-

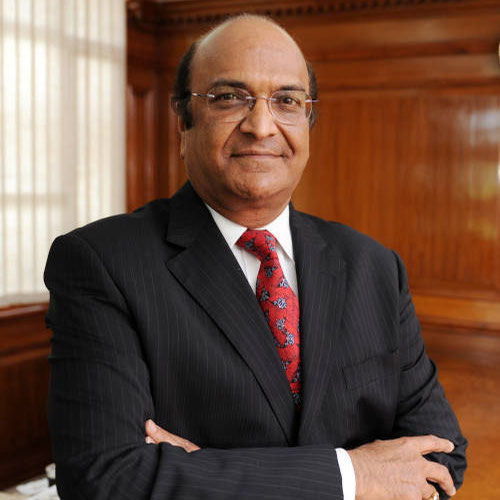

Raghupati Singhania: we are optimistic about the upcoming years

Also see interview: Our subsidiaries are doing well, says Raghupati Singhania

Those who have monitored the tyre sector closely will vouch that around the middle of the previous decade, a major issue for domestic manufacturers was the threat from cheap Chinese imports. But now, this has been effectively checked by the government, which has imposed a series of anti-dumping restrictions. “In real terms, the total supply of tyres from China at its peak was about 5 per cent of domestic requirements,” points out Rajiv Budhiraja, director general, ATMA. “But it was primarily happening in the value segment of commercial vehicles and hurting the interest of local players. Of course, now, much of this has subsided.”

On the export front too, Indian manufacturers have built a sizeable and steady scale, which is close to 35 million units now. “According to the UN Comtrade Database, India exported a total of 32.91 million pneumatic rubber tyres, worth $1.74 billion in 2020,” explains Karan Chechi, research director, TechSci Research. “Moreover, about 3.45 million units of two-wheeler tyres were exported during the same period.”

According to a study that examined trends in the Indian tyre industry during recent decades, it has more than doubled in cumulative sales, rising from Rs25,000 crore in 2010 to Rs60,000 crore in 2020. In revenue terms, trucks and buses account for 54 per cent, followed by passenger cars (14 per cent), two- and three-wheelers (13 per cent), light commercial vehicles or LCVs (9 per cent), tractors (8 per cent) and industrial and others (2 per cent).

Replacement remains the biggest demand sales segment, followed by OEM consumption and exports. “Tyre and battery companies are outliers because they are driven by strong replacement demand,” observes Srikumar Krishnamurthy, VP, ICRA. “They do not get affected in a major way even amidst strong slowdowns in the automobile business.”

Between 2010 and 2020, the average growth rate has been close to 9 per cent. There was a period of high growth between 2010-15, with a 15 per cent average uptick, which fell substantially to an average low, single-digit trajectory of just 4 per cent in the second half of the last decade. Later, 2018-19 too turned out to be a year of high growth. But, otherwise, there were a host of reasons, which kept sales growth at a small positive range – the adoption of new environment norms, insurance for two-wheelers going up, the axle load limit of commercial vehicles getting enhanced, etc.

Automobile production slipped into a negative growth trajectory after 2018-19 and this rubbed off on the tyre industry, though to a lesser extent. The market had contracted by 8 per cent in 2019-20 and, then, the Corona-led lockdown, which came just at the beginning of 2020-21, resulted in Q1 being washed off for the tyre industry as well. However, there was a real surprise during the latter part of the year, when the pent-up demand resulted in tremendous surge in the replacement market, facilitating some of the companies, including JK Tyre, to give their best quarterly results in recent times.

“It has surprised many. But there have been a couple of reasons for it. Pent-up demand came into play from June onwards. And, the surge in demand was led by the commercial vehicle segment, which has a higher share in the business pie. Commercial vehicles were back on the roads soon, unlike personal mobility,” emphasises Budhiraja.

The easing of raw material pricing pressure (substantially linked to oil prices) in the Corona-affected year is also being attributed to the exceptional financial results of the leading pillars of the Indian tyre industry. Apollo Tyres reported a rise of 6 per cent in its revenue in 2020-21 – Rs17,397 crore, as against Rs16,350 crore in the immediate fiscal before Corona hit. MRF, another biggie, saw a negligible dip in its earnings – Rs16,373.13 crore during the 12-month period ended 31 March 2021, as compared to Rs16,574.74 crore in 2019-20.

