-

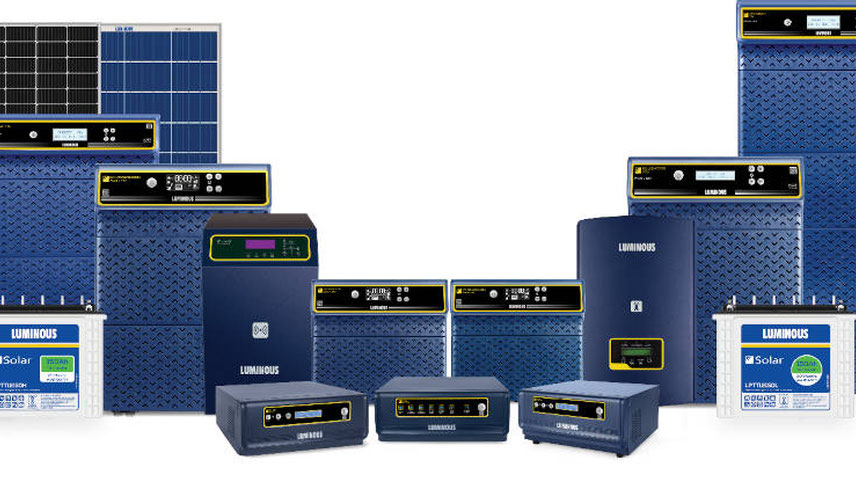

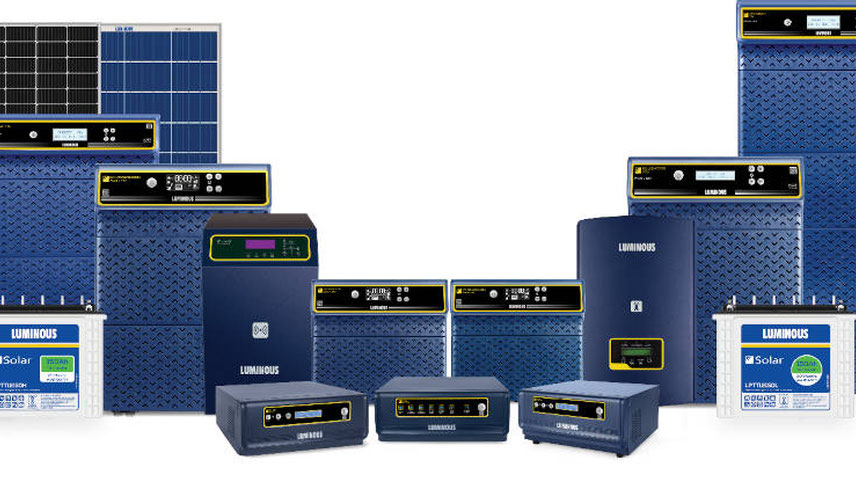

Luminous has a dominant positioning in the inverter and inverter battery segments

