-

The PSUs will remain on the radar of investors for a long time and continue to drive the market

A. Balasubramanian, MD, Aditya Birla Sunlife Mutual Fund

Investors’ darlings

It would not be an understatement to say that over the last two years, there has been a considerable change in how PSUs are being viewed. PSU stocks in defence, railways, capital goods, power, power finance, and oil companies have suddenly become the darlings of investors, with prices moving up sharply compared to 2022.

Bharat Heavy Electricals, one of the leading engineering and manufacturing companies, has seen its shares, which were around Rs51, go up nearly sixfold. BEML, another company in manufacturing, railways, and mining, has also seen its shares triple in value. BEML has also separated its land assets into a separate company. Coal India, which was around Rs160, has gone up by more than threefold. Shipping Corporation has likewise given 2x returns, even after separating its land assets into a different company.

Cochin Shipyard has increased 8.3 times in the last year alone. Mazagon Dock has increased tenfold in the last two years. REC, formerly Rural Electrification Corp, has gone up by 4.5 times. Most petroleum companies, including Indian Oil, HPCL, and ONGC, have doubled in the 2 years since the end of May 2022. The best returns were seen in defence and railways shares. Hindustan Aeronautics has increased nearly fivefold in the last 2 years. Bharat Electronics and Bharat Dynamics have also given equally spectacular returns.

PSU banks, which were the ‘bad boys’ in the class, have also caught the fancy of investors post Covid and after writing off huge NPAs. Performance has improved markedly, with several PSU bank shares having risen considerably. Bank of India has doubled, and Bank of Baroda has gone up 2.5 times. Central Bank of India, which was under Rs20, has given 3x returns.

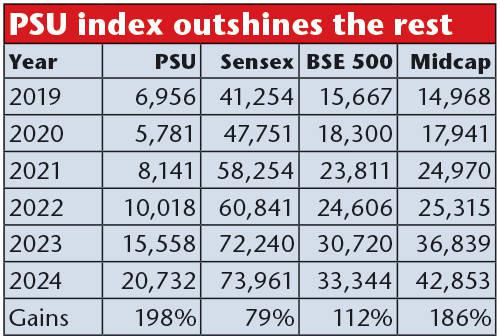

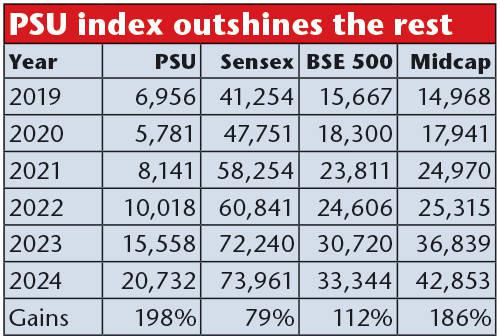

The point is that PSU shares have been rerated over the last 2 years. In some cases, the pace of growth in share prices has been more than their peers in the private sector. The PSU index has also given good returns. It is not just the last 2 years; even over a longer period since 2019, the PSU index has outshone the returns of the Sensex, BSE 500, and even BSE midcap index.

Over the last 5 years, the PSU index has given 198 per cent, point-to-point returns, compared to 186 per cent for BSE midcap and 112 per cent for BSE 500. Till recently, with midcaps and small caps being favoured over large caps, the Sensex had increased by just 79 per cent. The moot question is whether investors will have just a fling with PSUs or if their fancy will be sustained.

“The PSUs will remain on the radar of investors for a long time and continue to drive the market,” says A Balasubramanian, MD of Aditya Birla Sun Life Mutual Fund. They are fundamentally better and have been the big beneficiaries of the enhanced capex expenditure by the government in the last 2 years.

The Centre’s capex has risen from Rs6 lakh crore to Rs9.5 lakh crore in the interim budget of 2024-25. In percentage terms, the capex as a percentage of total expenses in the budget has risen from 12.2 per cent in FY22 to nearly Rs10 lakh crore in FY24. In the interim budget for 2024-25, Rs11.11 lakh crore has been earmarked for capital expenditure.

