-

Ola plans to continue to develop and launch next-generation EVs to serve a variety of price points

Over the last decade, India’s electric two-wheeler space has achieved significant maturity, evolving from a market dominated by Chinese imports to a thriving ecosystem led by local players, says competitor Ather Energy. “Previously, most EV products available were from China, with no local supply chain ecosystem for components. Moreover, Chinese EV products and components were not designed nor tested for Indian conditions, posing significant challenges for users,” says Ravneet S Phokela, Chief Business Officer of Ather Energy. He refuses to discuss competition in accordance with Ather’s policy.

The PLI advantage

The Government’s impetus to technologically advanced automotive manufacturing, through the production-linked incentive (PLI) schemes, has come handy for Ola. Targeted to boost domestic manufacturing, cut down import bills, encourage exports and generate employment and with a budget of Rs2.73 trillion ($34.1 billion), these schemes were launched across 14 sectors, to create national manufacturing champions and an additional production of Rs30 lakh crore ($375 billion) over the next 5 years.

Ola is the only EV manufacturer that is a beneficiary of two Government of India PLI schemes – the Automobile and the Cell Schemes, according to a Redseer Report. The company is one of only three beneficiaries awarded benefits under the Cell PLI Scheme, as of September 2023. Cell PLI was awarded for a total of 30 GWh capacity, of which Ola was awarded 20 GWh, the largest for any Cell PLI recipient. Accordingly, says Ola CFO Harish Abhichandani, “We are required to achieve 1GWh capacity in the first year in Fiscal 2024, 5GWh in the second, 10GWh in the third and 20GWh capacity by the fourth year”.

E2W penetration in India is expected to expand from approximately 4.5 per cent of domestic 2W registration sales reported on the VAHAN portal in FY23 to 41-56 per cent of the domestic 2W sales volume by FY28 and Ola believes that its singular focus on EVs enables it to leverage this transition in the growing Indian 2W market. Over the next several years, Ola plans to continue to develop and launch next-generation EVs to serve a variety of price points and automotive use cases.

India is a global production hub for two-wheelers – a total of 19.5 million 2Ws were produced in India in FY23, contributing 15-20 per cent of the world’s total 2W production, making it the largest 2W producer in the world after China. Of the total production, 4 million units were exported, and 16-17 million units were sold domestically. Globally, India is the second largest 2W market in terms of domestic sales volumes. The value of the 2W domestic market size in India was Rs1.4-1.6 lakh crore ($17-20 billion) in FY23.

The EV revolution is driven by multiple factors such as the rise in the need for affordable personal mobility that ensures greater reach and convenience than public transport facilities and modes of shared mobility. The current state of road transport infrastructure and a strong supply across price points, fuel types and with multiple features, marketed specifically towards targeted age groups, gender and income levels, is another major factor. The last-mile mobility for industries such as food, e-commerce, etc, will also fuel greater demand for electric 2Ws as players in these markets move towards meeting their sustainability commitments.

-

Women power: Ola’s all women manufacturing facility

A notable industry feature is that the scooter sub-segment has grown quickly in the past few years owing to ease of learning and riding – smaller structure, gearless, light-weight framework which makes it the preferred choice for most women, old and even inexperienced riders. This also pushes the demand in domestic and international tourism markets where people need rentals for temporary use. Also, features such as the storage space, low top speed, ease of manoeuvring through congested roads contributed to its utility.

India’s 2W production market of approximately 19.5 million units in Fiscal 2023 is primed for electrification and is expected to aid in achieving India’s promise at the UN COP 26 Summit to cut emissions to net zero by 2070, according to the Redseer Report. The penetration rate of 2Ws in India is relatively low at approximately 15 per cent in Fiscal 2023, evidencing significant growth potential within the Indian 2W market.

