-

The government feels that NIP holds the key to the future as infrastructure building has a domino effect

Even if one goes back to the UPA I years, when our economy was clocking impressive growth numbers, economists were worried about one anomaly – jobless growth. Salaried jobs were just not growing in tandem with the economic growth. This may have something to do with the fact that the growth was powered by a wave of entrepreneurship consisting of self-employed and small-scale businesses, points out Mahesh Vyas of the Centre for Monitoring Indian Economy (CMIE). There was no large-scale job generation. Can the Modi government now reverse this trend and generate jobs via infrastructure?

A recent report ‘Infrastructure Priorities for Job Creation in India’ by think-tank IDFC Institute seeks to bridge the gap between two crucial policy debates – the infrastructure deficit and the need for more jobs. The survey conducted used data from a primary survey of 2,500 agro-allied, manufacturing and services enterprises in 18 districts to estimate how that deficit can be plugged in a way that reduces costs for firms most effectively. This will result in higher business growth and boost job creation.

The US is seen by many as a model for economic development, yet the infrastructure gap there has sparked off a lively debate. It is commonly acknowledged that the aging US infrastructure industry is 30 years behind its global counterparts and only a new centralised and data-driven approach to infrastructure projects could help it catch up. Also, to ward off a pandemic-driven recession, the government needs to promote infrastructure projects that will create economic growth. So, why can’t we have 5G cellular infrastructure that will allow for faster data rates, a better electricity grid that allows us to drive electric cars or new roads that reduce congestion and commute times, ask a multitude of Americans. Major cities across the US hold a week-long event under the auspices of United for Infrastructure, where federal officials, city leaders, advocacy groups, and other experts participate. The latest such event, a virtual one due to the raging pandemic, was held during 14-21 September. India needs to engage in a similar exercise if NIP is to be given a coherent direction.

Tested formula

What is true of the US should apply to India also. When monetary policy isn’t enough, the government should turn to the fiscal stimulus that infrastructure-creation will provide in getting us through the pandemic, in keeping millions of people employed and helping the nation to overcome so many problems that pre-date the crisis. “Infrastructure development is imperative to revive economic activity, create employment and infuse more liquidity into the system,” says S.N. Subrahmanyam, CEO & MD, L&T which, along with NCC and Ashok Buildcon, was among the stocks that gained after the Modi government’s announcement on the new infrastructure push. “The declaration that the government proposes to spend Rs111 lakh crore on NIP gives a clear indication that India’s growth revival, going forward, will be led by infra push,” adds V.K. Vijaya Kumar, Chief Investment Strategist, Geojit Financial Services. “From the market perspective, companies that would gain from Atmanirbhar push would be the focus of investors’ attention, as has been the case lately”.

-

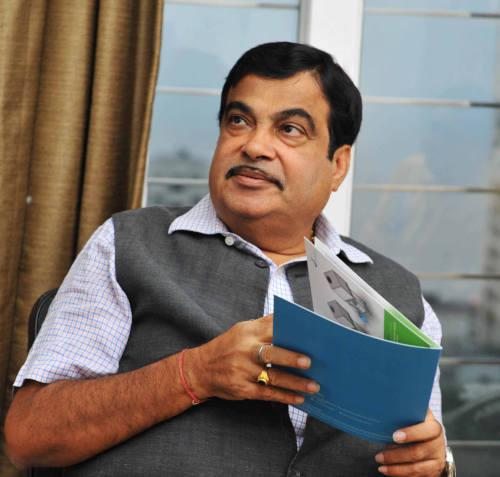

Modi: can he generate jobs via infrastructure?

“Focus on critical infrastructure building through an integrated approach is bound to place India in the league of advanced nations like the US, the UK and Australia in the coming two years,” says Nitin Gadkari, minister for road transport & highways. Indeed, if India wants to compete with other destinations in attracting investment, away from China or elsewhere, the Modi government has no go but to push towards elevating India’s infrastructure to world-class standards. But can the NIP be that vehicle?