-

Meanwhile, considering the present scale which Indian tyre firms have developed, stakeholders, including leading research agencies, are projecting a more than ordinary uphill ride for the industry in the near to medium run. “We expect the good growth momentum to continue for at least the next two fiscals. Things remaining normal, the tyre industry may well grow in double-digits (10-15 per cent) in 2021-22 and 2022-23,” maintains Pallavi Bhati, senior analyst, India Ratings.

“On an expanded base, we expect substantial growth. As things stand today, the only spoiler could be more waves of Corona,” Budhiraja says. The growth impetus is also expected to come from international shipments. According to Krishnamurthy, exports in 2020-21 have grown by 10 per cent in value terms and 8 per cent in volume terms and, if there is no serious disruption in the coming years, the tyre export basket will expand further.

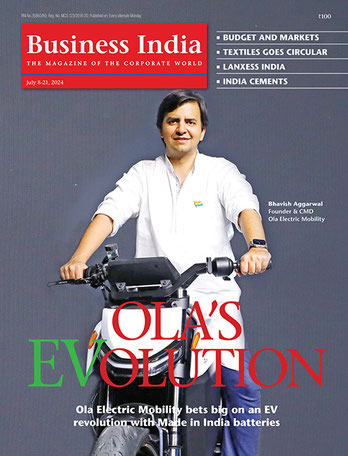

JK’s calling card

JK Tyre can proudly claim to be one of the few firms which are present on both the cause-and-effect spectrums of Indian tyre industry growth in the last five decades. Starting its journey in 1976 by commissioning its first plant in Kankroli, Rajasthan; the company picked up a decisive momentum by the 1990s, when it commissioned its second plant in Banmore, Madhya Pradesh, followed by the acquisition of Vikrant Tyres in 1997 and the launch of its all-steel radial truck tyres in Mysuru. “Around the turn of the millennium, the company’s turnover was close to Rs1,000 crore, which was substantial by the size and scale of the industry around 2000,” points out Arun Bajoria, director & president, international operations.

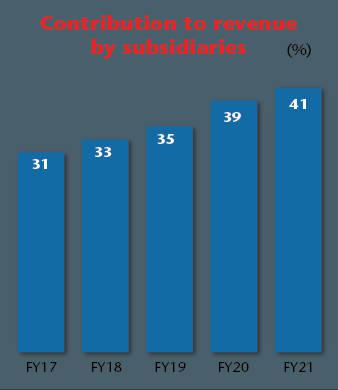

“But, since then, we have grown our revenue by nearly 10 times and at present stand in the trajectory of Rs10,000 crore.” A tyre industry veteran, Bajoria is a lead figure of JK Tyre’s management and has been with the company for more than two-and-a-half decades, now. In the last two decades, as the Indian tyre industry has attained new heights, JK Tyre is believed to have conveniently tagged along on the basis of two notable acquisitions – Tornel Plant in Mexico in 2008 and Cavendish Industries (from BK Birla group company Kesoram Industries for over Rs2,100 crore) in 2016.

“For quite some time before Tornel actually happened, our chairman was keen to start working for a larger global presence,” Bajoria further elaborates. “And, therefore, when Tornel put the plant up for sale, we also participated in the tender process and eventually won it. This acquisition has been our gateway to markets in America and the Latin American countries.”

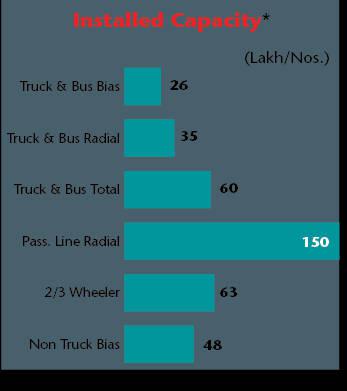

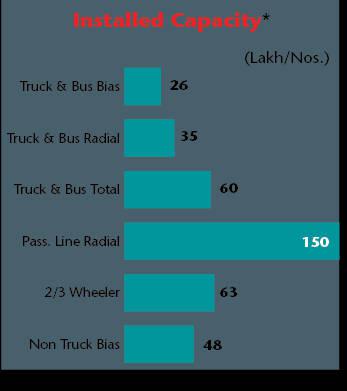

On critical quantitative parameters, JK Tyre has an impressive report card, comprising a dozen plants – nine in India and three in Mexico. Its current output is in the range of 32 million units, as against just 500,000 units in the early part of its operations in the 1970s. Today, it boasts of a staggering 2,000 SKUs across all its product categories and has the capability to produce a three-kg scooter tyre as well as a 3,400 kg off-road tyre (and everything in between). But even as the company today covers the entire range of tyres for automobiles (two- and three-wheeler strength picking up with the acquisition of Cavendish), its calling card is leadership positioning in the commercial vehicle tyres category, which is the top-priced segment.

