistic of good numbers. The economy is seen to have grown at a four-quarter high of about 8 per cent during the period, boosted by strong domestic demand, an uptick in the services sector as well as the government’s focus on capital expenditure.

Nirmala Sitharaman, finance minister, recently said at the B20 Summit India 2023, organised by industry body CII, the government’s priority is to tame inflation to ensure sustained economic growth. Hiking interest rates is not the only option to tackle price rise.

But the dilemma for the government is that while it has barely 8 months to rein in prices for voters before it seeks to renew its electoral mandate, it also cannot afford to blow out the budget deficit that is being closely watched by global investors.

As it is, the government is said to be edgy over the latest report of Moody’s on India’s economic outlook and has even called the rating agency’s credibility into question. The report said that India’s fiscal position remains a ‘key weakness’ in its sovereign credit profile.

Moody’s has affirmed the BAA3 rating on India and maintained a 'stable' outlook on the Indian economy but there are political undertones in the agency’s report, which talk about ‘a curtailment of civil society and political dissent, which, compounded by rising sectarian tensions, support a weaker assessment of political risk and the quality of institutions’.

Earlier this year, S&P Global Ratings also affirmed India’s long-term 'BBB-' and A-3 short-term sovereign rating with a stable outlook, citing sound economic fundamentals that will underpin growth over the next 2-3 years.

RBI’s quandary

But here comes the bad news. According to internal research conducted by RBI, inflation exceeding 6 per cent would have adverse effects on India’s growth. It would negatively impact the financial savings and investment climate.

In the West, many economists are now questioning the feasibility of having an inflation band which results in monetary tightening and contributes to a climate of recession. The 2 per cent inflation target is key to the Federal Reserve’s vision for stable prices in the US. Canada, Australia, Japan and Israel are among the many economies that include 2 per cent as their inflation rate targets.

But the 2 per cent inflation target is relatively arbitrary and should be done away with, these economists feel. Besides, there’s no evidence that 3 per cent or 4 per cent inflation does substantial damage to growth relative to 2 per cent inflation.

-

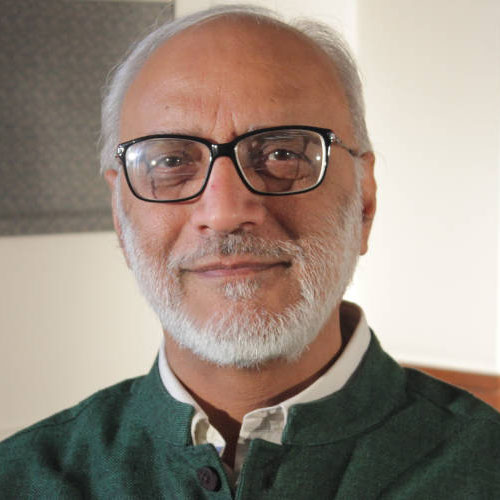

Goyal: a short-term ‘hiccup’

India has adopted a relatively flexible inflation targeting framework. Subsequently, India’s average inflation declined notably compared to previous periods. CPI inflation, which is targeted in the framework, and WPI inflation, were low and stable. Stable international commodity prices and moderation of minimum support prices also played an important role in stable inflation figures up to 2019.

Inflation targeting, therefore, does not offer a complete solution to the inflation problem of developing countries like India, prone to high exposure to supply shocks.

In India too, some finance ministers have gambled with inflation to promote growth while presenting Union budgets. Nobody seems to have the political gall to do it openly.

However, the Modi government’s wariness on the current price spiral appears to be mostly political. The edginess recently manifested itself in an export duty of 40 per cent on onions with immediate effect to check price rise and improve supplies in the domestic market. This new export duty is valid till 31 December, 2023.

As things stand today, the prices of quality onions used by household consumers are set to nearly double to Rs55-60 per kg by September. Despite ample stock of onions in the country, a high proportion of bad quality onions due to a prolonged period of excessive summer heat this year has made good quality onions expensive.

The 40 per cent duty on onion exports is aimed at ensuring a sufficient supply of onions in the domestic market at a time when prices are just about inching upwards. The average modal retail price of onions is currently at Rs30, compared to Rs25 this time last year, as per the Department of Consumer Affairs’ data.