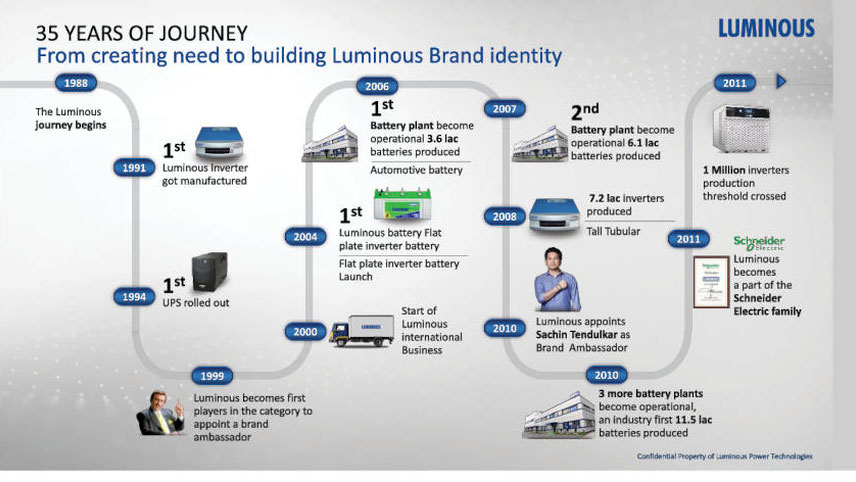

Having all the trappings of a player capable and set for a long innings, the company took the first fresh stance when global automation and energy management giant Schneider Electric entered in the picture by buying about 74 per cent in Luminous at a reported price of Rs1,400 crore, which gave it control of the company. The French firm, which had been operating in India for last 60 years, has shown an aggressive streak in recent decade and made the most of inorganic route options in strengthening its presence in the country.

Its biggest acquisition in the country was that of L&T (electrical & automation division) in 2018 for Rs14,000 crore. In 2017, Schneider acquired the remaining 26 per cent of Luminous, which gave it complete control of the firm. The original promoters exited and went on to form SAR group, which has stepped into the inverter and water purifier segments with LivGuard and LivPure brands, creating space for themselves in the fast expanding market.

The top officials of the company underline that the company’s momentum has been pushed to a new trajectory after the ownership change. Today, it is more formidably positioned – aligned with demand impetus, primarily of the domestic market, with increasing share of international sales, using Schneider’s global network). “We must have grown by four times in size than what we were in 2011,” says Manish Pant, chairman, LPT board & executive VP (international operations), Schneider Electric.

Pant was the CEO of Luminous, when the French firm took over the majority stake (he spearheaded the company’s moves for three years after the change in ownership management team). “We inherited what I would call basic manufacturing capabilities. Schneider’s advent ensured that those units were upgraded and their capacities were taken to the next level,” says Bajaj.