NIP consists of a range of projects spanning across sectors such as energy, social and commercial infrastructure, communication, water and sanitation. In his latest (2020) independence day address, Prime Minister Modi had said that the mega scheme to connect the country through a multi-modal connectivity infrastructure would end the tradition of working in silos in the infra space. A break-up shows energy projects account for 24 per cent of NIP, roads 18 per cent, urban projects 17 per cent and railway projects another 12 per cent. The share of the Central government and the states in the projects would be 39 per cent and 40 per cent respectively, while private sector would contribute 21 per cent.

Smart thinking needed

However, the government will have the think smart with a long-term perspective if it really wants infrastructure to drive growth and social equity. It can, for instance, tap the demographic dividend to create an army of semi-skilled professionals. Post-lockdown, millions of migrant workers were left in the lurch and had no option but to leave for their native places in Chhattisgarh, Uttar Pradesh, Bihar, West Bengal, Odisha, Jharkhand and Rajasthan. While some of them have returned on their own or brought back by their employers to the project sites in cities, many still need to be gainfully re-employed. This labour force has basic skills which need to be upgraded for building the kind of world-class infrastructure that the government appears to have in mind. The Centre should co-ordinate with the states to start short-term programmes to map the skills of migrant workers, identify their jobs roles and start their apprenticeship capsules in business establishments. They can then be deployed in the new infrastructure projects.

-

Bullet Train: delayed by political glitches and land acquisition

India’s high cost of logistics relative to other competing nations has always been a major disadvantage. Issues such as congestion and inferior quality of roads are major concerns for companies, the IDFC report points out. Investing in its upgradation and maintenance can result in higher cost savings. “Furthermore, the induced employment effects of building roads are quite high and have the potential to unlock growth among firms across regions,” the report said.

Roads are just one problem. Our port turnaround time stands at about 60 hours, despite significant improvements in the past years. Ports in India handle 90 per cent of the country’s export-import cargo by volume and 70 per cent by value. Accordingly, the quality of port infrastructure and its operational efficiency plays a critical role in improving the competitiveness of importers and exporters in the country. A recent analysis shows that reducing the average turnaround time of a ship – the duration when the vessel reports at the anchorage of a port to the time of its departure – by 50 per cent can boost India’s manufacturing exports by at least 20-25 percent. “Digitisation of our ports will be critical in reducing our turnaround time,” says Amitabh Kant, CEO, NITI Aayog.

The last time any major work was done on ramping up the infrastructure was during the term of Atal Bihari Vajpayee. Two major programmes of expanding the road network through Golden Quadrilateral, a network of highways connecting four metros, Delhi, Mumbai, Kolkata and Chennai, and the National Highways Road Development project to connect Kashmir to Kanyakumari and Silchar to Porbandar were launched. The then government also conceptualised ideas like Sagarmala, the ports-led development to reduce exim logistics costs, and projects like the world’s longest highway tunnel above 10,000 ft, the Rohtang Pass tunnel, connecting Manali with Leh, which was recently inaugurated by Modi. These projects, along with economic reforms carried out during 1998-2004, helped pump-prime the economy.

The UPA took the reforms to airports by privatising them. It also launched the $100-billion Delhi-Mumbai Industrial Corridor (DMIC) in 2006 with much fanfare. The project involved the creation of 24 industrial regions, eight smart cities, two international airports, five power projects, two mass rapid transit systems, and logistical hubs between the two metropolises. DMIC spanned Uttar Pradesh, Haryana, Rajasthan, Madhya Pradesh, Gujarat and Maharashtra. Ten other similar projects were subsequently conceived – Amritsar Kolkata Industrial Corridor (AKIC), Chennai Bengaluru Industrial Corridor (CBIC), Bengaluru Mumbai Industrial Corridor (BMIC) and Hyderabad Bengaluru Industrial Corridor (HBIC), to name a few. The project in which Japan has a 26 per cent stake, has been caught in land acquisition problems in various regions. Just five components of Phase 1 of DMIC have seen some progress – Shendra Bidkin Industrial Area, Maharashtra; Dholera Special Investment Region, Gujarat: Vikram Udyognagari, Ujjain, Madhya Pradesh, Integrated Industrial Township, Greater Noida, Uttar Pradesh and Integrated Nangal Chaudhary Multi Modal Logistics Hub, Haryana.

