-

The 72-member council of ministers contradict with the party’s credo, ‘less government, more governance'

Modi has put up a brave face so far, but the fact that he is now working in a changed political environment was evident from his repeated emphasis on coalition dharma in his post-verdict speeches. “If a majority is necessary to run a government, consensus is necessary to steer the country,” he told the newly-elected NDA MPs in the Central Hall of Parliament. It is an NDA government now, not simply BJP, he reminded his senior party colleagues who called on him. Ram Madhav, a member of the RSS national executive who had once been seconded to the BJP as national general secretary, notes: “The situation calls for greater accommodation and better understanding…”

But given Modi’s centralised, top-down style of governance, will he be able to adjust to the realities of coalition politics quickly? So far, he has enjoyed unfettered power since 2001, first as Gujarat’s Chief Minister till 2014 and as Prime Minister after that. Can a leopard change its spots?

Bearing on Modi 3.0

The 4 June verdict will now have a bearing on the functioning of Modi 3.0, as the BJP will be heavily dependent on its allies to run the union government. This will result in compromises, the resultant problems in governance, and the dilution of the BJP’s core agenda. So, no Universal Civil Code or One-Nation, One-Election, which were to be Modi’s dream projects in the upcoming term. Even the Citizen’s Amendment Act will have to be implemented with care. It will be difficult to brush aside the sensitivities and priorities of key allies.

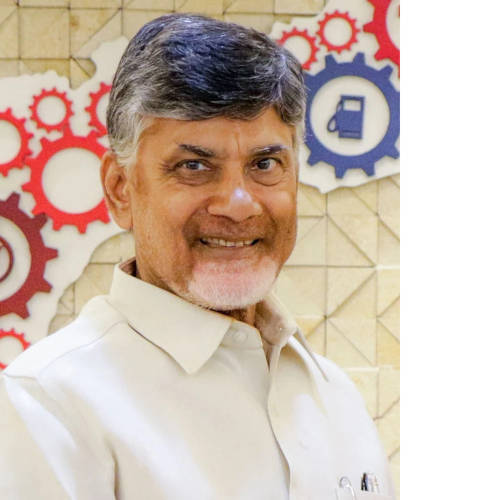

Consultation will precede reforms of any nature. For instance, while N Chandrababu Naidu of TDP, who swept the Andhra Pradesh assembly poll, was once a votary of economic reforms and one of the early promoters of IT, the same cannot be said of him now as his state is facing acute financial distress. Naidu’s demands will start surfacing once his white paper on the state’s finances is out.

Some of the promises which Naidu has made during the assembly election may pit him against the BJP. He has promised 4 per cent reservation to Muslims in his state, apart from Rs1-lakh financial assistance to every Muslim who visits Mecca on the Haj pilgrimage. The BJP will have to turn a blind eye.

The JD(U), led by Nitish Kumar, has been talking of a nationwide caste census, something that is anathema to the BJP, and a review of the Agniveer recruitment scheme for the army. Then there is the question of special status for the state. “Special status to Bihar has been a demand of the JD(U). Bihar has not received the kind of economic support it should have got. When Narendra Modi takes oath as the Prime Minister for the third time, the people of Bihar expect a special package that will put the state on the path to becoming a more developed economy,” says Arvind Nishad, spokesman of JD(U). With the assembly election scheduled for next year, Kumar will be under pressure on this front. Revisiting the subject of special status, abolished in 2015, may not be that easy.

Another JD(U) leader said, “Kumar has been demanding electricity at subsidised rates from NTPC and other central producers. Bihar purchases electricity at a very steep cost. The state also has subsidies for consumers. He may ask for ‘one nation, one tariff’ for electricity.”

-

Naidu and Kumar: slippery customers

Package Clamour

Along with special status, there will also be a clamour for financial packages. Recently, the Supreme Court had suggested that the centre consider a ‘one-time financial package’ for Kerala in the present financial year to help it tide over funds shortage. The centre has been sitting over this issue, arguing that it was ‘handicapped’ on this issue as it had rejected similar ‘bail-out’ packages for other states. Naidu is now expected to up the ante for financial aid for his languishing Amaravati (the new state capital) project and the Polavaram irrigation project.

While both Kumar and Naidu have said that they will stand by the NDA, they are considered slippery customers in political circles. Both have had a history of antagonism with Modi. Kumar, of course, is vulnerable as he is dependent on the BJP for support in his home state.

