-

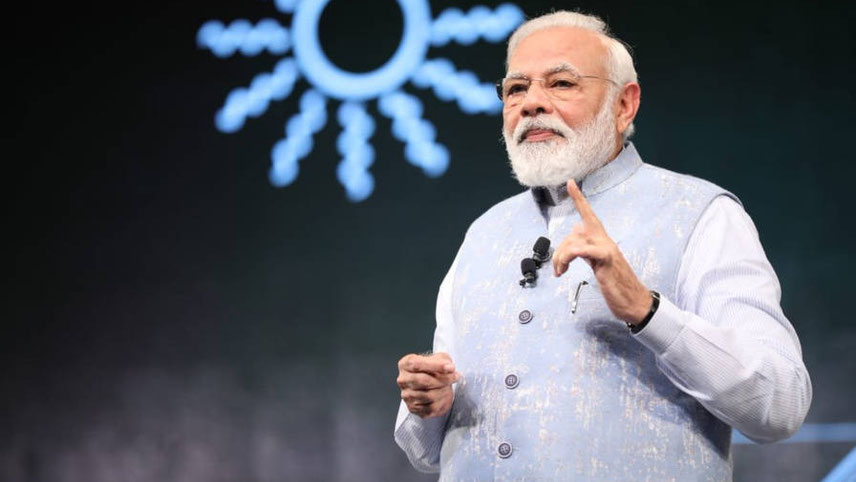

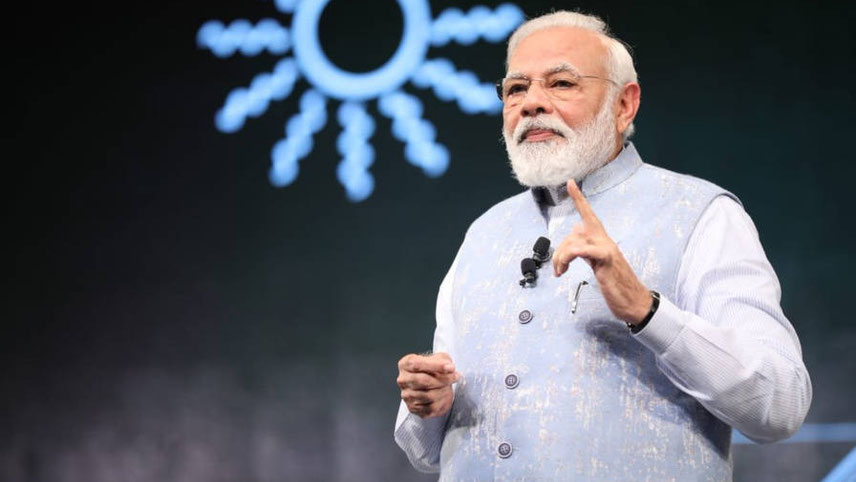

Modi: leading the PR offensive

Bugbears

In yet another instance of the government’s prickliness, there was a sharp official reaction to an assessment by the International Monetary Fund (IMF) that adverse shocks could lift India’s general government debt to, or beyond 100 per cent of GDP in the medium-term (by 2027-28).

Besides, credit rating agencies became the target of the government’s ire. Individual ministers too have locked horns with critics who have picked holes in the government’s flagship programmes, namely the Production Linked Incentive (PLI) scheme, with Rajeev Chandrasekhar, minister, IT & electronics, even describing Raghuram Rajan, former RBI governor, as a ‘repeat offender’. All this and more led to speculation whether there is a design to the sharp responses coming from the Modi government against charges about mishandling of the economy.

Developed India counter

Decent economic growth also fits into the theme of Viksit Bharat (developed India) which the government is also propagating to reach out to the poor and the labharthis (beneficiaries of government schemes). The government has launched a Hamara Sankalp Viksit Bharat, a nationwide campaign to raise awareness through outreach activities to achieve saturation of such schemes of the government across the country covering all Gram Panchayats, Nagar Panchayats and Urban Local Bodies. The campaign is being taken up by adopting a whole of government approach with active involvement of various ministries/departments, state governments, Central government organisations and institutions, to ensure the widest possible participation.

On top of these two planks will be the consecration of the Ram temple in Ayodhya on 22 January, which will signify the ‘beginning of Ram Rajya’ in India. The term is generally used from ancient times to denote the highest level of benevolent governance,

“The construction of the Ram Temple in Ayodhya will be the beginning of 'Ram Rajya' in the country, where there will be no discrimination on the basis of caste and religion,” said Adityanath, chief minister, Uttar Pradesh, which sends 80 MPs to the Lok Sabha. “Prime Minister Modi had laid the foundation of 'Ram Rajya' during his nine-and-half-year-old rule at the Centre through schemes related to housing for the poor, toilets, tap water and health insurance”.