-

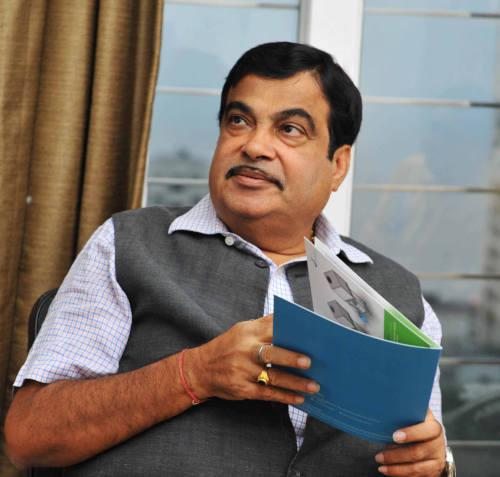

Gadkari: record number of contracts

The delay in DMIC is also an example of shifting priorities of succeeding governments. For some strange reason, the Modi government did not give this project the priority it deserved. Gadkari, for instance, wants smart cities to come up along Delhi-Mumbai expressway that his ministry is steering and not along DMIC. The government perhaps feels that its showpiece bullet train project deserves greater priority than DMIC.

Vajpayee model

Narendra Modi has often spoken about taking forward the work done during the term of Vajpayee by spending Rs100 trillion on infrastructure creation. He has also spoken of development led by ports connected by four-lane road networks. His government promoted the Sagarmala programme, a flagship project of the Ministry of Shipping launched during the Vajpayee years, to promote port-led development in the country by exploiting India’s 7,500 km long coastline, 14,500 km of potentially navigable waterways and its strategic location on key international maritime trade routes. However, the Ministry of Shipping has now started the work related to drafting a new blueprint for India’s maritime sector for the next decade. This comes after the Corona virus pandemic decimating the previously laid-down assumptions and projections on trade that formed the basis for Sagarmala.

While Gadkari, who has been steering the road transport and highways ministry for the last six years, can justifiably take credit for awarding a record number of contracts and speeding up the roads and highways construction work, the fact is that the delay in payment of dues to developers has been a drag on entrepreneurial incentive in the infra sector. Also, projects worth lakhs of crore are stuck as getting financial closure from banks has become difficult. Take the case of the Rs16,000-crore Navi Mumbai international airport project, which has now gone to the Adani Group after it acquired Mumbai airport from the troubled GVK Group. The project had failed to achieve financial closure. The Adani Group will now have to work towards achieving this end; only then will the construction commence. The airport was first scheduled to start operations in 2019 and is a sorry tale of how things have gone wrong in this country. Could this then be Modi’s moment to grasp the nettle with both hands?

-

Subrahmanyam: infra can lift economy

Wooing sovereign funds

Finance Minister Nirmala Sitharaman has been doing her bit. In her last budget, Sitharaman had announced significant income tax exemption for sovereign wealth funds (SWFs) of foreign governments and global pension funds for their investment in infrastructure. The exemption is broadly based on the US income tax exemption provided to SWFs. This is a wise, though belated, move, as asset managers in charge of huge pools of savings in the developed world are groaning under the burden of near-zero yields at home. The task is to induce them to invest in India’s growth-enabling, productivity-boosting infrastructure, offering them attractive returns.

