-

The company is one of the largest rooftop segment players in India

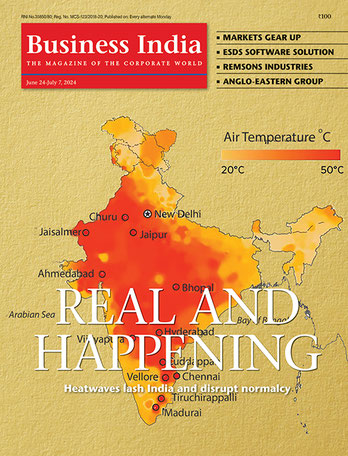

CRISIL Research expects 62-64 GW of solar capacity additions over fiscals 2022 to 2026 as compared with approximately 36 GW over fiscals 2015 to 2021. Growth in capacity additions will be driven by support from government which has outlined an aggressive tendering roadmap and has followed it so far.

CRISIL forecasts approximately 8-9 GW of projects to be commissioned under the solar rooftop segment over the next five years (2022-2026), mainly led by the commissioning of capacities of 1,000 MW by the Solar Energy Corporation of India (SECI); capacities allocated by state governments (up to 1,500-2,000 MW); commissioning of 1,000-1,500 MW of capacities by government institutions such as metro, railways and airports; and 3,500-4,000 MW of capacities to be added by industrial and commercial consumers under net/gross metering schemes of various states.

Further, the ministry’s approval to allow net-metering up to 500 KW will give a much-needed fillip to the sector leading to an increase in demand for rooftop installations. MNRE (Ministry of New and Renewable Energy) provides financial assistance for all rooftop projects constructed by the residential category of consumers: 70 per cent for special category states and 30 per cent for other states. Solar power can act as an alternative for states with high load-shedding such as Tamil Nadu, Uttar Pradesh and Punjab, which are also served by diesel generator sets, as well as rural areas with a poor grid.

Solar energy accounted for 28.50 per cent of the renewable energy basket (including large hydro) as of March 2021. Growth in the solar power sector over the last seven years has been robust, with as much as approximately 36 GW capacity being added in the segment over fiscal 2015-2021 at a CAGR of a staggering 48.46 per cent, although on a low base.

As per the government target of 100 GW of solar energy by December 2022, 40 GW is proposed to be added under rooftop-based solar systems. However, till March 2021, only approximately 7 GW of rooftop capacity is estimated as installed, with approximately 2-2.3 GW estimated to have been added in fiscal 2021 as against approximately 2.5 to 3 GW of ground-mounted solar projects in the fiscal year.

The government has laid significant emphasis on combating climate change. It launched the National Action Plan on Climate Change (NAPCC) in 2008, which includes an eight-pronged strategy – NSM, National Mission for Enhanced Energy Efficiency, National Mission on Sustainable Habitat, National Water Mission, National Mission for Sustaining the Himalayan Ecosystem, National Mission for a Green India, National Mission for Sustainable Agriculture, and National Mission on Strategic Knowledge for Climate Change. The government has laid considerable emphasis on solar power in particular – its target to install 175 GW of renewable energy capacity by December 2022 includes 100 GW from solar.

Safeguard duty (SGD) which was imposed in July 2018 on import of solar cells and was applicable until July 2021, is being replaced with the significantly higher basic customs duty (BCD) of 40 per cent on solar modules and 25 per cent on solar cells, commencing 1 April, 2022 (source: CRISIL Report). The imposition of such high BCD on imported solar cells and modules is expected to significantly improve the competitiveness of Indian cell/module manufacturers.

-

Mehta: strong performance

Waaree is one of the manufacturers in India on the ALMM as released by the MNRE. The company has applied to the IREDA for approval for setting up manufacturing facilities under the PLI scheme, which aims to promote manufacturing of high efficiency solar PV modules in India and reduce dependence on imports in renewable energy. The financial outlay for the PLI scheme is Rs4,500 crore over a five-year period and is aimed at increasing domestic production by 10 GW.

Marquee customers

“We have, over the years, developed a wide customer base,” says Virenkumar Chimanlal Doshi, one of the promoters and a wholetime director. In fiscals 2019, 2020 and 2021, Waaree’s top 10 accounted for 51.61 per cent, 42.62 per cent and 42.78 per cent, respectively, while the largest customer accounted for 16.95 per cent, 9.23 per cent and 14.07 per cent, respectively, of its total revenue from operations in such periods.