Ola operates its own direct-to-customer (D2C) omnichannel distribution network, India’s largest, comprising of 935 experience centres and 414 service centres (of which 410 service centres are located within experience centres) pan-India, in addition to the company website. The omnichannel network helps Ola increase its reach and manage customer engagement and experience. For example, it received a total of 54.8 million unique users on the Ola Electric website in FY23 and 23.22 million unique users between June 2023 to October 2023.

In October 2023, 80.68 per cent of Ola’s EV scooter owners visited the Ola Electric Companion app at least once to access various features and/or functions on the app. The D2C model can lead to cost efficiency by eliminating dealership margins. “We are India’s first E2W OEM of scale to provide an end-to-end online purchase experience to customers,” adds Abhichandani, who was earlier the CFO of Ekart, Flipkart’s logistics unit.

In addition to facilitating home charging through portable chargers, Ola currently offers its customers exclusive charging services through its network of 224 hyper charger guns in 17 states and 764 standard charger guns across 21 states. “Our EV scooter owners can achieve a 50km driving range on a 15-minute charge at our hyper charger guns. For the fiscal year 2023, revenue from operations increased more than seven times to Rs2,630.93 crore against Rs373.42 crore a year ago. For the three months ended 30 June, 2023, revenue from operations stood at Rs1,242.75 crore,” says the CFO.

The R&D focus

“Ola’s in-house capabilities to develop EV technologies are driven by its focus on R&D in India, the UK, and the US, concentrating on designing and developing new EV products and core EV components, such as battery packs, motors, and vehicle frames,” says Aggarwal. The Bengaluru-based BIC (Battery Innovation Centre) focuses on developing cell and battery technology and manufacturing processes for cell manufacturing at the Ola Gigafactory, such as material synthesis, cell manufacturing technology, and material characterisation, prototyping, and testing.

The R&D efforts are centred around five key technologies: software, electronics, motor and drivetrain, cells and battery packs, and manufacturing technology. Over 200 of Ola’s 1,000 employees in the R&D setup are PhD holders, and its R&D spend in fiscal 2023 was over Rs500 crore.

-

India’s 2W production market of approximately 19.5 million units in FY23 is primed for electrification

At Ather Energy, the focus since the beginning was on designing and developing everything from scratch, including the scooter, charging infrastructure, and even the battery, says Phokela. Unlike traditional Internal Combustion Engine (ICE) vehicles, which have a robust supplier ecosystem, many EV components had to be developed from the ground up, he explains.

“So, we worked along with suppliers to design and develop components. This approach enabled us to create products tailored to Indian conditions, with a deep understanding of the local market and user needs. Our batteries, for instance, are designed and built in-house to suit Indian riding conditions, featuring IP67 rating, aluminium casing, etc. Currently, cells are the only component we import. Encouragingly, other OEMs have also started manufacturing their own battery packs or have announced plans to build domestic capacity for battery packs and the components that go into them.”

Automotive electrification

India’s automotive electrification journey started in 2007. Since 2010, the government has focused on EV adoption and initiated regulatory discussions and planning (including setting up the National Council for E-Mobility) to encourage reliable, affordable, and efficient EVs that meet consumer performance and price expectations.

All automotive vehicle segments are witnessing the electrification wave. Shared mobility segments (3Ws, commercial vehicles, and taxis) are undergoing electrification to achieve better operating economics (than ICE). E-commerce and logistics players have adopted EV fleets as part of their decarbonisation commitments. Central and state governments are boosting the electrification of public buses. 3Ws are getting electrified on the back of exemptions from registration and road taxes.

Within the personal mobility segments (2Ws and private 4W-Passenger Vehicles), 2Ws are well positioned to lead the electrification wave in India, unlike many developed markets. This is because of the high sensitivity of Indian consumers to the initial vehicle prices of EVs versus ICE vehicles (given the lower GNI per capita vs the developed markets). Adjusting for purchasing power parity, the average Rs2,00,000-5,00,000 (ie $2,500-6,250) difference between the price of an E4W - Passenger Vehicle and ICE 4W - Passenger Vehicle in India, is quite high for an Indian consumer, unlike in the developed markets.