Last month, Sitharaman held a virtual bilateral meeting with United Arab Emirates (UAE) counterpart, Obaid Al Tayer, urging the Middle Eastern nation to participate in NIP. The Abu Dhabi Investment Authority, the sovereign wealth fund of the Gulf emirate, has emerged as a beneficiary of the budget proposal. As the world’s third-largest sovereign wealth fund, ADIA is an active investor in India’s infrastructure sector in recent years. It invests in both publicly listed and privately held companies. But now most SWFs are looking for a piece of action in blue-chip companies which have been in the news like Reliance Industries’ new platforms as well as in the Indian stock market. Typically, SWFs use their assets as buffers and will invest their money in infrastructure only if they see good returns. The Modi government should package infrastructure in such a way so as to ensure good returns.

Sitharaman has launched an information repository of projects identified under the NIP (www.indiainvestmentgrid.gov.in). Investors can use the ‘India Investment Grid’ to access information on infrastructure projects, and form public private partnerships with the government. The portal – recommended by the task force formed to prepare an infrastructure spending road map for the government – will also monitor development of these projects.

But it will need more than a dedicated portal to get things right. Serious issues of implementation (see box: Issues of implementation), along with planning and political glitches, have delayed even showpiece infrastructure projects, the Mumbai-Ahmedabad bullet train being a case in point. From low participation by Japanese companies to tenders cancelled because of steep rates quoted by bidders, India’s first bullet train project is stuck on multiple fronts – and staring at a reported delay of around five years if all the outstanding issues are resolved quickly. Land acquisition is another problem. Currently, only about 100 hectares of the required 430 hectares have been acquired in Maharashtra. After the change of government in the state, the ruling Shiv Sena, a key partner in the three-party ruling alliance, has shown no interest in taking the project forward. However, in Gujarat, owing to active support of the BJP state government, the process to acquire close to 1,000 hectares will be completed by the year-end. Then there is the rising cost of the project due to the widening gap between the Indian rupee and the Japanese yen.

-

Issues of implementation. Photo credit: Sanjay Borade

Recently, technical bids were opened for the design and construction of 237 km length of mainline for the section of the bullet train corridor falling in the state of Gujarat. In the competitive bidding, a total of three bidders involving seven big firms participated, IRCON-Afcons Infrastructure-JMC Projects consortium; Larsen & Toubro; and Tata Projects-J. Kumar Infra Projects-NCC-HSR consortium. The fact that no Japanese companies participated could be a sign of their dwindling interest and the government’s insistence on having an indigenous component. In any case, Japanese executives working on the ground have taken a dim view of the speed with which the project is being executed.

The Modi government needs to get its act right on this project, which has been close to its heart, for the simple reason that it alone will generate over 90,000 direct and indirect jobs during the construction period. Besides, the production and manufacturing markets are also likely to gain. About 2.1 million tonnes of steel, 750,000 tonnes of cement, and 140,000 tonnes of structural steel are estimated to be used in the construction, all of which shall be manufactured in India.

Delayed payments

Delayed contractor payments for infrastructure projects have been another bugbear for the industry, though this is slowly being resolved. Earlier, payments were being made on ‘milestones achieved’ basis, which led to delays; now, these are being made every month. The Gadkari-led Ministry of Road Transport & Highways (MORTH) has undertaken settling of contractors’ issues, including dues, through arbitration to boost stakeholder confidence in building quality road infrastructure in the country. Last month, the government settled highways developers’ claims worth Rs14,248 crore. These claims involved just 47 cases; but there are 59 more under discussion. MORTH also released a sum of Rs10,339 crore during the Covid-19 period under the simplified payment process as envisaged in the ambitious Atmanirbhar Bharat scheme. Another sum of Rs2,475 crore is being processed and is likely to be released soon.

Optics right, reality different

At a time when the economy has gone comatose, the talk of such a big bang project makes for impressive optics. But the reality is different. Modi has first flagged the idea of NIP in his 2019 Independence Day speech. He had then floated a figure of Rs100 lakh crore, which would be invested on infrastructure over the next five years, including social and economic infrastructure projects. The first meeting of the task force set up to draw the NIP took place in September 2019. Towards the end of the year, the government projected the total project capital expenditure in infrastructure sectors in India during the fiscals 2019-20 to 2024-25 at over Rs102 lakh crore. (The figure now being touted is Rs111 lakh crore.) However, by December last year, it was claimed that 42 per cent of such identified projects were already under implementation, 19 per cent under development and 31 per cent are at conceptual stage. Clearly, the projects in NIP were not all new; many ongoing ones had been included – a typical Modi government ploy to rebrand old schemes and parade these as new.