Doshi, younger brother of Hitesh, oversees the company’s engineering, procurement and construction projects and explains: “We have, over the years, established strong relationships with a large number of marquee customers across India and globally. Our utility and enterprise clients in India include ReNew Power, ACME, Hero Solar, Mahindra Susten, Essel Infra, AMP Energy, Sukhbir Agro Energy, Solarworld Energy and Rays Power Infra. In addition to our large utility and enterprise customer base in India, we have successfully developed a strong customer base globally and our products are sold globally, including to customers in the United States, Canada, Italy, Turkey and Vietnam. Our international clients include Central 40 and Novel Energy. In addition, we also manufacture Merlin flexible panels for sale to Merlin Solar Technologies.”

Waaree has recently received two large contracts, for approximately 1,000 MW each, from ReNew Power and another solar energy project developer in India, which are expected to make a significant contribution to the results of operations in fiscal 2022 and fiscal 2023.

To reach out to end users such as residential, commercial, and industrial consumers, local contact is very important, particularly for those consumers who accept solar products. With increased awareness, more and more consumers are showing interest in solar installations. The distribution channel partner helps in reaching out to consumers as well as informing them about the new technology.

The end user generally does not have any technical knowledge of complex products such as modules and hence has very little say in the selection. However, through a known partner, consumers can be convinced to a large extent and such networks utilised for enhancing consumer reach.

Waaree Energies has over 350 unique franchisee networks across India. This model differs from dealerships or distributorship of products. These are exclusively tied-up traders which help in end-to-end product plus service. They help in reaching last mile connectivity and in increasing consumer awareness about various offerings in residential and C&I (commercial and industrial) consumers, specially in tier-1 and tier-2 cities.

Vikram Solar has a distribution network connecting more than 40 cities, ensuring the availability of solar products and solutions across 600+ locations pan-India. Similarly, Adani solar has retail distribution of its solar panels in seven regions, with over 500 cities across the country, says the CRISIL report.

-

Waaree Energies has over 350 unique franchisee networks across India

“We have made significant investments in terms of training, resources and support provided to our franchisees over the years and developed strong relationships with these franchisees. Our extensive franchisee network across India increases the visibility and reach of our products through direct customer interaction and distribution by such franchisees,” explains Hitesh Doshi. This deep penetration across metros, large cities, towns as well as rural areas developed over several years presents significant entry barriers for other players in penetrating the rooftop and MSME customer segment.

Waaree’s revenue from operations has grown at a CAGR of 10.79 per cent from Rs1,591 crore in fiscal 2019 to Rs1,952.7 crore in fiscal 2021, while net worth has grown at a CAGR of 15.94 per cent from Rs256.4 crore in fiscal 2019 to Rs344.6 crore in fiscal 2021, despite the impact of the Covid-19 pandemic in fiscal 2021.

“We believe we have prudently utilised our resources, which has enabled us to fund our expansions through a mix of internal accruals and debt. We believe that our strong operational and financial performance will allow us to take advantage of the growth opportunities in the solar energy industry in India,” says Hitesh Pranjivan Mehta, whole-time Director and CFO of Waaree Energies.

“Our focus on continuous efficiency improvements, improved productivity and cost rationalisation has enabled us to deliver consistent and strong financial performance,” says Mehta, a qualified chartered accountant with more than 22 years of experience in the field of engineering, solar and oil industries.

