-

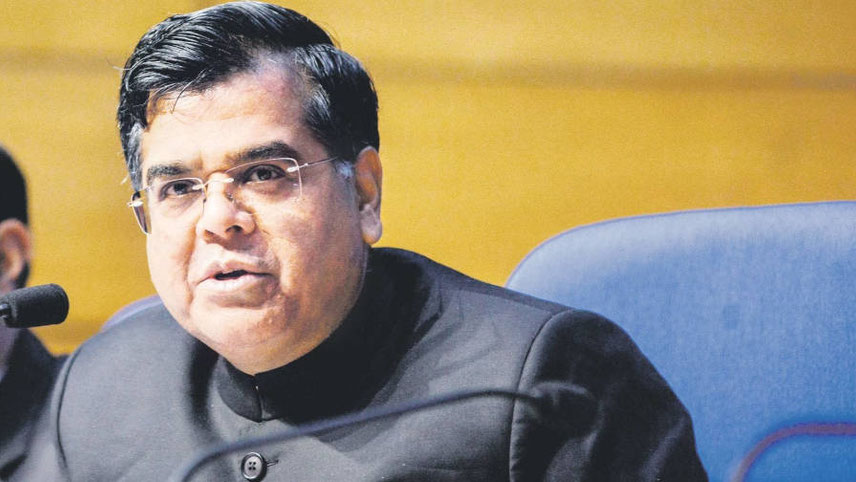

Chadha: warning on indexation

Several members of Parliament also urged the government to reconsider the proposal, arguing that property these days is a hedge again inflation. Raghav Chadha, AAP MP, who in his early career as chartered accountant worked with accountancy firms including Deloitte and Grant Thornton, said, “If you do not bring back indexation, three things will happen in this country.

First, investment in real estate will go down and people will never be able to buy their 'dream homes'. There will be an undervaluation of property deals, where people will buy real estate at ‘circle rates’ and will never disclose the real value of the property. Third, there will be a huge inflow of black money if you don't roll back this decision to withdraw indexation."

Buckling under

The matter reached the PMO, which was monitoring the public response to the budget. The finance ministry then buckled under pressure and agreed to restore the indexation benefit, thereby relieving property owners of the extra tax burden that would have arisen on account of the latest changes announced in the budget. Tax would now be calculated at the rate of 12.5 per cent without indexation, but if it exceeds 20 per cent with indexation, it would be ignored.

However, there is a small sting in the tail. Tax experts say that this is not a complete rollback. In fact, the government has chosen to give relief to those who could be impacted by the retrospective taxation element of the budget proposal through an amendment, they said adding that with this amendment, there is no additional tax burden due to the proposal.

Yogesh Kale, executive director, Nangia Andersen India, points out that the abolishment of indexation benefit still holds as only properties acquired prior to 23 July 2024 are proposed to be grandfathered with option to the taxpayers to offer the capital gain tax under the new scheme. Property bought on Budget-day or later will have only one option on LTCG which is 12.5 per cent. This means there is no indexation benefit for them.

Another instance of ‘unthinking taxation’ was the steep hike in customs duty on laboratory chemicals from 10 per cent to 150 per cent, which shocked scientists and researchers. It also hit as the heart of Make in India. Lab chemicals (Harmonised System Code 9802) include fine chemicals and pure compounds used by the pharmaceutical and biotech industry and researchers for lab analysis and synthesis.

These chemicals are niche in nature and mostly imported. Pharma companies and research labs might have faced soaring costs for critical imported chemicals, potentially driving up research expenses and end product prices. Naturally, the scientific community was up in arms and a rollback was announced.

Market tremors

The stock market took some time to recover from her announcements. In a move that appears to aim at reining in rampant F&O trading, Sitharaman raised the Security Transactions Tax (STT) rate to 0.02 per cent and 0.1 per cent, respectively. So, after implementing this budget proposal, equity and index traders will have to pay double the tax for their trades.