-

The last time any major work was done on ramping up the infrastructure was during the term of Atal Bihari Vajpayee

Identifying and conceptualising the projects to be put on the pipeline was the easy part. Implementing and commissioning them will be the more difficult one. The challenge, however, is in making the plan to boost investment in infrastructure work. Typically, infrastructure projects are characterised by high capital intensity and long gestation periods, often leading to a funding gap. Public investment is key to filling this gap. But, while several economists have made it clear that the country’s Gross Domestic Product (GDP) will not recover unless the government loosens its purse strings, government spending has been comparatively low and uneven during the first four months of 2020-21.

“The government should take stock of the project pipeline and review its expenditure and financing programmes to obtain optimal results and impacts,” says Arun Kumar, Chairman & CEO, KPMG, India. The closing of the infrastructure funding gap calls for developing financing solutions and placing more emphasis on collaboration and shared responsibilities across public, private and non-governmental organisations.

Financing hurdles

There are a few significant hurdles that the government will have to take into consideration. First, the financing plan. Going by the present fiscal situation, it will be no small challenge for the Centre to raise the Rs42-plus lakh crore, even if it is over five years. The financial position of the states is even more perilous. Where will the states get their share of Rs40 lakh-plus crore to plough into infrastructure projects?

Second, the Rs24 lakh crore expected from private investment also looks steep considering the lack of appetite for fresh investment by the private sector now and in the last few years. In fact, this factor has been a major drag on economic growth. Currently, the quantum of private financing flowing into the infrastructure sector has ebbed to around 20 per cent of the total funding, for reasons that are well known – the crisis in the NBFCs, the financial challenges faced by infrastructure companies, and the inadequately developed Indian market for infrastructure financing.

Elias George, partner & national head, Infrastructure, Government and Healthcare, KPMG India, feels that the challenge of ramping up private investments in infrastructure will need action on two fronts: Refreshing institutions and policies for channelling financing; and providing a stable, durable, and empowering ecosystem for private players to partner with government entities in the task of infrastructure-creation.

“Learning from the past mixed experience of PPPs (public-private-partnerships), we need to re-imagine and redesign the PPP ecosystem along many fronts. The Vijay Kelkar committee had put out a timely, practical, and balanced report in 2015 on overhauling the PPP ecosystem, including governance reform, institutional redesign, and capacity-building. This report is laden with eminently sensible plug-and-play recommendations which can radically improve the PPP environment.”

-

Representative image. Road projects have been increasingly delayed, costing financial burden

Given the requirement for private participation to support infrastructure growth, the government has been focussing on enabling PPP projects in the sector. The Indian PPP infrastructure market is significantly large with over 1,550 projects worth over Rs11.4 lakh crore ($150 billion) under various stages of implementation, according to data from, Infrastructure Division, Department of Economic Affairs. India has witnessed a maximum number of PPP projects undertaken in the Transportation (particularly, roads) and Energy sectors. Over the years, while PPPs have been lauded for their approach in sectors such as roads and aviation, they have been equally criticised for being constrained due to long gestation periods and increasing disputes leading to languishing projects. Response to PPPs has been less enthusiastic in most other sectors, owing to a number of regulatory challenges, economic and political changes, inaccurate demand estimation, high risk perception and pending dispute resolution procedures, besides the want of commercially pragmatic implementable models.

The government has tried to address these challenges by exploring alternative approaches towards PPP, with models such as HAM (hybrid annuity model) and TOT (toll operate transfer), backed by public funding, along with policy and regulatory reforms. These may work towards enhancing confidence in the banking system and investors comfortable with EPC (Engineering Procurement Construction) route to an extent. But more needs to be done.

