-

Dr Moopen: delivering clinical excellence

Guided by his mission to provide quality healthcare at affordable costs, over a period of 36 years, Aster grew by leaps and bounds to become a global healthcare conglomerate with a presence in GCC (UAE, Qatar, Bahrain, Saudi Arabia and Jordan) and India. With 34 hospitals, 130 clinics, 508 pharmacies and 224 labs and patient experience centres across these geographies, the company emerged as one of the largest private healthcare service providers in the region.

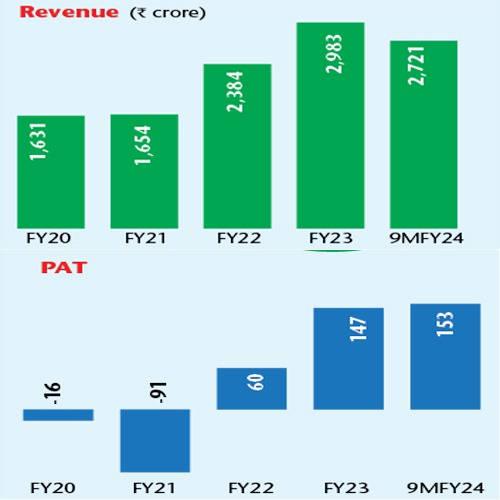

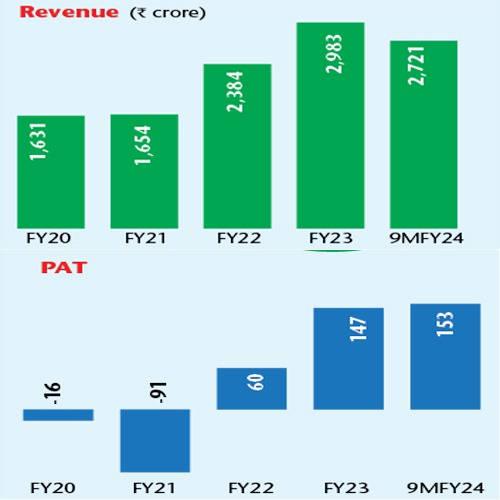

The combined business clocked a revenue of Rs11,933 crore (India revenue Rs2,983 crore) in FY23 from Rs7,963 crore (India: Rs1,314 crore) in FY19. As of December 2023, it had over 28,000 dedicated staff including around 4,310 doctors and around 9,880 nurses committed to ensure service excellence.

While the overall business was growing, the management realised there was a need to deal with both the regions separately in order to explore geography-specific opportunities in a more focused manner. A segregation plan was therefore mooted last year, followed by a formal completion of the separation of the India and GCC businesses (an announcement to this effect was made on 3 April, 2024)

“The rationale behind taking the bold and strategic decision to separate the India and GCC entities was to establish fair value to both entities and to unlock long-term investor value. In India, we as promoters, remain committed to our growth plans and hence increased our stake to around 42 per cent earlier this year. Major institutional shareholders continue to remain invested, reflecting overall confidence in the company’s India business model and go-to-market strategy spanning all segments of the healthcare space. The current Indian healthcare market looks promising and post segregation, our efforts will be to dynamically increase our footprint in India. Through both greenfield and brownfield opportunities, we aim to take our total bed tally in India to 6,600+ in the coming 3 years and scale up our labs and pharmacy business to emerge as one of the top 3 integrated healthcare providers in India,” says Dr Moopen (70), founder & Chairman, Aster DM Healthcare.

Under the separation plan, a consortium of investors led by Fajr Capital, a UAE-headquartered sovereign-backed private equity firm, has acquired a 65 per cent stake in the GCC business (new entity named Aster DM Healthcare FZC), with the Moopen family retaining a 35 per cent stake alongside management and operational rights.

Separation plan

In the Indian operation, the Moopen family continues to hold a 41.88 per cent stake. Pursuant to the separation process, Affinity Holdings Ltd, a wholly owned subsidiary of the company, received a cash consideration of $907.6 million. The transaction valued the GCC business at an enterprise value of $1.7 billion (Rs13,540 crore), and an equity value of $1.0 billion (Rs8,215 crore).

