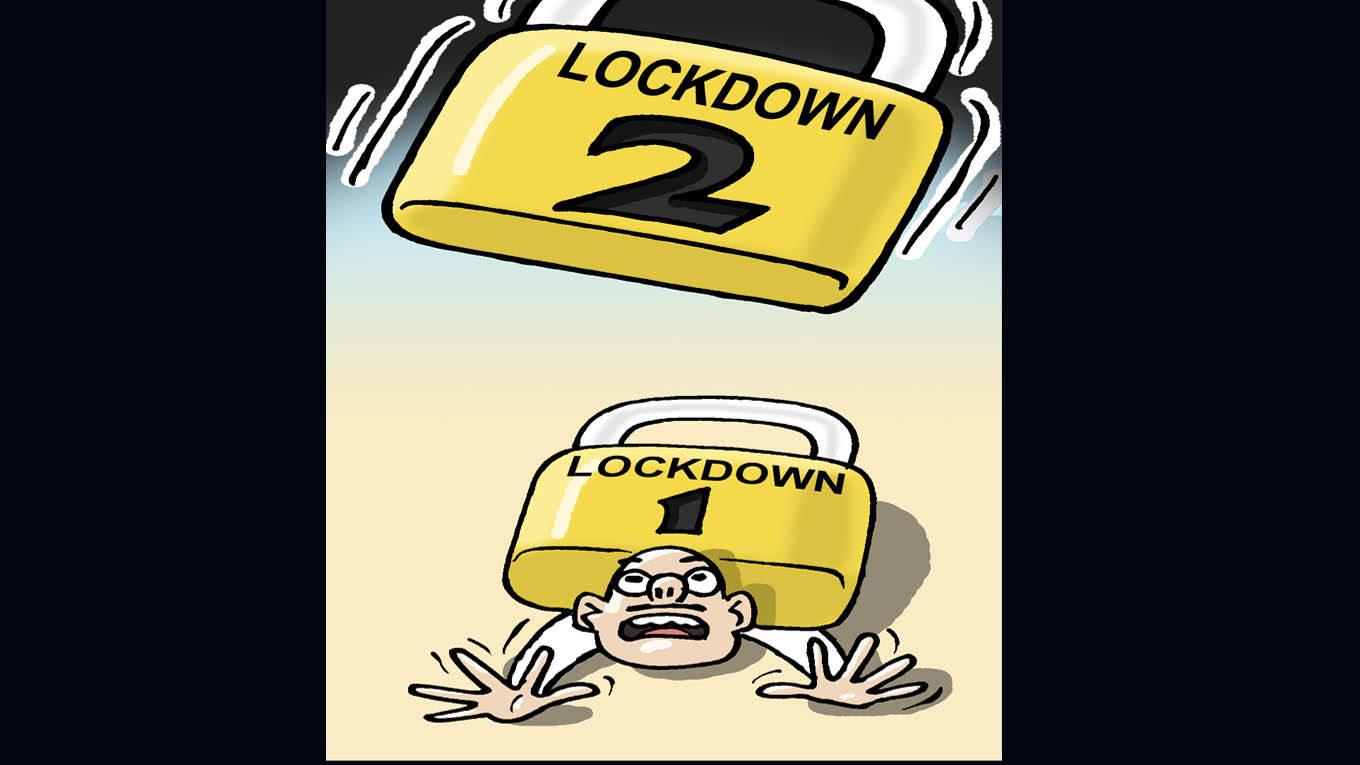

The pandemic and the lockdown that followed has been a blow on businesses that have had to cut, curtail or bring operations to a halt. Has the government, however, as parens patriae, done all that it could have done to help and support such businesses to get back on track? Several business associations – over 20 of them representing small-scale industries, mall and shopping centre owners, real estate players and power producers among others – do not believe so. With the pandemic displaying qualities of a disaster, they prayed to the Supreme Court that it direct authorities to provide more relief to all financially affected parties – in the form of a waiver on interest during the moratorium period, an extension of the moratorium itself, and the announcement of sector-wise economic packages. They argued that an ‘ex-gratia’ scheme of the government lacked empathy and that the regulator representing lenders and depositors have focussed on their own statutory and internal compliances and interests. But, the government argued that, along with the RBI, it had already done what it could within the timeframe at hand – and also that, with a fall in GST collections, it too was an affected party. It had announced the Garib Kalyan Package for Rs1.70 lakh crore involving free food grains, pulses and gas cylinders and cash payment to women, poor senior citizens and farmers. It said that more than 420 million poor people received financial assistance of Rs65,454 crore under the package. The Aatma Nirbhar Package of Rs20 lakh crore was aimed to provide relief to MSMEs, NonBanking Finance Companies, agriculture, contractors and street vendors. The RBI argued that its decisions were aimed at protecting depositors, since the burden of waiver falls upon the banks which in turn would pass it on to the depositors. If the burden were to pass on to the government, that would have a detrimental impact on other welfare measures. In the Indian Banking system for every ‘loan account’, there are about 8.5 ‘deposit accounts’. Had the government considered a waiver of interest for the moratorium’s six-month period the estimated amount would be more than Rs6 lakh crore. This, the RBI argued, would “necessarily wipe out a substantial and a major part of the banks’ net worth, rendering them unviable”. Insofar as the NDMA Act is concerned, Section 13 of the act states that the National Authority may recommend a relief in payments or grant of fresh loans to persons affected by the disaster. But, the emphasis here is on the word ‘may’, with the legislature refraining from using the word ‘shall’. Moreover, relief, in this case, is to be directed towards affected persons and not specifically or including businesses.

-

Illustration: Panju Ganguli