On the contrary, the difference in prices of E2W over ICE 2Ws in India (Rs20,000-70,000, ie $250-875) is more palatable for Indian consumers, resulting in E2Ws leading the electrification in personal mobility automotives. Reduced registration costs for EVs across states make the on-road price differential between E2Ws and ICE 2Ws lower.

Furthermore, the TCO of an E2W breaks even with a comparable ICE vehicle in ~2 years, while that for an E4W breaks even with that of a comparable ICE 4W in 6-7 years (assuming a total lifetime of 2Ws and 4Ws to be 10 years and 15 years respectively). Moreover, the leaner charging and infrastructural requirements of E2Ws over E4Ws also contribute to their faster adoption in India.

E2Ws have seen an accelerated adoption journey in India, with penetration increasing over six times between FY21 and FY22 and over two times between FY22 and FY23, reaching penetration levels of 4.5 per cent of the 2W registrations reported on the VAHAN Dashboard (MoRTH) in FY23. It has increased further to 5.1 per cent in H1FY24. E2W registrations (and subsequently penetration as percentage of overall 2W registrations) were marginally lower in Q2FY24 than the previous quarter due to a reduction in the FAME subsidy, effective from June 2023.

-

Each EV is powered by the company’s electric powertrain, designed in-house

E2Ws are at the forefront of the electrification of mobility in India due to their favourable total cost of ownership (TCO). E2W adoption, which has grown rapidly to reach approximately 5.1 per cent of total 2W registrations in India in the first half of Fiscal 2024, is projected to account for 41-56 per cent of domestic 2W sales volume by FY28. Additionally, markets like Africa, Latin America, and Southeast Asia provide an export opportunity for Indian E2W OEMs, which are well placed to leverage an export opportunity of 100-110 million units globally, says Redseer.

Asked about the constraints, Ather’s Phokela says: “The best way, we believe, to hasten EV adoption and make it a hassle-free process is by building the necessary ecosystem around EVs. This is why, since the beginning, we have focused on building not just quality EV two-wheelers, but also establishing a network of fast-charging infrastructure across the country that is easily accessible. This, to a great extent, helps reduce any charge anxiety a rider may have.” According to Ather, range anxiety and the fear of running out of battery power without an immediate charging facility are still concerns for many prospective EV buyers. To alleviate this anxiety, a widespread network of charging infrastructure across the country is important.

“We currently have 1,900 fast-charging stations across the country. Despite having the second-largest domestic 2W sales volume, E2W penetration in India is lower than in Germany, China, France, Spain, and Italy but is expected to expand from approximately 4.5 per cent of domestic 2W registrations reported on the VAHAN portal in FY23 to 41-56 per cent of domestic 2W sales volume by FY28. Approximately 18 per cent of vehicles manufactured in India in Fiscal 2023 were exported."

India’s favourable policy environment is also accelerating the electrification of mobility, led by improved EV penetration across vehicle segments. The National Electric Mobility Mission Plan (NEMMP) 2020 covers multiple incentives, including demand incentives for various EV categories. Pursuant to the NEMMP, the government launched the Faster Adoption and Manufacturing (of Hybrid &) Electric Vehicles in India (FAME) in 2015 to enable a leapfrog to an environmentally cleaner, sustainable, advanced, and more efficient electric vehicle-based system.

“Ola is well-positioned to address the large market opportunity in EV due to our vertically integrated approach, focus on technology, R&D, execution ability, and eligibility to avail certain government incentives,” says Aggarwal. Globally, disruptor OEMs versus incumbent OEMs have emerged as winners in EVs driven by a focus on innovation. Similarly, in India, disruptor OEMs have scaled well to cover more than 70 per cent of the E2W domestic sales by volume in the first half of FY24.