The removal of the indexation benefit from tax computation also triggered some heartburn among long-term investors of debt mutual funds. While the likely impact of the changes on asset classes like property and gold has been in focus, returns on earlier investments in debt mutual funds – which offer relatively low but more secure returns – could also get impacted significantly.

The new LTCG tax regime does away with the indexation benefit available for calculation of LTCG on unlisted assets. As debt mutual funds on long-term average basis give returns of 6-8 per cent, the removal of indexation benefit will have material impact on debt MF.

-

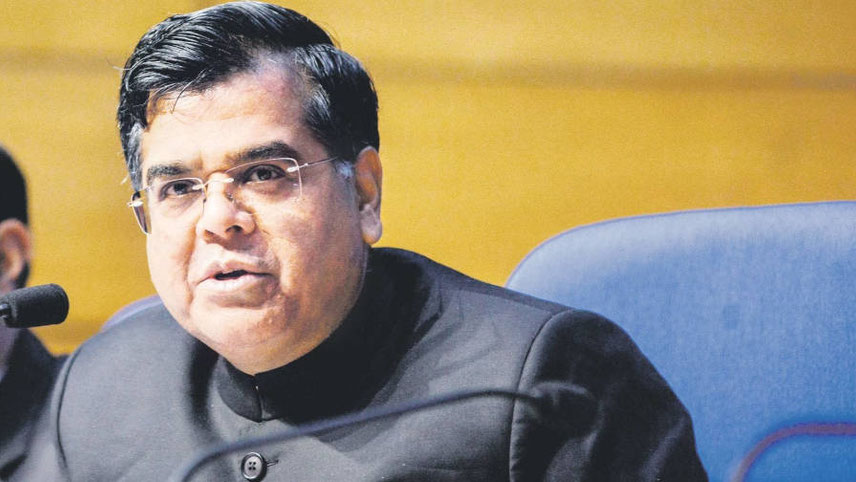

Somanathan: no pre-announcement of divestment plans

The budget, for the second consecutive year, did not emphasise on the term 'disinvestment', though this year’s target has been set at Rs50,000 crore, 40 per cent higher than Rs30,000 crore of 2023-24, but nothing to write home about. Critics say this is as loud an announcement as it can get about Modi’s new emphasis on overhauling the almost 200 PSUs instead of divesting their equity holdings – a sharp departure from the previously stated aggressive privatisation programme that struggled to take off. The government claims to be shifting focus from indiscriminate asset sales to enhancing intrinsic value of state-owned companies. Possibly this way it can get more money from dividends than from sale proceeds.

Of course, the finance ministry has its own rationale for it. T.V. Somanathan, finance secretary, says that the government will not pre-announce the timing of its divestment plans for 2024-25 to ensure its best value for public companies.

Ditto asset monetisation though there was some talk after the budget of this process being ramped up with NHAI targeting over Rs50,000 crore of roads and highways during the year. But with the proceeds on this count last year ranging at about just Rs16,000 crore, it remains to be seen whether the NHAI target will be met.

During post-budget briefings, senior finance ministry functionaries have been at pains to underline that the budget has an unprecedented emphasis on skilling and employment. The FM has announced a slew of employment-linked incentive scheme for new employees as well as employers.

• Rs2 lakh crore package for schemes, which are aimed at creating jobs and providing skilling to 4.1 crore youth in the country;

• one month wage to all persons newly entering the workplace in all formal sectors and direct benefit transfer (DBT) of one month salary in three instalments to first-time employees as registered in the EPFO up to Rs5,000; and

• an internship scheme offering 10 million youth opportunities in 500 top companies over five years. The interns will gain real-life business experience and receive Rs5,000 monthly allowance.

Such a major thrust on skilling and employment, while utterly necessary for India, if it has to take benefits from its demographic dividend, is also aimed at appeasing a new constituency of voters – the youth, who form the majority of population in India today. This could be in response to efforts of Opposition leaders like Rahul Gandhi and Akhilesh Yadav to attract youth voters, especially from poor segments.