It is primarily the state of Uttar Pradesh that brought the saffron party below the majority mark. UP had scripted Modi’s uninterrupted reign at the Centre for two terms. This time, a number of factors combined to thwart the BJP’s carefully-crafted strategy and the prime among them was the reverse social engineering attempted by the saffron party’s main challenger – Samajwadi Party chief Akhilesh Yadav.

Taking advantage of the virtual collapse of the Bahujan Samaj Party, Yadav co-opted the BJP’s ‘non-Yadav OBC and non-Jatav Dalit’ social combination into his ticket distribution strategy. This is the section that had voted overwhelmingly for the BJP in 2014 and 2019. In doing so, SP broke the previous perception of being an MY (Muslim-Yadav) party.

The fear of the BJP tinkering with the Constitution and doing away with reservations made the Dalits and backwards shift to the INDIA bloc. The SP-Congress alliance also largely ensured the consolidation of Muslim votes.

Questions Arise

The electoral verdict has raised questions about Modi’s strategy and even the UP-strongman Yogi Adityanath’s appeal. The BJP’s campaign slogan, “Abki baar, 400 paar” (this time, more than 400), set a target of 400 seats for its alliance and 370 seats for the BJP itself. That pitch carried a tone of overconfidence at a time when a large section of the population is grappling with the realities of soaring prices, joblessness, and income inequality.

Also, as India’s long-drawn-out election campaign played out, Modi had increasingly turned to fearmongering over an alleged plot by the opposition to hand over the nation’s resources to Muslims, at the cost of its majority Hindus.

Large parts of Maharashtra, Punjab, Rajasthan, and Haryana, to a certain extent, states that have been witnessing distress among agrarian communities, citizens dependent on jobs in the army and resenting the Agniveer scheme, as well as socially disadvantaged groups anxious about the future of the reservation policy, expressed their disapproval of the BJP’s policies and political antics.

Goldilocks Era?

The new government is taking over at a time when economic growth in FY2023-24 beat all expectations to record 8.2 per cent. Although GDP and GVA growth moderated to a four-quarter low of 7.8 per cent and 6.3 per cent respectively in Q4 FY24 from the revised prints of 8.6 per cent and 6.8 per cent in Q3, the extent of the dip was rather limited compared to expectations.

The growth in the former was also boosted by the continuing sharp 22.2 per cent expansion in net indirect taxes in real terms in Q4 FY24. This resulted in the growth in GDP exceeding that in the GVA by a considerable 148 basis points (bps) in the quarter.

-

Chandrasekhar, Irani: prominent among the losers

Similarly, the fiscal deficit for FY24 shed nearly 20 basis points further to reach 5.6 per cent. An equally important development is that after a gap of 10 years, S&P Global revised its outlook on India to ‘positive’ from ‘stable’, thus providing a window of opportunity within 24 months for a rating upgrade after a gap of 17 years.

According to Motilal Oswal Financial Services Ltd: “India is witnessing its own mini-Goldilocks (steady growth and low inflation) moment with excellent macros, solid corporate earnings (Nifty ended FY24 with 25 per cent earnings growth and FY25/26 earnings are likely to post 14-15 per cent CAGR), focus on manufacturing, capex and infrastructure creation, and valuations at 20x one-year forward earnings. This verdict and the consequent political stability and continuity in policy-making will act like an icing on the cake and keep India as the cynosure of all eyes, in our view,” the report said.

Indeed, before the results came out, many brokerages believed that the current policy environment itself is providing a good investment opportunity. Private industrial capital spending is set to pick up with ongoing supply chain diversification benefits and the government’s Production Linked Incentive (PLI) scheme to boost targeted manufacturing industries.

The impression was buttressed by the Ministry of Commerce and Industry, which claimed that healthy corporate and bank balance sheets, rising capacity utilisation and upbeat business sentiment point to an improving private investment outlook. Companies have invested around Rs1.07-lakh crore through December 2023 across the 14 sectors covered under the PLI scheme, with exports surpassing Rs3.40-lakh crore since the scheme’s implementation.

However, can a weakened Modi government sustain the policy continuity and continue its work of shortening the fiscal gap, that it has been able to do in the last few years? Some economists say this is doable but perhaps not at the pace it would have preferred to.