-

Aggarwal, Anshuman, Misra, Bajoria: leading figures of the management

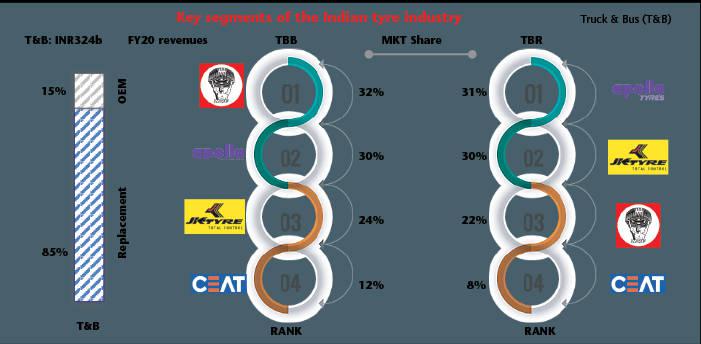

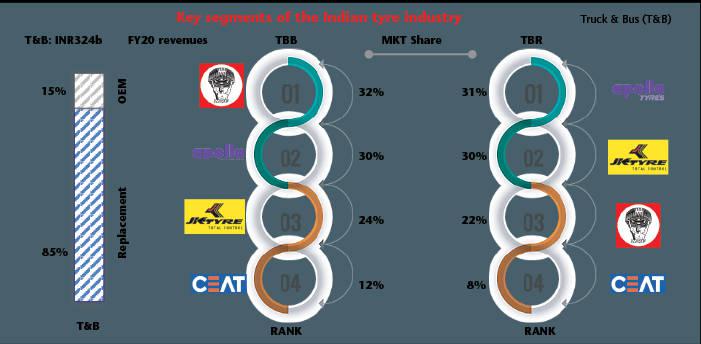

According to a recent report, in the premium radial (containing steel belt) truck and bus category, it is among the top two, along with Apollo, while in the commercial vehicle bias tyre (supported by nylon belt and 20-25 per cent cheaper than radial) category, it is among the top three, with a substantial 24 per cent share (see graph). In the passenger car tyre segment, its share is believed to be small, at about 12 per cent, while in the two- and three-wheeler category, it is in sub-5 per cent trajectory in terms of market share.

“We entered into the two- and three-wheeler tyre segment after the acquisition of Cavendish Industries in 2016,” says Srinivasu Allaphan, director, sales & marketing, JK Tyre & Industries. “With Cavendish, we have managed to partner with key two-three-wheeler and EV manufacturers. We also launched a premium range of tyres in this segment with brand name “Blaze” that received phenomenal response from the market”. The company is committed to gain further market share with captive production strength, adds Allaphan.

As per details provided in the annual report for 2019-20, JK Tyre earned 55 per cent of its revenue from the bus and truck tyre segment (radial and bias included), 25 per cent from passenger cars, only 5 per cent from two- and three-wheelers and 15 per cent from other segments, led by tractors (see graph). “Their major calling card is the truck and buses radial tyre segment, which is becoming a bigger pie. The company is comfortably placed in this segment, which offers good margins. And, I think it would continue to look at ways and means to further consolidate it. The other segments may become formidable sideshows, going ahead,” says senior official of a rival firm. Furthermore, the replacement demand is the backbone of the company’s business, accounting for as much 68 per cent of the revenue, followed by supply to OEMs (17 per cent earnings) and exports (15 per cent).

Ask Raghupati Singhania to underline the salient features of JK Tyre’s journey and he will focus on qualitative and innovative inputs, which have gone into shaping the company during the past four decades. “From initiating its journey by producing the first radial tyre in 1977 to becoming the market leader in the truck bus radial segment, today the company has 12 globally benchmarked ‘sustainable’ manufacturing facilities. Committed to driving innovation, JK Tyre has become the first and the only Indian company to achieve the milestone of rolling out the 20 millionth truck/bus radial (TBR) tyre,” says he (see box: Interview), while pointing to a series of initiatives on the innovation front.