The Congress has claimed that Sitharaman has copied the scheme from its Lok Sabha election manifesto. This shows the intense competition to woo a segment, which includes new voters.

India Inc’s role

However, the success of this scheme will depend on how India Inc translates it on the ground. India Inc has always maintained the new staff hirings depend on capacity utilisation. Its average capacity utilisation is now touching the 75 per cent mark, according to the Reserve Bank of India (RBI). According to a report by Motilal Oswal Financial Securities, private sector capex has started ramping up from select sectors, which will get another leg up from thermal power, production linked-led capex and semi-conductor capex. But, will this facilitate new mass hirings of the kind that a growing India needs?

-

The budget as such is a missed opportunity. As it was the first year of Modi 3.0, the exercise should have been used to roll out a coherent economic framework to deal with the pressing concerns as well as the more long-term structural impediments to growth

Besides, more clarity is required on the new schemes. Puneet Gupta, tax partner, EY India, has questions relating to the manner of determining compliance with the minimum employment threshold on an ongoing basis and manner/timelines for payment of the annual incentive to employee and employer.

Besides, while the incentive will be paid by the government to employer and employee separately, the refund of incentive on termination of employment before completion of 12 months is required to be paid by the employer. This raises several questions – does the incentive paid to employer as well as employee need to be refunded? Also, if the incentive paid to employee is required to be refunded by the employer, can the employer recover the subsidy from the employee?

The circumstances that dictated budget-making this time were entirely political. The outcome of 4 June elections robbed the Modi-led BJP of an outright victory and the compulsions of coalition politics have cast their brooding shadow over the budget. The most conspicuous part of the exercise is the announcement of special projects for Bihar and Andhra Pradesh, ruled by the Janata Dal (U) and the Telugu Desam Party, the allies which are propping up the BJP-led government at the Centre. While Bihar got Rs58,900 crore, AP was even luckier, bagging Rs65,000 crore.

Defence, railways, infrastructure and women, some of the big themes of Sitharaman's past budgets, are not as prominent in her latest budget. One reason could be the interim budget she presented in February, which had announcements related to these themes for the current fiscal year.

Upcoming state polls

Apart from coalition pressures over the much-hyped larger packages to Andhra Pradesh and Bihar, political analysts believe that the upcoming assembly elections in Maharashtra, Haryana and Jharkhand, where the Bharatiya Janata Party is facing headwinds, weighed heavily on the ruling regime. The BJP has its back to the wall in Maharashtra and Haryana. Adverse verdicts there would further dent Modi’s aura. So, Sitharaman had to tread carefully.

-

The FM enjoyed greater manoeuvrability, with the Reserve Bank of India’s record Rs2.11 lakh crore dividend pay-out to the government announced in May

The budget as such is a missed opportunity. As it was the first year of Modi 3.0, the exercise should have been used to roll out a coherent economic framework to deal with these pressing concerns as well as the more long-term structural impediments to growth. Sitharaman needed to make a frontal assault on one deep-seated problem facing our economy – private sector investments haven’t quite commenced despite the corporate tax breaks in 2019, the significant ramping up of government’s capex over the last few years, the improving profitability of India Inc, and healthy bank balance sheets. And that means few jobs.

Sitharaman's budget arithmetic was expected to be based on more cash with the Central government. The FM enjoyed greater manoeuvrability, with the Reserve Bank of India’s record Rs2.11 lakh crore dividend pay-out to the government announced in May. The dividend for 2023-24 is 141 per cent higher than the Rs87,416 crore dividend pay-out in 2022-23 and more than double the Rs1.02 lakh crore that the finance minister estimated in the interim budget.

In presenting her seventh budget, Sitharaman has gone one up on Desai's record of presenting five consecutive budgets and an interim one between 1959 and 1964. Desai however holds the record of presenting the most numbers of budgets at 10. Who knows Sitharaman may even break that record? But to what end?