-

There is a distinct amount of aggressiveness witnessed in the performance of PSUs

Deven Choksey, MD & Promoter, KR Choksey

Bala, as he is popularly known in the financial sector, adds: “Unlike the earlier perception, PSUs have very good visionary leaders, who will take the growth forward. Modi, when he was the Chief Minister of Gujarat, had placed bureaucrats, many of whom were from the IAS, in charge of Gujarat PSUs. Full operational freedom was given to them, and they were assured there would be no political interference. This freedom allowed the leaders to turn around the PSUs, making them profitable and starting to pay handsome dividends to the state. Divestment was not required. Modi, as the PM, is now trying a similar tactic with the Central PSUs.”

Bala feels that the P/E of the PSU index, which is low compared to other indices, will move up with increased awareness about CPSUs’ dividend and growth-paying abilities. The P/E will thereafter narrow. In 2022, Bala had pointed out that having a PSU tag does not make a company inefficient. Several other countries have government companies that are competing with the best globally.

Deven Choksey, MD and promoter of KR Choksey Shares and Securities Pvt Ltd, says: “There is a distinct amount of aggressiveness witnessed in the performance of PSUs. They are becoming more performance-oriented, and managers are also becoming alert. The intention is clear – to get the right valuation which can enable companies to go in for raising funds.”

Secondly, Choksey says: “PSUs are well capitalised. Over the last few years, they have changed the method of giving contracts. Instead of selecting vendors on an L1, L2, and L3 basis, they are awarding contracts on a design and build basis. This is the same practice that is being followed by the private sector. The increasing usage of the Open Network Digital Commerce platform is also streamlining procurement processes and obtaining the best rates. It is a more transparent system and helps in optimising costs.”

“These are small changes, but they have all been reflected in the improved performance of the companies and subsequently their market capitalisation. To give a few examples, when BPCL was put up for divestment, its valuation was under Rs60,000 crore. Business India had argued several times that BPCL should not be sold cheaply and that the fair valuation, even during the Covid period, should be above Rs1,00,000 crore. Currently, it is more than Rs1.25 lakh crore, with the government still holding the majority.

Likewise, IDBI, which was also under Rs50,000 crore when it was listed for divestment, is now nearing the Rs1 lakh crore mark. With the government also divesting a minority stake in LIC (market cap over Rs6 lakh crore), the overall market cap of all PSUs is now Rs67 lakh crore compared with the Rs145 lakh crore market cap of the Sensex. Undoubtedly, there are three PSU shares, SBI, Powergrid, and NTPC, which are also included in the Sensex. Even so, the market cap of PSU shares is growing by the day.”

Anish Tawakley, Deputy CIO – Equity at ICICI Prudential AMC, says: “PSUs have moved from being one of the most unloved stocks to a level where they are not cheap. This has been largely possible owing to the good work done by the PSU managements coupled with the way the government has ensured that these companies were disciplined in capital allocation and in returning cash to shareholders. Another factor which helped PSU names is a stable policy regime.”

-

The government should look at the IPO of Indian Railways, which could be another big game changer

Ajay Garg, Founder & MD, Equirus Capital

The key point here is a stable policy regime. A stable government policy helps the boards of respective PSUs to plan out their long-term projects, knowing that there will be no backtracking on approved projects. Further, having once cleared the projects, funds will not be squeezed by last-minute appeals for more funds, either through dividends or contributions to one scheme or another.

In fact, the government, through its Department of Investment & Public Asset Management (DIPAM), in November 2020 mandated that profit-making PSUs pay 30 per cent of their profit or 5 per cent of their net worth by way of dividends. Since the results of all listed PSUs are declared quarterly, it mandated that instead of bunching dividend payments after the closure of the accounting year, they should pay interim dividends more frequently.