The latest action, which may seem excessive, seems to suggest that the government is concerned about onions going the way of tomatoes: tomato prices had soared in July, retailing above Rs200 in parts of the country. While those prices are now hovering around Rs80, they are still roughly twice as high as their year-ago levels.

So, what may appear as desperate measures to free-market economists has become the norm. Other instances of government intervention in the food market in recent times include the ban on exports of wheat, non-basmati white rice and sugar, and imposition of stock limits on tur, urad and wheat. In early August, with wheat and rice continuing to witness inflation, it also decided to offload 5 million tonnes of wheat and 2.5 million tonnes of rice from the Food Corporation of India’s stocks in the open market.

Nepal to the rescue

The government is also using neighbourhood diplomacy to boost supply-side measures. From 4 August, India has begun importing tomatoes from Nepal to douse the inflationary fires. A deal to this effect was struck when Nepal PM Prachanda visited India.

Nepal has exported about 1,000 tonnes of tomatoes to India via three border customs points as of 20 August. The number includes only those exported in large quantities and by paying the official taxes after India resumed import of tomatoes from Nepal. A sizeable volume of tomatoes might have been exported to India from Nepal by small businesses and farmers themselves, which haven’t been recorded in the customs offices.

-

Das: wait for a few months more

Tomatoes are grown in abundance in the Kathmandu valley. Now, Nepal is willing to export other vegetables as well provided it gets easy access to Indian markets. But will New Delhi formalise this supply source? Officials say the tomato imports from Nepal were a ‘one-off thing’.

While dealing with supply side problems is one thing, tackling political demand is another. There are reports now that the government is considering a plan to reallocate as much as Rs1 lakh crore (Rs1 trillion) from the budgets of various ministries to contain the surge in food and fuel costs without imperilling the deficit target. That’s almost equivalent to 2 per cent of the budget for the year through March 2024.

But as it happens in this government, it will be Modi who will take the final decision on this issue, which could include lowering taxes on local petrol and diesel and easing import tariffs on cooking oil and wheat. (Recently, shares of Hindustan Petroleum, Bharat Petroleum and Indian Oil erased some of the earlier losses on news that domestic fuel taxes will be cut.) Such supply side measures would be the second straight year of similar adjustments to contain costs for consumers.

Budgetary re-allocations aren’t unusual. Officials aver that higher dividend payments from the central bank and steady tax collections allow for legroom of about a trillion rupees.

Cheap loans to the poor

The fiscal space could also be used to provide cheaper loans and homes for the poor, while sticking to the budget deficit target of 5.9 per cent of the GDP for this fiscal year. Modi spoke of one such scheme from the ramparts of the Red Fort. The new scheme will help poor and middle-class families living in cities to build their own houses by providing interest relief on loans from banks that will help them save lakhs of rupees.

“Earlier, Rs90,000 crore were spent to build the houses of the poor; today it has increased four times, and more than Rs4 lakh crore is being spent to build the houses of the poor,” Modi said.

Actually, alarm bells had started ringing for the government last year when the inflation print had last breached the 7 per cent mark in September 2022. The previous high for the headline retail inflation rate was recorded at 7.79 per cent in April 2022. But that was after Russia’s invasion of Ukraine which sent global prices of commodities soaring.

The current spurt is the third instance of retail inflation rate crossing the upper limit of the 4+/- 2 per cent band of the RBI’s medium-term inflation target in this calendar year and the seventh instance since July 2022.

The role (and success) of the RBI in taming inflation has also been questioned. The central bank mainly factors in the retail inflation while deciding the benchmark interest rate. The sharp increase in inflation has come amid the RBI keeping the key repo rate unchanged at 6.50 per cent in its latest monetary policy review.

While the six-member Monetary Policy Committee, led by Governor Das, retained the policy stance as ‘withdrawal of accommodation’, it hiked the inflation projection from 5.1 per cent to 5.4 per cent for FY24 in the wake of high food inflation, signalling that a rate cut is unlikely in the near future.