In November 2023, the company obtained board approvals to separate its GCC and India businesses to establish two distinct regional healthcare entities that would benefit from strategic and financial flexibility to meet the priorities of patients and focus on the growing demand in their respective markets. The separation plan was subsequently approved by the company’s shareholders in January 2024. The transaction was subject to customary regulatory approvals, contractual approvals and closing conditions, all of which have now been satisfied and concluded.

EY and PwC provided independent valuation advice, while ICICI Securities provided a fairness opinion for the valuation guidance of the company. Moelis & Company and Credit Suisse acted as the sell-side advisors. Baker & McKenzie LLP served as the sell-side’s legal advisors, with Cyril Amarchand Mangaldas representing Aster in the transaction. AZB & Partners advised the independent directors. HSBC Bank Middle East Ltd, Allen & Overy LLP, and PwC acted on behalf of the Fajr Capital consortium.

-

Dr Shetty: leveraging growth avenues

Experts believe that the GCC and Indian healthcare markets are distinct, each with different growth dynamics, warranting different business strategies. The strategic decision to segregate the India and GCC operations is based on establishing fair value for both entities, creating two pure-play geographically focused entities that can leverage growth opportunities in their respective markets.

The separation will also provide Aster’s India business (ie Aster DM Healthcare Ltd) an opportunity to potentially expand its institutional investor base to include investors mandated to invest in India-only or majority businesses. Shareholders of the India business will also benefit from improved reporting of operating and financial parameters for the listed entity.

The company, with existing shareholders remaining with the listed Indian entity, has decided to distribute 70-80 per cent of the transaction proceeds as dividends to shareholders who have shown strong confidence in this restructuring and sale of the GCC business. The dividend is expected to be in the range of Rs110 to Rs120 per share.

The remaining transaction proceeds will be retained to pursue growth opportunities and maintain reserves. Amidst these developments, the company’s stock price has nearly doubled in the last year. The stock is currently trading in the price range of Rs422-467. The company was listed in February 2018 on the NSE & BSE.

A long-term strategy

Post-segregation, the Indian entity will continue to be led by Dr Nitish Shetty as Chief Executive Officer, focusing on growing the India business to create value for shareholders. Dr Azad Moopen will continue as the Founder & Chairman of Aster, overseeing both India and GCC entities, while his daughter, Alisha Moopen, will remain a director on the board and has been promoted to serve as the managing director and Group CEO of the GCC business (Aster DM Healthcare FZC). This move aims to lead a long-term strategy to unlock value as a pure-play GCC operating company.

The Rs9,000-crore GCC business is a robust integrated healthcare provider with 15 hospitals, 117 clinics, and 285 pharmacies across six countries, including UAE, Oman, Qatar, and Saudi Arabia. Alisha, a Chartered Accountant from the Institute of Chartered Accountants of Scotland and previously employed at Ernst & Young, joined the company as a director in 2013.

“The Indian healthcare market, with a population of 1.4 billion to serve, is poised for rapid and sustainable growth in the next few years. With the finalisation of the transaction and the proceeds available for Indian expansion, we have already outlined our expansion plans for the next 3 years. While we focus on expanding our footprint in the South, we are open to venturing into newer geographies depending on their potential,” says Dr Shetty, 53, CEO of Aster DM Healthcare, India.

Now, the India-focused company, in its pursuit to be among the top 3 hospital chains in India, is set to add around 1,700 beds by FY27, taking its total bed tally in the country to around 6,600 beds. The expansion plan will encompass a mix of brownfield and greenfield projects. Approximately 60 per cent of the beds are going to be added as brownfield, ie expanding the present capacity in the existing hospitals.

In the Kerala cluster (where it has six hospitals), the company will add 275 beds across three of its existing hospitals: Aster Medcity, Kochi (current capacity: 760, addition: 100; owned); Aster MIMS, Kannur (312; 100; owned); and Aster MIMS, Calicut (696; 75; leased). Additionally, the company will add 159 beds to Aster Whitefield, Bengaluru’s current capacity of 347 beds, and 75 beds to Aster Ongol, AP’s 100-bed capacity. Both properties are on lease.