Given the scale of investment, debt will play an important role and it remains to be seen if banks have gotten over their apprehensions on infrastructure financing as a major part of their bad loans originated there. So, there is talk of a new development bank for new infra funding. Not a great idea as in the past, big development finance institutions (DFIs), such as ICICI, IDBI, IFCI and IRBI were also set up. These institutions either reinvented themselves or faded away.

-

Kumar: growth needs infra push

The task ahead for the government is to woo global capital as well as generate both equity and debt. Sitharaman recently made an attempt to tap the sovereign wealth funds and pension funds. The way forward also is to boost modern arm’s-length finance by way of corporate bonds for infrastructure projects. But, as the NIP report itself mentions, while institutional investors are permitted to invest in infrastructural bonds rated AA and above, in practice, most are rarely rated BBB or higher. Hence the pressing need for credit-guarantee to duly enhance bond rating, from, say, Credit Guarantee Enhancement Corporation, announced in Budget 2019-20. Further, given the reluctance of investors to bear construction risk inherent in infrastructure assets, what’s proposed is securitisation of loans backed by cash flow of operating projects. Additionally, value capture financing, which refers to, for example, redevelopment along bypasses and urban infrastructure, can all be gainfully followed through. For viable infrastructure funding, the key really is reasonable user charges collected efficiently, read, digitally.

Centre’s expenditure

But more than anything else, it is the Centre’s capital expenditure that will play an important role. In this connection, EY (Ernst &Young) has made a series of immediate and medium-term recommendations on policy and fiscal measures to finance the infrastructure spending of government, which includes public sector borrowing (Centre and states) of 15 per cent of GDP in 2020-21 to ensure NIP financing for the year. It has also recommended increasing Centre’s fiscal deficit for 2020-21 to 7 per cent of GDP. According to the RBI’s revised borrowing programme, fiscal deficit is estimated at 5.6 per cent of the GDP, adding that additional 1.4 per cent ( Rs3 lakh crore) can be financed through deficit monetisation or borrowing from abroad at substantially low interest rates and spent on capex for infrastructure.

“As per official data on the cumulated revenue collections under road and infrastructure cess and health and education cess, of the total collections from these cesses, there is a short transfer of about Rs2 lakh crore (0.9 per cent of the estimated 2020-21 nominal GDP) to the specified designated funds. These amounts should be available in the Consolidated Fund of India,” the consultancy firm said. Both put together will provide resources up to Rs5 lakh crore for potential infrastructure investment in the next few months, it added. Additional fiscal space can be made available through expenditure restructuring. EY estimates that fiscal space up to 1 per cent of GDP may be released by reduction of revenue expenditure which can be used to augment capital expenditure while keeping the total expenditure at the same level as budgeted for 2020-21.

-

The task ahead for the government is to woo global capital as well as generate both equity and debt

Finally, co-operation from states becomes important in implementing infrastructure projects. The bullet train project is a reminder of how politics can stall infrastructure. Indeed, the experience on this count has not been very happy till now. Land, according to the Constitution of India, is a state subject; labour is on the Concurrent List – it falls under both the Central government as well as the state governments. To align with Central government’s efforts to attract foreign investment and encourage domestic ones, policy for the business environment, conducive to encourage investment and business, is also formulated by the state governments. Thus, the three aspects of development are largely dependent on the state governments’ decisions and participation. Therefore, this opportunity to ramp up country’s infrastructure should be viewed as a chance to proactively engage all the states in the development process. In turn, states should be given a free hand to identify the potential areas for building physical infrastructure on the basis of geographical conditions, markets, existing resources, such as raw materials, and required physical infrastructure including roads, electricity, water, etc.

In short, the key to success will be getting the states to rise above politics, getting the funding right, besides following up and reviewing the pipeline at regular intervals. Only then will the new move deliver results and the Great Indian Infrastructure Dream be realised.