-

Sitharaman: priority is to tame inflation

RBI’s mandate

As the monetary policy framework mandates, the primary job of the RBI is to keep inflation in check. Therefore, on the face of it, the RBI’s rate hikes are a no-brainer. However, the dominant role of commodity prices in retail inflation has reignited the discussion on whether it is necessary to focus on targeting headline inflation. Transitory fluctuations in headline inflation caused mainly by food prices can also lead to a rise in non-food or core inflation due to higher inflation expectations.

In a study, ‘Explaining Inflation in India: The Role of Food Prices’, Prachi Mishra and Devesh Roy, economists, examined whether food inflation affects non-food inflation in India. They found a significant pass-through effect from food price inflation to non-food inflation.

There are counter arguments as well. Nicholas Kaldor, the renowned economist, argued that monetary policy is not an effective tool to control inflation that is caused by supply-side factors, particularly those arising from the agricultural sector. Since monetary policy typically deals with the demand side of the economy, it cannot address inflation stemming from the agricultural sector.

In their 2022 paper, ‘What lowered inflation in India: monetary policy or commodity prices?’, Pulapre Balakrishnan and M Parameswaran argue for a new set of instruments to control inflation arising from commodity prices.

In its latest meeting, the US Federal Reserve increased the interest rate by 25 basis points to 5 per cent. This reduces the difference between interest rates in the US and India, which triggers a set of chain reactions, including capital outflow, rupee depreciation, depletion of forex reserve, and current account deficit. This will exert pressure for a rate hike from the RBI so as to contain the interest rate differential between India and the US.

Whither RBI strategy

The central bank, to achieve its long-term goal of stable inflation and growth, would have to look at different instruments to reduce the impact of supply shock-induced inflation volatility. Till now, the RBI seems to have concentrated on the demand-side of inflation, and as a result the entire perspective of supply is ignored.

Indeed, inflation can be curtailed if supply is bolstered to meet the demand of the people. Granted, the supply side cannot be strengthened so easily as it requires infrastructure development, planning, large scale investments, etc. This is where the RBI can play a proactive role and not leave everything to the government.

It can, for instance, for the purpose of boosting agricultural growth and building infrastructure, smoothen regulations to facilitate flow of funds, including FDI and external commercial borrowings, directly and indirectly into these sectors. Besides, it should go slow on the move to raise the cash reserve ratio (CRR) and other credit rates which make it difficult for the MSMEs and farmers to get loans.

-

Balakrishnan and Parameswaran argue for a new set of instruments to control inflation

Current spell

As for the current spell of trouble, economists believe that deficient rainfall is likely to put pressure on vegetable prices if El Niño sets in. An immediate reversal may not be possible until the next harvest. They feel the inflation rate is expected to stay above the 6 per cent mark in the coming months and may prompt an upward revision in the 6.2 per cent projection by the RBI for the second quarter.

“Given the CPI inflation print for July 2023, the MPC’s revised forecast for inflation for Q2 FY24 of 6.2 per cent appears to be at risk of being overshot, as the vegetable price shock may not reverse adequately before the next harvest. Moreover, rainfall has been deficient in August so far, which is likely to put upward pressure on food prices, amid the lags in kharif sowing across some crops. The MPC’s latest forecasts suggest inflation will remain above 5 per cent through Q1 FY25, based on which we have pushed out our forecast for the earliest cut to Q2 FY25…in our view, inflation would need to persist above 6 per cent for at least two quarters, amid transmission of pressures to core inflation, to set the stage for a rate hike,” Aditi Nayar, Chief Economist, Head Research and Outreach, ICRA said.

Fighting inflation is politically important for Modi. When his government came to power in 2014, India's inflation rate was around 8.33 per cent. Since 2014, inflation stabilised and fell largely within the RBI’s comfort zone. However, it hit a high of 7.7 per cent in April 2022 due to Russia’s invasion of Ukraine. Apart from inflation, the issue of unemployment has been a thorn in an otherwise impressive economic record.

Reasons behind rise

But why is inflation rising? With almost half of the CPI basket comprising of food items, any price changes in this category have a substantial effect on the overall inflation rate in India. So, even small fluctuations in food prices can have a significant impact on the cost of living for the average Indian consumer.