User-centric approach

“We take a user-centric approach to design that seeks to enhance the mobility experience and our products’ appeal to India’s 2W customer segment. Our design philosophy emphasises both functionality and aesthetics,” says Aggarwal. The company follows a design-for-cost philosophy, whereby the EVs are designed to optimise the cost of manufacturing, sales, and distribution of the end product.

Each EV is powered by the company’s electric powertrain, designed in-house using a modular design that incorporates core EV components, including a modular battery pack that varies in size depending on the EV model, an in-house developed BMS, a motor, and a power electronics module. The design and configuration of the motor also contribute to improved efficiency. Ola’s EV design received the German Design Award in 2020.

-

We will hopefully be able to sell our cells to other EV-makers after meeting our own needs

In August 2023, Ola transitioned from its Generation 1 platform to Generation 2, which will now be the base for future EV scooter models. Compared to the Generation 1 platform, the Generation 2 platform has a lower BOM (bill of materials) and unit economics as well as enhanced features. The Ola S1 Pro (second generation) offers a 26 per cent improvement in EV performance, a 28 per cent improvement in thermal performance, an 18 per cent reduction in cost, 11 per cent fewer parts, 6 per cent less energy consumption, and a 4 per cent reduction in EV weight compared to the first-generation model.

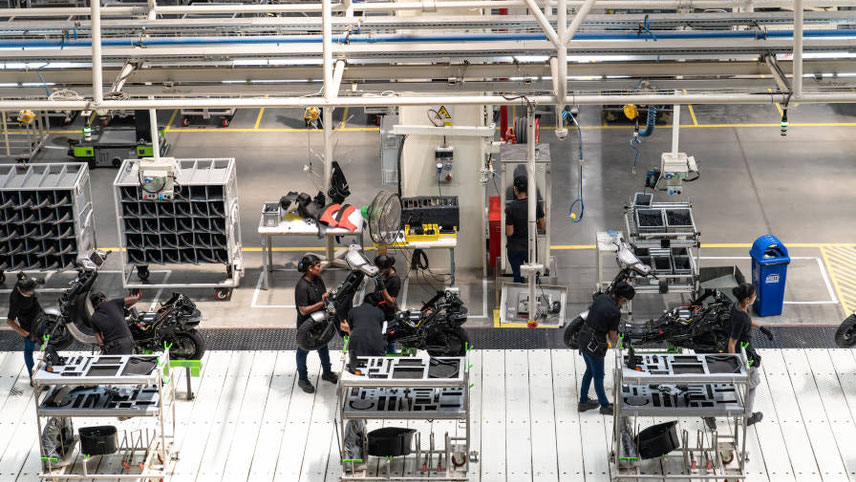

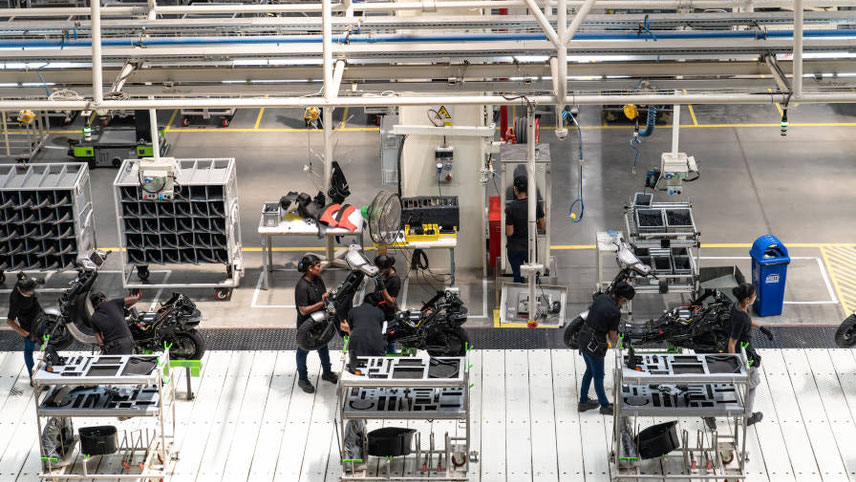

“We started manufacturing EV scooters on our Generation 2 platform at our Ola Future factory in September 2023. Ola designs its E2Ws to suit India’s terrain and climate, applies industry standards in the E2W testing and validation process, and undertakes multiple pre-production tests on specific batches of EVs, such as cell charging and discharging tests,” says Aggarwal.

