Over the last decade, the wealth management industry (WMI) in India has experienced robust growth. According to the Securities & Exchange Board of India, this market has already raised $80 billion in assets under management (AUM) in India. “This is backed by the country’s increasing affluent segment that has created a sizeable customer base for wealth management and investment advisory services. Our culture of saving and investing has further fuelled the demand. Mass affluent and high net worth individuals (HNIs) are increasingly moving away from traditional asset classes such as fixed deposits, real estate and gold to focus on an asset allocation based approach that includes an increasing allocation to equities and opportunities in the rapidly growing alternative investments space”, explains Ganashyam S, MD & CEO, Spark PWM Private Limited, a subsidiary of Spark Capital Advisors (India) Limited, one of the fastest growing companies in the Indian wealth management landscape. It was formerly known as Spark Family Office & Investment Advisors (India) Private Limited. The key promoters of Spark are Y. Ramarao (chairman & senior MD), Kapil Ramamurthy (part of the founding team) and Thyagesh Baba (based in Singapore). Spark Capital has organically expanded its offerings, culminating in over $10 billion worth of PE and M&A transactions across diverse sectors. Spark Capital ventured into building an institutional equities business in 2007 and pivoted it over 15 years to be India’s top ranking domestic institutional brokerage. In late 2022, Spark Capital divested that business to repurpose its focus and energies on the next phase of its journey. As a logical extension to its DNA of understanding and working closely with promoters and using knowledge and research to differentiate and add value to clients, Spark Capital seeded its asset management business in 2018. Today, it has offerings across asset classes. Notable among these are the long-only equity offerings (PMS) and a structured credit fund (Category II AIF), with a solid track record across strategies. It also manages an Angel Fund (Category I AIF) and has recently received the approval for a mid-stage to late-stage PE fund (Category II AIF). “Spark Private Wealth and Spark Capital are now focussing themselves to harness the compelling landscape of opportunity in financial services at the interplay of increasing private wealth with individuals and families, greater financialisation of savings and rapidly growing entrepreneurial wealth creation. Through Spark Private Wealth, it offers a holistic proposition that integrates Spark Group’s knowledge and research DNA, investment banking and asset management expertise to curate bespoke ideas and solutions along with helping clients in any of their investment banking related requirements,” says Arpita Vinay, MD & CEO, Spark PWM. Spark PWM has a clientele of about 2,400 families and the firm has just crossed the AUM of Rs20,000 crore mark (May 2024) from Rs3,000 crore in 2023. With a team size that has increased five-fold to about 300 people, it operates from eight locations – Mumbai, Delhi, Chennai, Kolkata, Bengaluru, Hyderabad, Ahmedabad and Pune, and three satellite locations. Transformative turn Spark PWM’s growth trajectory took a transformative turn with the introduction of new leadership at the start of 2023. Under the strategic guidance of Vinay and Ganashyam, appointed as MD and co-CEO, the company has undergone a remarkable transformation evolution, emerging as an evolving leader in the Indian wealth management landscape. Vinay has played a pivotal role alongside Ganashyam in driving the expansion and growth of Spark PWM. Their collaborative efforts have spearheaded the company’s trajectory, setting new avenues for the organisation. Vinay’s ability to seamlessly integrate her personal and professional pursuits underscores her multifaceted leadership style, making her a role model for aspiring women leaders in the industry. “Spark PWM specialises in serving affluent families, business owners, family offices, new age entrepreneurs, and CXOs, guiding them through the complexities of the financial landscape,” says Vinay, who is recognised for her leadership and innovation in the WMI circles. “The company’s mission is centred on facilitating the creation, preservation and transition of wealth across generations, offering a range of products and services to meet diverse needs”.

-

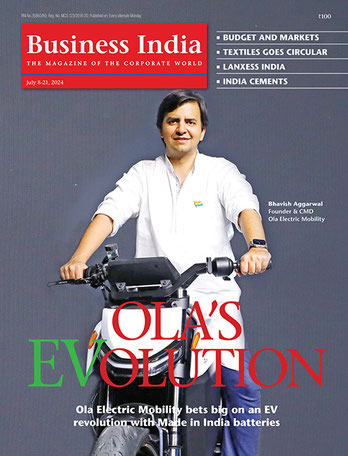

Ganashyam and Arpita: helping clients effectively manage and transfer wealth across generation; Photo: Sanjay Borade