Some food items, especially essentials like vegetables, grains, and dairy, tend to have relatively inelastic demand. This means that changes in their prices lead to disproportionate changes in overall spending, as people cannot easily reduce consumption even if prices increase. As a result, food inflation can quickly affect household budgets and lead to decreased purchasing power.

-

The MPC’s latest forecasts suggest inflation will remain above 5 per cent through Q1 FY25

Aditi Nayar, Chief Economist, Head Research and Outreach, ICRA

Prices of some of the most used vegetables in the Indian kitchen, including tomatoes, onions, peas, brinjal, garlic and ginger, have more than doubled in the last few months. Food prices have soared largely due to the erratic monsoon throughout the country, pushing tomato prices at wholesale markets up more than 1,400 per cent in the past 3 months. With the spike being significantly higher than expected, analysts are sceptical that inflation will return to its glide path anytime soon. The silver lining could be relatively range-bound core inflation, according to some estimates.

The price trends seem to suggest that food inflation is now getting generalised. Data from the National Statistical Office showed that along with higher vegetable prices, inflation in July was elevated in cereals (13.04 per cent), pulses and products (13.27 per cent), spices (21.63 per cent) and milk and milk products (8.34 per cent). It was this surging food inflation that led to the consumer price index rising to a 15-month high of 7.44 per cent in July, breaching the upper threshold of the RBI’s inflation targeting framework.

While the RBI expects the current surge in vegetable inflation to be temporary in nature, risks to the broader food basket remain. Rainfall has been low this month – there are indications that August this year could be the driest August in recent times. And there is an increasing likelihood of El Niño strengthening in the coming months. This could potentially impact the upcoming rabi crop. Now, that could mean a measure of uncertainty.

-

All export bans and stocking limits impact farmers’ incomes negatively

Ashok Gulati, Professor at the ICRIER

Consumers vs farmers

The Modi government’s tightrope walk in fighting food inflation on the one end and farmers’ interest on the other is being watched with keen interest. The government’s frequent measures to arrest the price rise in staples ranging from onions to rice are beginning to fuel concerns over its intent to enhance the income of farmers, a key vote bank.

Indeed, the government has been betting big on farmers with a series of steps to woo one of its largest vote banks. From direct cash transfers to withdrawing three controversial farm laws faced with protests, the Centre has kept a consistent focus on pleasing farmers. However, notwithstanding these measures, the current regime’s biggest promise of doubling farmers’ incomes remains unfulfilled. Modi, during his Independence Day speech in 2017, had first announced this aim, which was reiterated in the Bharatiya Janata Party’s manifesto ahead of the general elections held in 2019.

Naturally, farmers are not happy. While a fall in prices of tomatoes following the government’s decision to intervene in the market, including imports from Nepal, stopped them from taking advantage of a spike in cost, the government’s prohibition on exports of onions has also sparked anticipation of a similar moderation in prices. Consequently, key farm groups have erupted in protests across crucial regions of the country.

Facing opposition from farmers in key states like Maharashtra, within 48 hours of imposing the export duty on onions, the centre went into damage control mode. Piyush Goyal, food and commerce minister, on 22 August announced that two government agencies will procure 2 lakh additional tonnes of onions at a ‘historic’ rate of Rs2,410 per quintal, and that they could procure more if needed.

Farm economists have faulted the government’s strategy. Ashok Gulati, Professor at the ICRIER, says: “All export bans and stocking limits impact farmers’ incomes negatively. It only reflects consumer bias in the policy system. It is more for urban consumers who are more politically vocal. And it is at the cost of farmers. We need to correct this bias.”

Indra Shekhar Singh, an independent agri-policy analyst, termed the price control measures by the Central government as “a little too late,” adding that India’s agrarian policies have left its farmers confused.

“The current export prohibition (on onions) is mismanaged because it is going to upset farmers as well as small and medium traders who are trying to make an honest living. India needs a clear-cut export quota based on weather predictions,” says the former Director of the National Seed Association of India.

The effectiveness of price interventions is most likely dimmed by the fact that for perishable items such as tomatoes, the problem lies in storage. Even the Reserve Bank of India (RBI) in its latest State of the Economy article called for ‘major reforms’ to the country’s supply chains of vegetables.