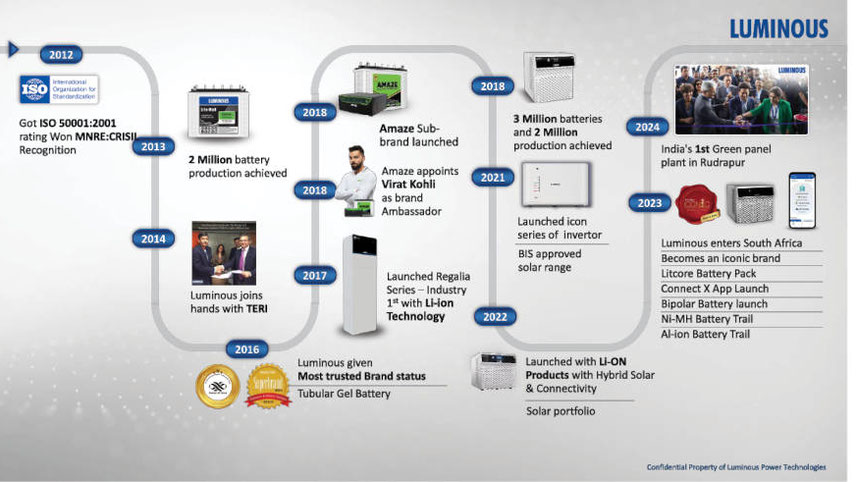

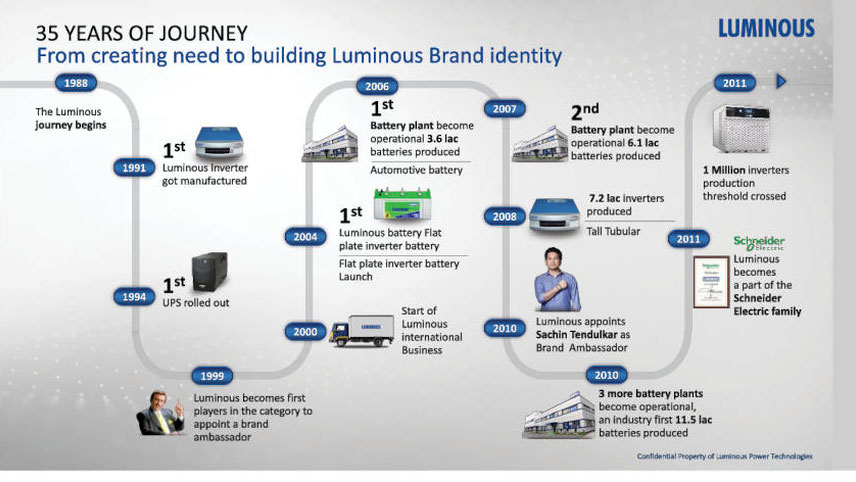

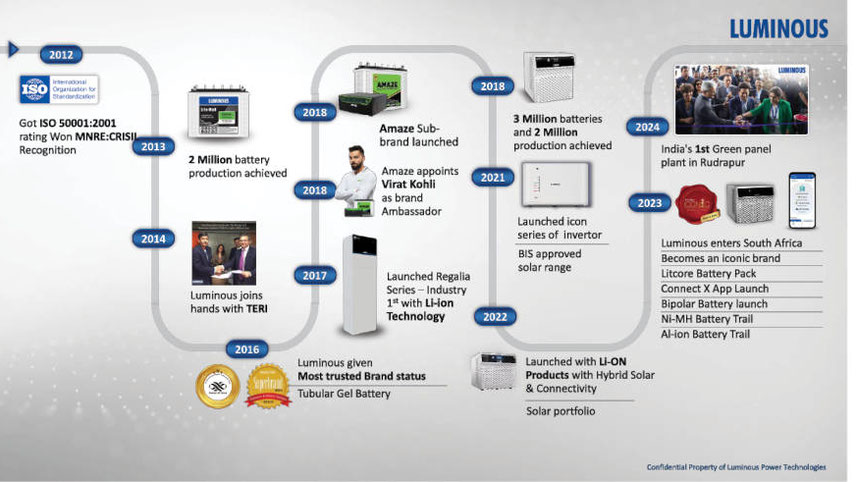

Once Schneider got onto the driver seat, Luminous saw addition of more strength, including a massive jump in the production capacity (see chart: The journey), launch of new series of inverters and batteries, initiation of sub-brand Amaze, etc.

Tapping solar

The company is quite comfortably positioned today. Though the top officials refused to divulge critical financial numbers, a CRISIL rating report (reaffirmed stable rating for the company) released about a year ago had underlined the plus points of the company clearly. Calling Luminous an established brand, the agency had estimated the revenue level of the company in excess of Rs4,000 crore in 2021-22 (Rs4,059 crore, to be precise), as against Rs3,748 crore in the previous fiscal.

The CRISIL evaluation of the company’s performance further elaborated its moderate to commanding market share in the key domains it is present in. Market shares of 41 per cent and 22 per cent in the inverter and inverter battery segments, respectively, is backed by a network of over 1,300 distributors supplying to almost 60,000 dealers across the country. Today, it has half a dozen manufacturing units concentrated in Himachal Pradesh (Baddi and Garget), Tamil Nadu (Hosur) and Uttarakhand (Haridwar & now Rudrapur).

The company is the leader of the pack in the residential inverter segment while it is number two in the battery supplies nationally. “On a cumulative basis, we have more than 300 SKUs when you look at our inverter and batteries portfolio,” informs Neelima Burra, chief strategy & transformation officer, LPT.

-

Burra: enhancing customer centricity

Luminous has also been selling solar inverters for quite some time. But the unveiling of Rudrapur plant has added a new dimension to its operational strength. It has become the first player in its segment to have got into panel manufacturing, with the largest solar panel factory in Uttarakhand, spread over an area of 10 acres. The plant is fully automated and equipped with the latest and cutting-edge solar module manufacturing technologies.