-

Aster has a strong presence across primary, secondary, tertiary and quaternary healthcare

Under greenfield expansion, Aster is putting up a 264-bed hospital in Kasaragod, Kerala (currently under construction and to be operational by FY26; leased), and another 454-bed hospital, Aster Capital, Thiruvananthapuram (under construction; owned), by FY27 in Phase-I. Besides, there is also a plan to have a 100-bed hospital (Aster KLE Bengaluru, to be ready by FY26) in Bengaluru on an asset-light O&M model. Moreover, Aster is also open for further inorganic expansion in the adjoining geography.

The healthcare chain currently has six hospitals (total bed capacity: 2,386; four owned & two O&M) in Kerala; four hospitals (capacity: 1,193 beds; three O&M & one leased) in Karnataka; and six hospitals (897 beds; one owned & five leased) in AP. Additionally, it has one hospital each in Kolhapur, Maharashtra (Aster Aadhar Hospital; 231 beds, owned), which the company added to its network by acquiring Prerana Hospital, Kolhapur in 2008.

Aster also has a hospital (Prime Hospitals; 158 beds; leased) in Ameerpet, Hyderabad, Telangana. Strategically, the majority of Aster’s network is spread over Tier II & III cities like Kochi, Kottakkal, Calicut, Kannur, Kollam in Kerala; Mandya in Karnataka; Kolhapur in Maharashtra; Vijayawada, Ongole, Guntur and Tirupati in AP.

“We are already present in three states now, Karnataka, Kerala, and Andhra Pradesh. We have a limited presence in Maharashtra and Telangana also. But we are also actively looking at expanding our footprint in neighbouring geographies. We are also looking at a presence in Northern India in states like Uttar Pradesh, and we are also very actively pursuing opportunities in Maharashtra through inorganic growth, which can be through M&A.

Coming to the labs and the pharmacy vertical, we have started to create an integrated healthcare ecosystem around the hospitals. This is basically to enhance the patient’s experience and convenience,” says Dr Shetty.

With over 23 years of experience in strategic planning and management, Dr Shetty possesses an impressive track record in establishing and commissioning several healthcare projects in India. Before joining Aster, he held leadership positions at reputable healthcare companies such as BGS Global Hospital and Narayana Hrudayalaya.

During his tenure at Aster, he has been instrumental in establishing many healthcare projects, including Aster CMI Hospital, Aster RV Hospital, Aster Whitefield Hospital, and Aster clinics in Bengaluru. He earned an MD in Hospital Administration from Kasturba Medical College and Hospital, (KMC) Manipal, Karnataka, and received various awards and recognition for his outstanding contributions to the healthcare industry.

“In addition to our dedicated regional focus, we are actively venturing into new geographies, including previously untapped regions and states within India, to uncover potential avenues for growth. It is important to highlight that our approach has evolved from primarily pursuing greenfield projects to brownfield project expansions of our existing hospitals and now embracing Operations & Management of hospitals in Tier II and III cities in the country.

The latter enables us to leverage their existing infrastructure and resources while expanding our expertise, brand, and create a holistic ecosystem of healthcare services. Through these strategic initiatives, we are committed to broadening our footprint, enhancing accessibility to quality healthcare to more people,” says Dr Moopen.

-

A phenomenal journey

A recipient of the Padma Shri Award, Dr Moopen’s journey in developing the healthcare sector of the region has been phenomenal. From a single-doctor clinic in Dubai, Aster has grown into a global healthcare conglomerate with more than 900 facilities spread across seven countries. As the son of the late MA Moopen, a freedom fighter and social leader from Kerala, he has revolutionised healthcare services in the region by creating a model and facilities accessible to different income groups and masses, without compromising the service aspect of the noble medical profession.

Today, Aster is an integrated healthcare service organisation that provides the complete circle of care to people through its world-class network of hospitals, clinics, and pharmacies, offering primary to quaternary care to all segments of the population.