New Trajectory?

Others believe that the smaller mandate for Modi raises risks of more populist spending to consolidate political support, even though the BJP in its manifesto did not give many hints of populist spending, neither did the Interim Budget announced by Nirmala Sitharaman. The full budget due to be announced in July would account for the government’s plans with the Reserve Bank of India’s record Rs2.11 lakh crore worth of surplus transfer.

It could use this bonanza to further consolidate the fiscal position. Conversely, it could use the money to garner political support in view of the assembly elections in Maharashtra and Haryana where its position appears to be shaky.

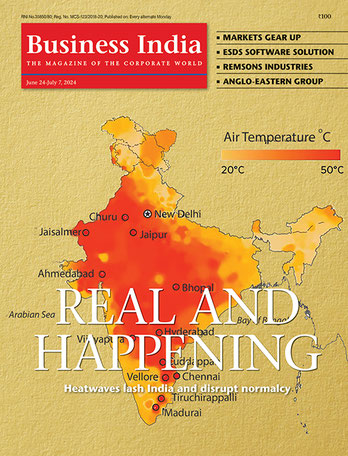

Looming large over the canvas are the issues of inflation, jobless growth, slow private investment, real wage stagnation, widening wealth-income inequality, and poor economic incentive-led schemes (like PLI) at the cost of decreasing allocations for essential social welfare programmes (MGNREGA, Nutrition Programmes, etc). These are factors that prompted voters – especially in rural areas – in the north, west, and parts of the south to come out against the BJP.

In a revealing post-verdict analysis in The Indian Express, Arvind Subramanian, noted economist and chief economic advisor in Modi 1.0, felt that there were two ways to reconcile the economy (and the attendant official hoopla about its growth) with the election results. Clearly, growth has not been as dynamic as the official numbers suggest, nor has it been very balanced. “Put another way, the overall pie has not grown sufficiently rapidly and it has been shared unequally, but in a different manner than believed. As a result, the unskilled people working in the agricultural, informal and manufacturing workers – the bulk of the workforce and voters – experienced the economy in a way that accords with ground-level reporting; that is, negatively.”

-

IDBI presents a low-hanging fruit. The path is clear for the disinvestment of 60.72 per cent in the bank, which includes the government’s 30.48 per cent and LIC’s 30.24 per cent

These issues are unlikely to disappear in the coming future. The government’s challenge is to address these issues and also undertake key economic reforms. But the weakened majority could pose challenges to reforms as it will need to rely more heavily on its coalition partners. Passing contentious reforms could prove more difficult, particularly around land and labour, which have recently been flagged as priorities by the BJP in its election manifesto to boost manufacturing. In any case, ramming bills in Parliament with a resurgent opposition will now not be possible.

Recent numbers released by the RBI on foreign direct investments for FY24 raise concerns over weak gross inflows, though the outgoing government said that the alarm being raised over the decline in net FDI to $10.6 billion is overdone. Fall in net FDI flows is led by repatriation and divestment touching a decadal high of $44.4 billion. Critics say the high repatriation figure implies that foreign promoters and investors are exiting India or withdrawing large sums out of the country.

That may not be the case. India is still among the top ten economies which are expected to receive large FDI flows in 2024. But the government will have to ensure that there is no let-up in promoting ease of doing business at all levels of the regulatory structure to support the growth, vigour, continued infrastructure investment drive, and commitment to fiscal consolidation.

Post-election results and formation of the new government, all eyes will be on the full budget for FY25, which is likely to be presented in July. Of particular interest to rating agencies will be the fiscal deficit target. Will it be revised lower to 5 per cent or even below that? The budget should also give details of the reform agenda for the next 5 years.

The key to broad-based growth would lie in the signals that the budget will send about post-election policy continuity. A continued focus on infra development will also help.

IDBI Test Case

Another area that will be closely watched is privatisation. The privatisation of assets in the insurance and banking sectors has been kept in abeyance for some time now. In the Budget 2021-22, the finance minister announced the strategic disinvestment of the government’s and LIC’s shareholding in IDBI Bank, along with the transfer of management control. In the last 20 months, however, this got mired in various issues, including delays in regulatory approvals, security clearances, valuation differences, and state elections, as well as the general election.