It boasts of being the first in the country to have future module technology, with fully robotic automation capabilities to manufacture high-quality modules. Launched with a capacity of 250MW, the state-of-the-art plant is expandable up to 1 GW. This plant can make poly-crystalline, mono-crystalline, n-Type and Topcon panels (both mono-facial and bi-facial), with options to adapt from 5BB to 16BB. With these capabilities, Luminous is now capable of managing all forms of roof-top solar panel requirements for residential or commercial. This site will also host a state-of-the-art PV module performance efficiency and reliability evaluation lab, which has the potential to get NABL accreditation in the future.

“This factory is a significant step towards achieving the collective goal of Schneider and Luminous to promote net-zero practices and sustainable energy solutions. With this facility, Luminous is well-positioned to further accelerate its solar business, given India’s evolving renewable energy market,” Pant says.

The company has reportedly spent Rs75 crore in setting up this facility and the production process here will adhere to the highest international standards. “We subscribe to UL (Underwriters Laboratories) standards, which is a leading global agency for the certification of solar panels,” explains Ganesh Moorthi, CTO, LPT.

Luminous is now ready to bet big on solar led applications in its key domain offerings. And, the panel plant is a move in that direction which, it feels, will be a key differentiator. Its solar-linked offerings account for nearly one-quarter of its sales and it is keen its share to corner larger share in the pie. Looking from the group perspective, this is the first major panel manufacturing plant which Schneider has set up anywhere in the world and it is clearly meant to play a crucial role in international supplies as well in the not-so-distant future.

“Solar will be a significant part of our business and we see it as a major growth enabler, as we aim to double our growth in the next three years. We believe that solar is the future, and as demand for clean energy sources continues to rise, we are committed to being a leading company in this energy transformation journey,” says Bajaj. And, it’s not only panel manufacturing.

To evolve as a player with the capability of offering an end-to-end solar energy management ecosystem, the company has also unveiled its flagship Connect X App. “You can call it a super app that offers customers’ insightful information on real-time energy consumption and monitoring, solar energy generation, and inverter performance,” Moorthi quips. “We are going to the next level of enhancing our customer centricity. We clearly want to emerge as a solar technology firm,” adds Burra

-

Solar will be a significant part of our business and we see it as a major growth enabler, as we aim to double our growth in the next three years

Broader direction

The top brass of the firm seems to be convinced that its solar solution ecosystem initiative with panel manufacturing capability is happening at an opportune moment, given the recent launch of the ‘Suryodaya Yojana’ by Prime Minister Narendra Modi. The scheme promises to revolutionise rooftop solar panel installation in the country which has not really taken off on expected lines. “We have only 0.5 per cent homes in the country, which meet their energy demands through rooftop solar systems. So, the opportunity here is huge,” points out Vinay Rustagi, senior director & global head, renewable, CRISIL.

The current government’s solar power thrust mooted during its first tenure beginning in 2014 had envisaged rooftop segment contributing 40 percent of the targeted 100 GW by solar by the end of 2022. But the actual figure achieved by the deadline through rooftop route was just 7.5 GW with poor adoption in the residential segment. As experts point out, this has remained a laggard due to a variety of reasons including the overall failure of the stakeholders to convince the consumers on financial benefits and other regulatory challenges.

But, now, the prime minister is promising a massive solarisation drive (if the BJP comes back to power), which will cover 10 million homes in the next few years, mostly in a grid alignment (another critical challenge, which has to be sorted out) giving them the avenue of earning extra income on surplus power generation.

Though the country’s lacklusture performance in the residential rooftop segment in the past could be a serious concern, the management says it is in no hurry. “Ours is a technology company, it’s our job to make the technology easy for the customer so that they can get value. That’s the job we’ll continue to do. Will we have to wait for the market to get created or create the market? I think the short answer is yes,” argues Bajaj.

However, market observers feel that prospects of solar-led home storage systems will be more positive now than in the past and when that happens, an entity like Luminous, with its complete solar solution package and intrinsic linkage with a leading multinational like Schneider, stands to benefit.