These include: the launch of India’s first ever ‘Smart Tyre’ technology, which incorporates AI-based Tyre Pressure Monitoring Systems (TPMS) through TREEL sensors. Interestingly, within industry circles, JK Tyre’s state-of-the-art global research and technology centre – the Raghupati Singhania Centre of Excellence – in Mysuru, which was inaugurated in 2018, is a much talked about unit, reflective of the company’s commitment to world class R&D efforts in tyre manufacturing.

The centre has India’s biggest anechoic chamber for noise and vibration analysis, capable of testing all tyres, including truck tyres. Extensive research on green technology or on an eco-range of tyres for cars, buses and two-wheelers, with ultra-low rolling resistance, is also a regular feature of the centre.

-

Cavendish Plant: strategically important turnaround story

Current equation

A senior official of the company says the company is in a transforming phase, wherein it could well be more in control to drive a robust future on the basis of some major cushions. From a purely sectoral point of view, there are already high expectations from the leading companies in the fray. “After a low growth phase for nearly five years, the market leaders may just be staring at another inflection point,” remarks Jinesh Gandhi, senior VP (equity research), Motilal Oswal Financial Services. “Verticals like export are slated to convert into much larger opportunities for them.”

JK Tyre, like other leading players, has also done exceptionally well in the Corona-disrupted year, with agile response to replacement demand driven growth, which picked up from Q2. JK Tyre’s consolidated turnover in Q4 surged by 63 per cent to Rs2,945 crore, with an EBIDTA of Rs472 crore. The net profit was Rs195 crore, as compared to a loss of Rs53 crore in the corresponding quarter last year.

Despite two months of production and sales washing away during the fiscal, on a consolidated basis, the company reported a turnover of Rs9,145 crore, which marks a modest annual growth of 4 per cent (see graph). Its EBIDTA had meanwhile risen to Rs1,349 crore, a growth of 33 per cent. In 2020-21, aftermarket, OEM and exports contributed 64 per cent and 18 per cent each to the company’s consolidated revenues.

“Our average capacity utilisation was about 75 per cent for 2020-21, due to 10 months of effective operations,” says Allaphan. “With our government’s vision of reducing India’s import dependency to boost the manufacturing sector, they have put in place restrictions on imports from China. This step has been playing a key role for generating better demand for Indian manufacturers. The drop in imports led to a 5 per cent market growth for domestic players in truck and bus and 10 per cent in the passenger vehicle segments,” he adds.

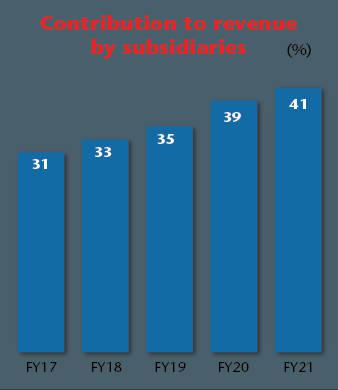

The icing on the cake is that the company’s domestic subsidiary has shown definitive signs of operational turnaround (a process which was set afoot in 2016), by reporting a revenue growth of 16 per cent to Rs2,571 crore for 2020-21. The cash profit for the year was Rs225 crore – a significant jump of 150 per cent.

The Cavendish acquisition has been critically important for JK Tyre as, according to a senior official, it saved three years of setting up a similar greenfield facility and quicker penetration into the two- and three-wheeler segment. The acquisition has expanded the company’s TBR capacity by 1.4 million units per year. The low-cost acquisition of new capacity has also resulted in savings of about Rs500-600 crore.

Incidentally, in a troubled year, JK Tyre’s Mexican unit also fared well, despite the lockdown lasting for a longer period than India in that Latin American country. “During just eight-and-a -half months of full operations, JK Tornel has achieved higher sales in 2020-21 than in 2019-20,” says Bajoria. “We witnessed a significant increase in demand from the US market, on account of our sustained efforts in making new products and appointing new distributors. These efforts were supported by the continuation of anti-dumping duty on imports of tyres from China and the imposition of anti-dumping duty on passenger and light truck tyres from South Korea, Taiwan & Thailand.”