BJP leaders point out that the 2024 Lok Sabha will be the first general election when their party will be seeking another term, after fulfilling its decades old poll promises like construction of Ram Temple in Ayodhya, scrapping exclusive privileges to J&K under Article 370, abolition of triple talaq and also implementing the CAA (likely to be done before announcement of the polls). Having delivered its key polls promises, BJP, under Modi, plans to reach out to the voters with a ‘pro-incumbency’ theme, highlighting how the party intends to make India a developed country by 2047.

Selling a dream

The government also wants the voters as well as foreign investors to take seriously its claim of India becoming the world’s third largest economy in the near future. Modi himself is leading the PR offensive on this count.

In a rare interview to The Financial Times in December, Modi had said that the aspirations of Indians have changed as the country is on the ‘cusp of a take-off’. Fielding questions on everything from the state of Indian democracy to the nation’s transformed perception in the world, he highlighted how India has emerged from being one of the ‘Fragile Five’ – a term Morgan Stanley used to describe the country in 2013 as it battled the twin deficits – to become the world’s fifth-largest economy. And he cited how his government’s infrastructure focus and reforms have propelled growth, making India the fastest-growing large economy in the world.

-

Hamara Sankalp Viksit Bharat: a nationwide campaign to raise awareness through outreach activities

Later, in an interview with India Today, he said: “Our track record speaks for itself. When I became chief minister of Gujarat in 2001, the size of its economy was about $26 billion (Rs2.17 lakh crore). When I left Gujarat to become the prime minister, the size of Gujarat’s economy had become $133.5 billion (Rs11.1 lakh crore). And as a result of the various policies and reforms, today Gujarat’s economy is about $260 billion (Rs21.6 lakh crore). Similarly, when I became PM in 2014, the size of India’s economy was $2 trillion (Rs167 lakh crore) and, at the end of 2023-24, India’s GDP will be more than $3.75 trillion (Rs312 lakh crore). It is this track record of 23 years, which shows this is a realistic target.”

As a retired finance secretary says, in such a situation, the government would not like “carping criticism from any quarter, Indian or foreign, to spoil the growth story”. That this government’s achievements have come against the backdrop of multiple black-swan events – a once-in-a-century pandemic, two bloody wars, sticky global inflation, and growing protectionism that threatens to upend both the post-pandemic recovery and the long-held consensus on globalisation – is a matter of pride for any dispensation, he added.

Resilience

India has indeed shown resilience against the backdrop of a challenging global environment. This resilience, as the World Bank noted in its India Development Update, is underpinned by robust domestic demand, strong public infrastructure investment and a strengthening financial sector. Bank credit growth increased to 15.8 per cent in the first quarter of 2023-24, compared with 13.3 per cent in the first quarter of 2022-23. Moreover, the pre-election spending stimulus could potentially revitalise flagging consumption.

That’s why all the Big Guns have come out blazing. Recently, the Finance Ministry released a document titled Re-examining Narratives: A Collection of Essays, which V. Anantha Nageswaran, Chief Economic Advisor, said was an “attempt to present alternate perspectives on diverse areas of economic policy that have long-term implications for India’s growth and development priorities”.

In the essay, the government criticised the ‘opaque methodologies’ used by the major global credit rating agencies to arrive at sovereign ratings. Nageswaran said the enormous degree of opaqueness in credit rating methodologies makes it challenging to quantify the impact of qualitative factors on credit ratings. “The significant presence of qualitative factors in credit rating methodologies also gives rise to bandwagon effects and cognitive biases amply reflected in various studies, generating concerns about the credibility of credit ratings," he added.

Rating agencies

Nageswaran’s comment comes as the government continues to engage with prominent global credit rating agencies to improve India’s sovereign credit rating. To that extent, finance ministry officials have met representatives from the top three rating agencies – Fitch Ratings, Moody’s Investors Service and S&P Global Ratings – seeking an upgrade.

A sovereign credit rating is a measurement of a government’s ability to repay its debt, with a low rating indicating high credit risk. While S&P and Fitch rate India at BBB, Moody’s rates the South Asian country at Baa3, which indicates the lowest possible investment grade, albeit with a stable outlook. Typically, rating agencies use various parameters to rate a sovereign. These include growth rate, inflation, government debt, short-term external debt as a percentage of GDP and political stability.

-

Nageswaran: criticising ‘opaque methodologies’

Sovereign ratings matter because this yardstick is used to measure the credit-worthiness of a government. These ratings provide a marker for investors around about the ability of governments to pay back debt. In short, sovereign ratings are about a country’s ability to borrow money from global investors. If the sovereign rating of a government is low, the businesses of that country end up forking-out a higher rate of interest upon borrowing loans.