As of 31 October 2023, it had accumulated over 13.7 million kilometres of road tests for its products. The battery packs have received an IP67 rating from the Automotive Research Association of India, which signifies that the E2Ws are protected against water ingress and are therefore able to operate in certain challenging environments.

Ola products are certified by the relevant authorities and certification organisations, including the Automotive Research Association of India for the Ola S1 Pro and its variants, and the International Centre for Automotive Technology for the Ola S1 Pro and the Ola S1 X+.

In September 2023, Ola launched MoveOS version 4, as a beta roll-out, which includes various new features such as navigation powered by Ola Maps (owned by Geospoc Geospatial Services Private Limited, a Promoter Group company), call filter, ‘find my scooter’, geofencing, time fencing, anti-theft alert, fall detection, hill hold, auto turn-off indicators, ride journal, and energy insights.

Following the MoU signed with the state government of Tamil Nadu, Ola plans to build its 2,000-acre EV hub with its Future factory and the Ola Gigafactory. The company plans to launch affordable mass-market Ola S1 models, including E2Ws targeted at the personal, business-to-business, and last-mile delivery segments by the first half of FY25.

“We will enhance the customer experience through the continued expansion of our network of experience centres and service centres across both rural and urban areas and deepen our penetration within India. We aim to further expand our network of charging stations across India in the near term, to provide added convenience to our customers in charging their EV scooters,” Aggarwal says.

Ola plans to expand its network of Ola branded charging stations strategically by focusing on fuel stations, high-density office complexes, malls, and educational institutes.

“Our capital allocation approach emphasises investment in R&D and technology to design, engineer, and manufacture core EV components and establish an adaptable platform architecture to support further development and manufacturing of EVs,” says Abhichandani.

As an Independence Day gift last year, Ola announced a line-up of E2W motorcycles: Cruiser, Adventure, the Roadster, and the Diamondhead, and it expects to begin delivery of the motorcycles in the first half of FY26.

-

Ola Electric Mobility has set up India’s largest integrated and automated E2W manufacturing plant

“While we have adopted an India-first strategy, we recognise the unfulfilled demand for EVs in international markets, especially in some key automotive markets such as ASEAN, Latin America, and Africa, which are large 2W markets as the Redseer report indicates,” says Aggarwal. These markets constituted approximately 75 per cent of India’s 2W exports in Fiscal 2023.

Ola is confident that the rise of EVs will aid in achieving India’s promise to cut emissions to net zero by CY2070 as communicated at the UN COP26 summit. Unlike ICE vehicles, EVs have zero tailpipe emissions. Moreover, the GHG emissions associated with an EV over its lifetime are typically lower than those from an average ICE vehicle (gasoline car GHG emissions are 2.6x of an EV with a 300-mile range, as per illustrative estimates by the United States Environmental Protection Agency), even when accounting for manufacturing.

EVs also typically have a smaller carbon footprint than ICE vehicles even after considering the electricity used for charging. Further, 40 per cent of India’s installed electricity capacity comes from non-fossil fuel sources and measures are being taken to make power generation more sustainable (such as the National Hydrogen Mission, Viability Gap funding support, and Framework for Pumped Storage Projects), says Redseer.

Evolving customer needs around safety, performance, comfort, and utility are leading to an increased role of software and electronics in vehicles. India is incrementally aligning vehicle safety rules with global standards. Features like anti-lock braking, rear parking sensors, and speed sensing door locks are already provided by OEMs.