Aster emphasises patient safety, quality assurance, and adherence to international standards to develop a culture of excellence in patient care. Adoption of digital health technologies and platforms improves patient engagement, accessibility, and convenience, resulting in enhanced healthcare experiences. The healthcare chain is also set to roll out the myAster app soon in India. This will help connect the various services offered from primary to quaternary care, seamlessly. The app is already operational in Aster’s GCC region and ranks among the top downloaded health & fitness apps in the EMEA region.

myAster is a one-stop solution designed to provide patients with a seamless, convenient, and personalised healthcare experience. Patients can access a wide range of healthcare services, including in-person appointment booking, virtual consultation, online medication ordering, medical record management, and lab report access, all with the click of a button.

With 700,000 downloads in FY23 alone, myAster has quickly grown to become a leading e-commerce platform for medicine delivery and ranks as the number one free medical app on the Google Play Store and iOS App Store in the UAE. Key upcoming services on myAster include labs and home care, which will enable end-to-end facilitation for all of Aster’s key healthcare services.

“By establishing a comprehensive healthcare ecosystem encompassing hospitals, labs, and pharmacies, we aim to provide a seamless continuum of care to our patients in South India where we are already present. We are also rolling out myAster super app soon in India. Our integrated approach ensures that individuals not only have access to high-quality medical facilities but also benefit from the convenience and efficiency of diagnostic services and pharmacy support. This holistic approach strengthens our position as a leading healthcare provider and reinforces our mission to deliver exceptional and patient-centred care across the nation,” states the Aster chief.

Offering holistic solutions

Dr Shetty says that the Indian healthcare market presents an unprecedented growth opportunity as our citizens seek quality healthcare services at an affordable cost. Aster DM Healthcare has perfected a carefully designed healthcare ecosystem, spanning the entire patient life cycle. The company is uniquely positioned to provide holistic healthcare solutions, including primary, secondary, tertiary, and quaternary care, and is investing heavily in new-age technology like Artificial Intelligence and Machine Learning to bring innovative medical solutions to the forefront, addressing critical healthcare challenges and contributing to improving patient outcomes. “Our five-year topline and bottom-line CAGR is a testament to the robustness of this business model. The restructuring provides the Indian balance sheet with the flexibility to align its capital allocation policies to emerging growth opportunities,” he adds.

-

The company is heavily investing in technology

India’s healthcare market has been expanding at a CAGR of 22 per cent due to favourable demographics, a growing middle class, higher earnings, increased health awareness, and an increase in lifestyle disorders. The Indian healthcare market is expected to reach $638 billion by 2025. The rapid expansion in the industry is facilitated by advancements in healthcare coverage and services, as well as rising investments from both public and private entities.

Following the Covid-19 pandemic, there has been a heightened emphasis on self-sufficiency within the Indian healthcare system, with a shift in focus towards innovation and research, the manufacturing of pharmaceuticals and medical equipment, the digitalisation of health services, equitable access to healthcare solutions, and the promotion of mental health and well-being. The Indian healthcare industry, with its remarkable diversity, presents numerous opportunities across various sectors of medical care.

The presence of world-class hospitals and skilled medical professionals has strengthened India’s position as a preferred destination for medical tourism. Superior quality healthcare coupled with low treatment costs in comparison to other countries benefit Indian medical tourism, and in turn, enhance prospects for the Indian healthcare market. The Indian medical tourism market was valued at $2.89 billion in 2020 and is expected to reach $13.42 billion by 2026. Experts are of the view that the percentage of the Indian population covered under health insurance has been relatively insignificant so far.

However, there has been a noticeable increase in the number of individuals opting for health insurance over time, indicating a growing demand for health insurance in India. The India health insurance market is expected to grow at a CAGR of 11.55 per cent from 2023 to 2030 and reach $30 billion by 2030. The growth of the health insurance market in India is expected to have a positive impact on hospitals as well. As more individuals opt for health insurance coverage, it will increase their ability to access healthcare service bills, including hospital care.

With all these developments in place, Aster is well poised to explore all the opportunities arising in the Indian market. With the segregation of the GCC business, the company now focuses on India and will be better positioned to commence its next growth phase. Both markets (GCC and India) have different dynamics and hence definitely call for different business strategies.

The strategic decision to separate the India and GCC operations has been based on the rationale to establish fair value for both entities, creating two pure-play geographically focused entities that are able to leverage the growth opportunities in their respective markets.