FinMin-IMF spat

It is in this context that the recent so-called spat between the finance ministry and the IMF played out. So, why did the spat happen in the first place? The IMF, under its Articles of Agreement, holds bilateral discussions with members, usually every year. IMF staffers collect economic and financial information, and discuss policies with top officials, before preparing a report that is discussed by the Fund’s executive board.

This year’s report was by and large complimentary of India’s economic performance. Globally, India’s G20 presidency has demonstrated the country’s important role in advancing multilateral policy priorities. As for the economy, it showed robust growth over the past year. Headline inflation has, on average, moderated although it remains volatile. Employment has surpassed the pre-pandemic level and, while the informal sector continues to dominate, formalisation has progressed. The financial sector has been resilient – strongest in several years – and largely unaffected by global financial stress in early 2023.

However, the report noted that the current account deficit in 2022-23 widened as the post-pandemic recovery of domestic demand and transitory external shocks outweighed the impact of robust services exports and proactive diversification of critical oil imports. While the budget deficit has eased, public debt remains elevated and fiscal buffers need to be rebuilt.

Balanced risks

The report emphasised that growth is expected to remain strong, supported by macro-economic and financial stability. Real GDP is projected to grow at 6.3 per cent in 2023-24 and 2024-25. Headline inflation is expected to gradually decline to the target although it remains volatile due to food price shocks. The current account deficit is expected to improve to 1.8 per cent of GDP in 2023-24, as a result of resilient services exports and, to a lesser extent, lower oil import costs. Going forward, the country’s foundational digital public infrastructure and a strong government infrastructure programme will continue to sustain growth. India has potential for even higher growth, with greater contributions from labour and human capital, if comprehensive reforms are implemented.

Risks to the outlook are balanced. A sharp global slowdown in the near term would affect India through trade and financial channels. Further global supply disruptions could cause recurrent commodity price volatility, increasing fiscal pressures for India. Domestically, weather shocks could reignite inflationary pressures and prompt further food export restrictions. On the upside, stronger than expected consumer demand and private investment would raise growth.

There were the routine prescriptions. Further liberalisation of foreign investment could increase India’s role in global value chains, boosting exports. Implementation of labour market reforms could raise employment and growth.

FinMin’s hackles

However, it was the IMF’s assessment about adverse shocks lifting India’s general government debt to, or beyond 100 per cent of GDP in the medium-term (by 2027-28) that got the finance ministry’s goat. It was a hypothetical observation but the finance ministry chose to react sharply, pointing out that the combined debt of Central and state governments stood at 81 per cent of the GDP in 2022-23, from 88 per cent in 2020-21.

Under favourable circumstances, even the IMF reckons this could even go down to 70 per cent by 2027-28. The ministry pointed out that the shocks faced by India so far in this century were global, and affected the entire world economy, be it the 2008 financial crisis or the pandemic.

-

Prime Minister Modi had laid the foundation of 'Ram Rajya' during his nine-and-half-year-old rule at the Centre through schemes related to housing for the poor, toilets, tap water and health insurance

Picking holes in the IMF’s view, the ministry noted that “certain presumptions have been made taking into account possible scenarios that does not reflect factual position The Ministry asserted this was only a worst-case scenario and not a fait accompli and emphasised that other IMF country reports show much higher extreme ‘worst-case’ scenarios, for instance, at 160 per cent, 140 per cent and 200 per cent of GDP, for the US, the UK and China, respectively.

Later, reacting to initial news flashes about an incipient confrontation, the ministry clarified that its statement was not a rebuttal of the IMF but ‘an effort to arrest misinterpretation or misuse’ of its comments to imply that government debt would exceed 100 per cent of GDP in the medium term.

Over-reach

Semantics experts may argue whether the communiqué was confrontational or clarificatory. K.V. Subramanian, India’s Executive Director on the IMF Board, had already placed on record reservations about its staff’s conclusions on debt risks (‘sounds extreme’) and some other aspects of the economy. In the broader picture, IMF staff’s perceptions of India’s fiscal position have actually improved over the past year. From arguing in 2022 that India’s fiscal space is at risk, they now believe sovereign stress risks are moderate.

This is in no small part due to the ability of the Centre to meet fiscal deficit targets in recent times. The finance ministry has all along been maintaining that reducing debt and spends to stay the course on its commitment to bring the deficit to 4.5 per cent of the GDP by 2025-26 from an estimated 5.9 per cent this year, is critical. It may even set a lower target for the next financial year.

But then why the over-reach? Clearly, the BJP does not want the Cassandras to queer its electoral pitch at this stage, even though reacting to an adverse detail in a report sometimes ends up drawing more attention to it. However, impartial observers believe that it is the government’s actions that should always speak louder than words.