Moreover, advanced safety features like electronic stability control, emergency stop signal, and emergency calling, etc have been mandated by the European Union and will drive Indian OEMs to further enhance safety features in their products. As a result, the share of electronics (including semiconductor chip) components as a percentage of the vehicle BOM for cars has increased by 5-10 percentage points (of the total BOM cost) in the last 2-3 years. With the evolving electronic architecture and electrification of the vehicle powertrain, this share is projected to reach 25-30 per cent of vehicle (4W) BOM costs in CY2030, says the Redseer report.

The risk of supply chain shocks has never been more palpable than today, following compounding crises from the US-China trade war, the Covid-19 pandemic, and the war in Ukraine. Manufacturers across the world are seeking supply-chain resilience, which would mean investment into the diversification of the supply chain, per the Economic Survey FY23.

India’s economic resilience, geopolitical stability, large and young working population resulting in cheap and abundant labour, and simplified labour laws make it an attractive alternative for global manufacturers, including automotive manufacturers. Moreover, youth upskilling initiatives like the National Skills Development Mission build a skilled workforce with a depth of technical knowledge.

The relative ease of doing business and high return potential in the Indian market also aid investment flow into the country. Further, automotive OEMs are focusing on increasing production capacities, as indicated by the growing private capex (Rs24,000 crore ie. $3 billion) in FY23, ie, 4-5 per cent of total private sector capex.

As per the Ministry of Heavy Industries, the PLI scheme for AAT has also been successful in attracting the proposed investment of Rs74,850 crore ($9.4 billion) against the targeted investment of Rs42,500 crore ($5.3 billion) over a period of five years. The scheme has also attracted foreign investments. The government’s thrust on capex is improving supporting infrastructure through the development of national highways and electric charging infrastructure.

-

The in-house design and manufacturing of core EV components enhance our control over the optimisation of EV performance and quality

Ather also believes that India is poised to become the global leader in the electric two-wheeler segment. “We are far ahead of anyone else. The strong domestic market has provided the industry with the opportunity to invest in R&D and create new platforms. These developments have also been accompanied by the development of a strong local supply chain. The government has played a strong role in this localisation drive by providing encouragement and incentives to build a local supply chain. As we intensify our efforts in this direction, we possess immense potential to become the world’s largest hub for EV design, manufacturing, and innovation,” adds Phokela.

Of the total domestic vehicle production in FY23, 18 per cent (approximately 4.8 million vehicles) were exported. Driven by the recent geopolitical concerns, global manufacturers are looking for alternatives to China as a production base. Also, India is seen as a market that produces high-quality, value-for-money vehicles suited for tropical climates and road conditions. Consequently, India stands to grab a bigger share of global exports. Under the Export Promotion Capital Goods Scheme, the import of capital goods at zero Customs duty for export production is being further rationalised.

Having been on the road to success, Ola Electric Mobility now plans to go public. “We have already obtained SEBI observations and a few more questions from the regulator are being responded to,” says Aggarwal. The Initial Public Offering (IPO) is a fresh issue of equity shares up to Rs5,500 crore and an offer for sale (OFS) of 95,191,195 equity shares at a face value of Rs10.

Kotak Mahindra Capital Company Limited, Citigroup Global Markets India Private Limited, BofA Securities India Limited, Goldman Sachs (India) Securities Private Limited, Axis Capital Limited, ICICI Securities Limited, SBI Capital Markets Limited, and BOB Capital Markets Limited are the book-running lead managers, and Link Intime India Private Limited is the registrar of the offer. The equity shares are proposed to be listed on the BSE and NSE.

India is now emerging as a manufacturing powerhouse of EVs. The total addressable market for 2W exports from India is between Rs7.20 lakh crore and Rs8 lakh crore. The trend towards the electrification of mobility is driven by increasing affordability of EVs attributable to lower battery prices, improved EV driving ranges, and regulatory support amongst other factors, in addition to advanced software-enabled features, a favourable policy environment, and a lower carbon footprint as compared to internal combustion engine vehicles (ICE).