IDBI presents a low-hanging fruit. The path is clear for the disinvestment of 60.72 per cent in the bank, which includes the government’s 30.48 per cent and LIC’s 30.24 per cent. IDBI Bank’s market valuation has almost doubled from Rs45,000 crore in October 2022, when the Department of Investment and Public Asset Management invited bids, to the current Rs92,000 crore.

In terms of performance, there has been a big improvement in the last year when the process was delayed. For instance, total revenues are up from Rs24,941 crore in FY23 to Rs30,037 crore in FY24. In the same period, net profits are up 54 per cent from Rs3,645 crore to Rs5,634 crore. Gross NPAs are down from 6.38 per cent to 4.53 per cent. The return on assets (ROA) is up from 1.20 per cent to 1.65 per cent.

This could be the first bold move of handing over a public sector asset to a private player or even a foreign player. While the stake was offered to private banks, NBFCs, and other interested investors with a minimum net worth of Rs22,500 crore, there was interest from Canadian billionaire Prem Watsa’s CSB Bank (erstwhile Catholic Syrian Bank), Kotak Mahindra Bank, and Emirates NBD.

Banking consultants feel there could be a bidding war for IDBI Bank if another suitor emerges with better pricing as the stability of the government and the future growth trajectory will create wealth in the financial services space. But will the new government bite the bullet?

-

The JD(U), led by Nitish Kumar, has been talking of a nationwide caste census, something that is anathema to the BJP, and a review of the Agniveer recruitment scheme for the army

Inner-Party Dynamics

Now that Nadda has been inducted into the cabinet, Modi will have to look for a new party president. In the coming days, Modi will have to navigate his party’s relationship with the RSS. The loss of over 60 seats should be a matter of concern for the Rashtriya Swayamsewak Sangh.

Even party stalwarts like Nitin Gadkari suffered an erosion of voter support in the Sangh bastion of Nagpur. Statements from senior party leaders like Nadda that the Modi dispensation is no longer dependent on the RSS may have caused some strain between the two.

Besides, state assembly elections in Maharashtra, Haryana and Jharkhand are due this year. The BJP and its allies are facing serious anti-incumbency in Maharashtra and Haryana and the INDIA alliance is expected to mount a serious challenge. If the BJP loses these states, then doubts will begin to surface in the BJP over Modi’s continued appeal.

Modi will also have to cultivate a second line of leadership like Atal Bihari Vajpayee and LK Advani did by encouraging leaders like Arun Jaitley, Sushma Swaraj, Pramod Mahajan and Shivraj Chauhan and to an extent even Modi himself. It makes good optics to call on the members of the Margdarshak Mandal, Advani and Murli Manohar Joshi, to discuss the new government formation. But a good leader has to look into his party’s future as well. Sooner rather than later, the question may be asked within the BJP: After Modi, who?

Bhavish Aggarwal is confident of playing a big role in India’s EV revolution

The textiles & apparel sector gears up to imbibe circularity into supply chain

Market anticipates a correction amid budget expectations and investor activity

UltraTech buys stake in India Cements. What lies ahead?

Our letter to you, once a week.

Register with The CSR Weekly for free!

Published on Jan. 21, 2023, 3:49 p.m.

The introduction of black pepper as an inter-crop in the sopari and coconut orchards, has enabled farmers to cultivate crops simultaneously

Published on Jan. 21, 2023, 3:43 p.m.

In 2020-21, the programme reached over 112,482 girls in urban and rural locations across six states in India, including 10,000 across Delhi

Published on Jan. 21, 2023, 3:34 p.m.

The event brought together stakeholders and changemakers to participate in a series of conversations on global trends and recent developments

Published on Jan. 21, 2023, 3:28 p.m.

The programme will focus on educating children on oral health and building awareness around the dangers of tobacco use

Published on Aug. 17, 2023, 11:54 a.m.

BioEnergy will showcase its innovative biogas technology in India

Published on Aug. 17, 2023, 11:26 a.m.

Ather aims to produce 20,000 units every month, soon

Published on Aug. 17, 2023, 11:06 a.m.

German Development Agency, GIZ is working on a roadmap for a green hydrogen cluster in Kochi

Published on Aug. 17, 2023, 10:45 a.m.

AGEL set to play a big role in India’s carbon neutrality target

Stay ahead of the times.

Register with The Climate Change Weekly for free!