Tawakley adds that “there has been a significant improvement in the business cycle across sectors where PSUs are present. There are several sectors where PSU names either have a dominant share or are sector leaders, so any improvement in sector fundamentals helps these stocks. This has led to an improvement in market sentiment and consequently valuations.”

A serious affair?

Is the relatively newfound interest in PSUs a mere flirtation, or will the interest be sustained? Many long-term investors are betting on the shares, rationalising that if the country is on a growth path to become a developed nation by 2047, PSU shares will be one of the key drivers of growth. While some PSUs have started exporting services and goods overseas, they will be in a sweet spot the day the government seriously tries to expand global trade.

Ajay Garg, founder and MD of Equirus Capital Ltd, a full-service investment bank, says: “Given the Government’s focus on Make in India and revitalising investments in railways, alongside providing impetus to make shipbuilding and defence manufacturing export-oriented, this has propelled many stocks in these areas (defence and railways) which are dominated by PSUs, onto a different trajectory. The stock market rally in these sectors is a reflection of this. As these are stocks with strong moats and strong credentials, when unleashed to tap global opportunities, they will see good rerating. I have recently also suggested that the government should look at the IPO of Indian Railways, which could be another big game changer.”

Some investors, such as those investing in mutual funds, may have a different perspective. Tawakley says: “The valuations across the PSU universe have meaningfully expanded. Since the start of 2024, we have turned cautious on the PSU space due to valuation concerns.”

-

PSUs have moved from being one of the most involved stocks to a level where they are not cheap

Anish Tawakley, Dy. CEO, Equity, ICICI Prudential AMC

Deven Choksey, noted for his wealth-building business, says that “the fancy for PSUs will last, and in some cases like the oil industry, it will also change. With the petroleum companies embarking on green energy initiatives in a big way, the perception of these companies will change. The government is earnestly trying to meet its carbon reduction targets, with Prime Minister Narendra Modi committing to India becoming a net zero carbon emitter by 2070. These very petroleum PSUs will be the harbinger of change, having surplus funds which will be invested in green energy initiatives”.

Business India also feels that PSUs have great potential, going forward. Capex is not an issue with most companies being profitable. With more and more professionals being inducted into management, the PSU tag will not be seen as an insult but rather an added advantage. If the government seriously wants to remove the PSU tag, it can create a holding company and hold a golden share in all companies where its equity goes beyond 50 per cent through divestment.

However, there is no immediate need to divest if the PSU companies and banks are able to provide Rs1 lakh crore as dividend and increase this amount steadily in the years to come. As long as the government chooses to be in the business of business, it may well endeavour to run it like a professional businessman. Perhaps as a benevolent business house with an eye to meet the needs of all stakeholders, not just investors. As long as profit-making is not compromised.

-

A PSU Index mirrors Sensex sectorally

It is quite interesting to note that the PSU segment is similar to the universe of the Sensex. Even the construct of the index is quite similar. Finance forms a little over 36 per cent, the same as the Sensex. Power, oil, and gas each contribute 17 per cent, with capital goods around 15 per cent and metals and mining around 10 per cent (see sectoral chart). It is quite possible that the sector was probably formed some years ago and there is a need to revise it.

The breakup of finance and giving separate weightage to insurance companies may be considered. As is having a separate subhead for defence, with stocks of BEL, BDL, Hindustan Aeronautics, Mishra Dhatu Nigam, Mazagon Dock, Garden Reach, and Cochin Shipyard being rightful claimants in this segment.

The railways’ market cap is relatively small, but the nomenclature of transportation can be further divided to include railways. There is also no reason for excluding SBI, the pride of the Indian banking sector, from the PSU index. While it is true that SBI operates more like a private sector bank, if SBI can be included in Bharat 22, why not in the main PSU index? The only difference between the Sensex and the PSU index is the lack of IT shares in the latter.