India, with its vast potential and conducive policies, can undoubtedly pave the way for a cleaner and greener transportation future, says CII. ‘By studying successful EV adoption strategies worldwide and focusing on infrastructure, technology, awareness, and stable policies, we can create a model for others to follow. So, buckle up and get ready for the electric revolution. Remember, every decision we make shapes the future,’ CII adds in the latest blog.

For Aggarwal, born in a middle-class family in Ludhiana, his dream journey towards energy transition has just begun. Having obtained the BIS certification for the Ola lithium battery, he is confident of playing a big role in India’s EV revolution. “We will hopefully be able to sell our cells to other EV-makers after meeting our own needs,” he quips. Watch this space.

-

E2Ws are at the forefront of the electrification of mobility in India due to their favourable total cost of ownership

EVolution – Focus on sustainability

At the heart of the EV revolution lies the pursuit of sustainability

EVs offer the potential to significantly reduce carbon emissions, improve air quality, and conserve natural resources. By transitioning to electric mobility, India can establish a harmonious equilibrium between ecological sustainability and economic advancement, says the White Paper on EVolution: Catalysing Technology-Led Ecosystem for e-Mobility Contexts, Challenges and R&D Imperatives, brought out by the Department of Science & Technology (DST).

The white paper, released in June 2024, points out that a truly circular EV battery ecosystem rests on three pillars: responsible sourcing, innovative reuse strategies, and efficient recycling. Each requires technological advancements, scalable processes, and business models that prioritise sustainability and economic viability.

The EV revolution hinges on the efficient and sustainable lifecycle of its batteries. It involves extracting critical minerals like lithium, nickel, cobalt, and graphite. Responsible sourcing practices are crucial to ensure ethical and environmentally conscious extraction. Diversifying supply chains beyond a few dominant countries further bolsters sustainability.

These minerals are refined and processed into battery components and are ultimately assembled into EVs. There is a need to evolve and standardise lithium processing technology both for the first mile, ie primary extraction, and the last mile, ie recycling and circularity from end-of-life cells.

The recent discovery of mines in Jammu & Kashmir and other regions may be explored. Geological exploration of raw materials related to e-mobility may be undertaken. Currently, in India, battery cells for EVs are imported. These imported cells are not necessarily tailored to suit Indian conditions, their cost is high, and the supply may be limited.

Furthermore, since India is not attracting top cell manufacturers, the cell quality is compromised, leading to safety (fire) incidents and cell failure. The local cell manufacturing industry is very nascent.

There is strong interest from the government in developing and expanding local manufacturing capacity. The Rs18,000 crore PLI subsidies for local battery manufacturing facilities have been successful in bringing players like Ola Electric (20 GWh), Reliance New Energy Solar (20 GWh), and Rajesh Exports (5 GWh). The projected capacity demand in India is 220 GWh by 2030 and 500 GWh by 2035.

From a long-term perspective, other battery cell chemistries are being developed. Sodium-ion batteries (SIB) and solid-state batteries (SSB) are emerging as promising options, and lithium-sulphur and lithium-metal chemistries are still in contention. SIB, where sodium replaces lithium, offers a potential cost benefit but suffers from lower energy density.

SSB has superior thermal stability, but lower cycle life and manufacturability hinder the development of commercial EVs. Metal-air batteries may be explored, especially for large vehicle applications. They are non-rechargeable but recyclable. Zinc-air and aluminium-air technologies do not rely on imported materials, which addresses the raw material scarcity and cost associated with LIB.

The journey towards widespread EV adoption in India requires a unified effort from all corners of the e-mobility ecosystem. Apart from the government, industry and R&D have a critical role to play. By collaborating, innovating, strategising, and investing together, the government, academia, and industry can transform the electrification of the road transportation sector and effectively contribute to realising the aspirations of decarbonising India.