Sales in Q4 for JK Tornel were at an all-time high, and are likely to go up even further, he feels. On a year-on-year basis, the revenue from Mexican operations has retained the previous year’s level of over Rs1,100 crore.

-

But, despite some critical intrinsic strength and more than ordinary performance in the immediate past, analysts have been pointing at some weak points on its balance sheet, particularly related to financial management. A recent paper by an investor advisory firm points at consistent low operating profits for the past five years, as also the company’s high debt-to-EBIDTA ratio and low return on capital employed (10.33 per cent), as some of the easily visible gaps on the financial performance front, which will have to be plugged.

However, Sanjeev Aggarwal, CFO of the firm, strongly underlines the point that JK Tyre has not shied away from augmenting capacity even in the recent lean years. “During the last few years, market demand has not grown linearly. It is greatly affected by various external factors, such as change in axle regulations, insurance norms, BSVI transition, NBFC liquidity crunch, the Covid pandemic, etc, which have seriously impacted the demand in the auto and tyre industry. But we have always focussed on building newer capacities, either organically or inorganically, which has resulted in higher debt levels in the past,” Aggarwal says. The company claims to have spent Rs1,500 crore in new capacity building and other business requirements.

Even as JK Tyre’s scrip at the stock market has beaten the BSE Sensex in terms of generating returns in the past year (growing by 122 per cent, as against BSE 500’s return of 57.24 per cent), in valuation terms, it is positioned in small cap bracket (about Rs3,600 crore). This has baffled many, as its esteemed peers like Apollo (about Rs14,400 crore) and MRF (about Rs34,400 crore) enjoy much higher valuations.

Point this out to Singhania and he gives you a straight answer. “The acquisition of Cavendish was financed by a combination of equity and loans,” he responds. “Immediately thereafter, the economic activities, more particularly in the automotive sector, started slowing down and this led to delayed turnaround of Cavendish. Incidentally, CIL plants were shut when handed over to us. This borrowing has led to a skew in the leverage, which has impacted the company’s market cap.”

Next frontier

The company’s net debt, however, has shown modest signs of shrinking, coming down from Rs5,412 crore last fiscal to Rs4,483 crore at the end of FY21. “In 2020-21, JK Tyre reduced the net debt significantly by Rs929 crore through higher cash accruals and funds released due to better working capital management, which is a reduction of 17 per cent, compared to last year and the finance cost is lower by about 15 per cent,” Anshuman Singhania points out.

The management has also communicated its intent to further reduce long term debt by 45 per cent by FY24. The market seems to have already taken a note of the company’s efforts for better control of its debts as its long-term rating was upgraded to stable by India-Ratings early this year. In June 2020 the agency had accorded a negative outlook for the tyre major.

The upgrade reflects JK’s better-than-expected operating performance and net leverage in 2020-21 and Ind-Ra’s expectation of a healthy revenue growth, robust profitability and credit metrics in 2021-22. Ind-Ra expects the net leverage to reduce further to 3.0-3.25x in 2021-22, on the back of a robust EBIDTA, the management’s focus on better working capital management and the absence of any significant capex plans.

-

Tornel plant: excellent stronghold in the domestic market

The company’s capital prudence approach is reflected by its decisions, like putting on hold a further investment plan of about Rs675 crore in the Cavendish facility, for further expansion of the TBR (truck/buses radial) facility. The company has sufficient production capacity, especially for its primary products, says Bajoria. “It is through these steps that we are trying to put our finances in a better mode,” he adds. “The view from the management is clear: in segments like TBR, we will go in for fresh capacity creation only when the existing capacity has been fully utilised. It is something which we can readily do when needed given our existing base.”

JK Tyre, meanwhile, has earmarked a new investment corpus. “It is planning to incur about Rs200 crore over the next two years by way of de-bottlenecking its plants to increase capacities, to be funded through internal accruals,” says Anshuman Singhania. “There will be sufficient operational capacities through the proposed de-bottlenecking to cater to higher demand for its products.”

This de-bottlenecking exercise has been drawn keeping in view a critical next frontier, which the company has chalked out for itself. “This de-bottlenecking drive will be undertaken for ramping up our car tyre manufacturing capacity,” Bajoria elaborates. “We have a market share of 12 per cent in this segment. We want to take it up to over 15 per cent in the next one or two years.”