“Solar power for common commercial and residential utility is likely to be a better visible trend in the future. And all companies in the inverter and battery space are doing something to cash in on the envisaged opportunity. Exide is ramping up its storage systems and Amara Raja has begun doing solar EPC. For Luminous, getting into solar panel manufacturing is a logical step. So far, we have been deficient in local solar panel manufacturing. With their captive unit, they can control the supply chain and quality,” says Rustagi.

Others like Akshay D’souza, chief, growth & insights, Bizom, underline that Schneider’s global network will be a huge asset for this line of operation. “They get a huge access to the international market. It could be a game changer for them,” says D’souza. Bajaj underlines the fact that the near run priority would be responding to the demand from the domestic market but expanding wings internationally will also emerge as a priority.

“In international markets, what we would want to do is position ourselves as a solutions player. So, today, we are in 40 markets where we supply much of which is countries in Africa and parts of the Middle-east and then south Asia Pacific,” she contends. “We are also looking at South America as the next major market from here,” adds Pant, while adding that the company is keen to increase its international sales revenue which is now 10 per cent of the total business.

-

“In the inverter and battery segment, significant developments are underway, with consumer preferences evolving towards higher-capacity inverters to support the growing use of high-power devices and gadgets. The replacement market drives a substantial portion of battery sales, with organised players gradually gaining dominance over unorganised suppliers,” says Dr. Rahul Walawalkar, Founder & President, India Energy Storage Alliance (IESA).

The agency’s latest report titled ‘Insights on Rooftop Solar & Home Inverter Battery Market’ clearly underlines that despite encountering operational and financial challenges, with market fluctuations in solar PV prices, the rooftop solar sector has exhibited resilience. The sector is now on an optimistic growth trajectory and the country is poised to surpass the 40 GW target (from rooftop solar) by 2030 in a regular scenario and can well achieve 80 GW in the best-case scenario.

Meanwhile, on the current market equation vis-à-vis inverter battery market, the report underlines that Exide and Luminous are the dominant players and other leading players are: Amara Raja, Okaya, LivGuard, HBL Power Systems, V-Guard Industries, Racily Udyog, Eastmann, Southern Batteries, and Jayachandran Industries.

Pant clearly mentions that the group is convinced that the India growth story is going to get stronger and is keen to expand its footprint further in the country. “India is one of our four hubs in the world today. The other three are: US, Europe and China. India, in fact, is the third largest contributor to our global sales. We will further expand here,” says he.

The group, meanwhile, has an ongoing capex plan comprising a corpus of about Rs3,500 crore and according to Bajaj a sizeable part of it has been apportioned for Luminous, which includes upgradation of existing plants and opening of another large scale plant at Angul, Odisha. The company is strengthening its sales channel. “We have just started partnership with leading e-commerce firms. Our sales exercise will be omni-channel,” says Burra.

-

One clear perception about the company has been its North India centricity. In the past, it was a company based in Delhi/NCR serving markets in the surrounding states and that supremacy seems to be intact even now. “About 50 per cent of our sales come from North India, followed by 16-17 per cent from the East, 15 per cent from the South and rest from West India. We are a number one in the north and the east and trying for sizeable expansion in other regions,” informs Amit Shukla, senior VP, energy solutions, who has been associated with Luminous since 2006, when the original founders were in command. Exide leads the western market; it is strongly positioned in the South too, along with Amaron.

Luminous’ sub-brand Amaze has not done as well as it was expected to, say the market sources. Company officials refuse to say how much of share it has in the total sales but emphasise that there are clear differentiating factors between the two, which will help in the medium to long run. “The rationality of setting up Amaze brand was to fight the Tier II brands. We don’t want to dilute the equity of Luminous,” Burra responds.

Being a battery player with diverse range and technology platforms, it is quite natural to wonder if Luminous will be contemplating any alignment with electric vehicles (EV) at some stage in the coming years. The company, according to Bajaj, may look at those options but currently it is more focussed on its core strengths – something that was expanded in the form of the panel manufacturing plant in Uttarakhand’s Rudrapur.