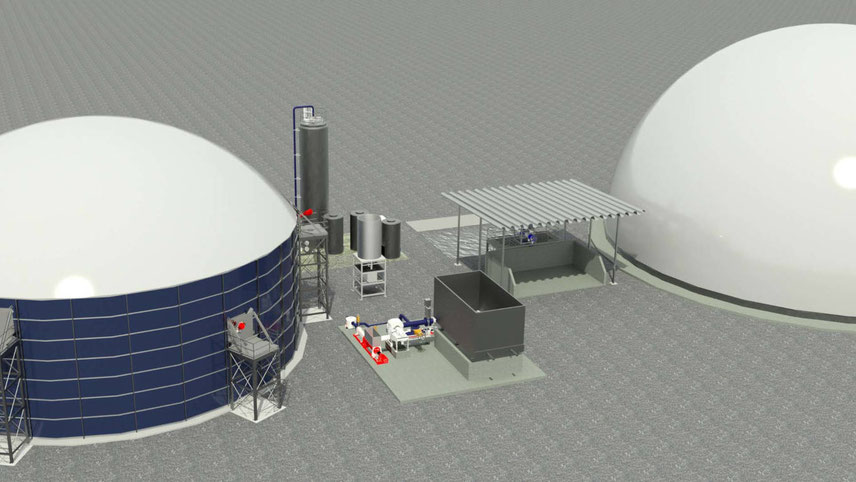

Waaree has three manufacturing facilities – Surat, Tumb and Nandigram in Gujarat – and is in the process of setting up a fourth one at Chikhli in the same state where the company is part of the expansion plans for PV modules and backward integration into solar cell manufacturing, says Mehta. This will help reduce dependence on imported solar cells and third-party suppliers in India. Backward integration in the manufacture of solar cells is a significant eligibility criterion to qualify for the benefits under the PLI scheme which requires that the modules are manufactured with domestically manufactured cells. This will also help mitigate the impact of the basic customs duty of 25 per cent on imported solar cells proposed to be imposed by the GoI with effect from April 2022.

Waaree has also applied to IREDA to qualify as a manufacturer for setting up manufacturing facilities for high efficiency modules under the PLI scheme. Once the IREDA approval is received, it will set up an additional 2 GW high efficiency module manufacturing facility at Chikhli or another location yet to be decided.

SEBI nod for IPO

To part finance the expansion, Waaree Energies Limited is going public. It has already received the market regulator SEBI’s nod for its IPO and the dates and price band will be decided in consultation with the managers to the issue – Axis Capital Limited, HSBC Securities and Capital Markets (India) Private Limited, ICICI Securities Limited and Intensive Fiscal Services Private Limited.

The IPO comprises fresh issue of shares worth Rs1,350 crore, and an offer for the sale of up to 4,007,500 equity shares by the company's promoters and existing shareholders. Of the fresh issue proceeds, Rs910.31 crore will be used for the solar cell manufacturing unit and Rs141.24 crore for the solar module facility. The remaining proceeds will be used for general corporate purposes.

-

Our extensive franchisee network across India increases the visibility and reach of our products through direct customer interaction and distribution by such franchisees

Waaree has various national and international certifications such as ISO 9001:2015, ISO 14001: 2015 and ISO 45001:2018 in place. The facilities are regularly audited by a reputed quality audit firm. It has also received Tier-1 rating from Bloomberg New Energy Finance in fiscals 2018, 2019, 2020 and 2021.

The company is one of the largest rooftop segment players in India with a pan-India network of 388 franchisees focused on the rooftop and MSME customer segments. CRISIL forecasts approximately 8 GW to 9 GW of projects are estimated to be commissioned under the solar rooftop segment over the next five years.

“We are in the process of identifying and training a large community of local electricians and construction and installation contractors who can promptly and efficiently support our franchisees with the installation and maintenance of rooftop solar panels,” says the younger Doshi. “We believe our experience in the retail and MSME segment through our franchisee network, together with our strong localised, ground level penetration across India, will continue to act as a strategic entry barrier for most of our competitors as well as for Chinese imports in the retail segment.”

CRISIL says with the decline in the prices of solar modules, the tariffs of solar power have fallen. In fact, solar power has scored over coal-based power in terms of competitiveness of tariffs. The weighted average tariffs for bids conducted in fiscal 2019 were awarded at Rs2.7/unit while in fiscal 2020 the weighted average tariff increased to Rs3.2/unit on the account of the tariff for wind-solar storage capacity allocations with awarded tariffs above Rs6/kWh. Further in fiscal 2021, the lowest bid tariff reached Rs2/kWh. With declining solar PV module prices, improvement in solar PV technology and increasing coal prices, the price advantage of solar over coal is expected to widen further. This will drive the demand for renewable energy.

Post Covid, the world is looking for China Plus options and India is well placed to meet this challenge, the senior Doshi says, as Waaree plans to continue to expand its export sales. Compared to direct module sales to utilities and enterprises segments, module exports tend to have better pricing terms and profit margins.

“We also intend to leverage our high-quality products and manufacturing capability to meet the increasing global demand for solar capacity additions and take advantage of various international policies including tariffs and antidumping duties on solar cells and modules produced in China by key export markets such as the United States, making us more cost effective and increasing demand,” he says and discloses that Waaree plans to expand the international customer base, particularly in regions such as North America, South East Asia and the European Union with high technology products such as flexible modules and floating solar modules.

Thus, Waaree is all set to take the big plunge and cash in on the sunshine industry.