And the company’s intent to make a better splash in passenger car tyre segment is well reflected in recent partnerships it has forged with leading OEMs like Hyundai India and Kia. It has become one of the tyre partners for some of their best-selling car models like Hyundai Creta, Hyundai ALCAZAR, and Kia Seltos.

Senior officials make it clear that they are fairly convinced that the new inflection theory coming into play will help their business grow in the medium term vis-à-vis the current base – something their esteemed peers also believe in strongly. In an investors’ presentation early this year, Apollo Tyres had indicated they were eyeing a $5 billion revenue by the end of 2025-26. In the case of JK Tyre, the target is to double its revenue base in the next six years. “Though the industry is expected to grow at a CAGR of 12 per cent over the next five years, it may be able to better it by doubling its turnover by 2026-27,” Anshuman Singhania underlines. “We are entering a period of strong demand in the replacement and exports segment. The OEM demand is also likely to improve substantially in the near future, on the back of the strong recovery seen in economic activities. Tyre industry prospects are bright in the medium term, as there is a great deal of focus on the infrastructural and developmental plans by the government. Lastly, the voluntary scrappage policy will also be a key growth driver in the medium term,” he elaborates.

And, according to V..G Ramakrishna of Avanteum Advisors, which tracks trends in the automobile business, the ambitious growth targets of these firms are attainable. “The leading Indian tyre firms have proved their credentials in building up a large-scale base. Companies like Apollo and JK, with their definitive international presence with manufacturing units, have the potential to make this vertical particularly big and, in the process, their own scale will go up significantly,” he emphasises. “You can’t discount China plus one sourcing option which many countries have adopted. This can benefit Indian tyre industry and its leading players in a big way,” Gandhi adds.

-

On a short-term basis, a major sectoral challenge could be the firming of raw material prices. It has already resulted in a marginal price increase by the company in early April. “We have increased our prices too in the last couple of quarters. We’ll continue our efforts at improved realisations in 2021-22, in line with the market and costs,” says Bajoria.

The company in recent months has increased prices by 10-12 per cent. “Raw material pricing pressure could affect the margins of tyre firms. However, raw material price increases are typically passed on to the customers, though with a lag and, hence, can be absorbed to an extent,” emphasises Pallavi Bhati of India-Ratings.

The addition of technology inputs – both in terms of gaining operational efficiency as well as better connect and services to customers – is another sub-plot which is likely to become bigger and play a more meaningful role in the brisk growth of leading firms in the case. And it’s happening across the sector. Take the case of Bridgestone, a global tyre major, which has a sizeable presence in India now and is a leading player in the passenger car tyre space. “We have believed in the power of digitisation and have been implementing some key digital initiatives to simplify our business functions, empower our teams, enable forward decision making, and bring in digitisation and efficiency in processes,” says Parag Satpute, MD, Bridgestone India, while citing a host of recent initiatives by the company.

These include: ‘Tyre-as-a-service’ model, ‘Pay per km’ model, launch of contactless tyre servicing platform called ‘Bridgestone Bookmyservice’, etc. The company is now ready to introduce some more initiatives – Smart Maintenance, Smart Energy Management, and Smart Learning Kiosk at Shop floor, etc.

JK Tyre, on its part, is also upping the ante on the digitisation and technology front, in anticipation of new-age tools providing big-time support to its big-ticket growth plans. “We are the only company in India, offering Smart Tyre technology to the customers," Allaphan points out. On the basis of this offering, JK Tyre is expecting to give a major push to its type fleet management system, which now services about 100,000 trucks.

Earlier this year, JK Tyre partnered with JBM Auto to offer end-to-end ownership of ‘Total Tyre Management’ for its city bus application across its 11 workshops set up in Delhi, Mumbai and Ahmedabad. For doorstep delivery, it has also joined hands with the likes of Amazon, though sales through the online channel are quite low.

Focussing on CV and EV segments, JK Tyre has also announced a partnership with JBM Auto for smart radial tyres. Furthermore, the company strengthened its service portfolio across the country by partnering with Ki Mobility Solutions to provide 24-hour customer assistance. Quite clearly, there are plenty of small technology-enabled pieces, which the company is keen to harness, as it readies for what it believes could be an exceptional growth spell.