The InvIT (Infrastructure Investment Trust) has come a long way over the last 7 years and has pumped more than $10 billion into the infrastructure sector. There are approximately 21 InvITs operating, with 10 of them in the road sector. Capital Infra Trust is looking to enter the market as a road-focused platform. “Sponsored by 15-year-old Gawar Construction Limited, Capital Infra Trust will have a sizeable portfolio of stable, revenue-generating assets with no construction risk and long-term cash flows,” says Manish Satnaliwala, CEO of Capital Infra Trust. Gawar Construction has developed expertise in the construction of road and highway projects across 19 states in India for various government and semi-government bodies, as well as statutory authorities, including the NHAI, the Ministry of Road Transport & Highways (MoRTH), the Mumbai Metropolitan Regional Development Authority (MMRDA), and the Central Public Works Department (CPWD). Since 2008, the InvIT sponsor has undertaken more than 100 road construction projects. As of the date of the Draft Offer Document, the Sponsor has a portfolio of 26 road projects on a Hybrid Annuity Model (HAM) with the NHAI, of which 11 are completed projects, including three acquired assets, and 15 under-construction projects, which include two acquired assets. Capital Infra Trust is intended to initially acquire, manage, and invest in the nine completed and revenue-generating initial portfolio assets, aggregating to approximately 683,875 km, operated and maintained pursuant to concessions granted by the NHAI and owned and operated by the Project SPVs. These roads are located in the states of Haryana, Rajasthan, Bihar, Uttarakhand, Himachal Pradesh, Madhya Pradesh, and Karnataka. In addition to the Initial Portfolio Assets, the Trust, through the Investment Manager, will also have the right to acquire new projects through a right of first offer with the Sponsor in accordance with the Right of First Offer (ROFO) Agreement. “Since all Initial Portfolio Assets are on a HAM basis, our entire revenue is expected to continue in the future from interest income on financial assets receivable from the NHAI, revenue from operations, maintenance of roads, construction services, and operating revenues from the NHAI,” says Satnaliwala, who has previously worked in InvITs, namely OIT Infrastructure Management Limited (Oriental Infra Trust) and Roadstar Investment Managers Limited (ILFS InvIT), in various capacities. In a HAM project, the concessioning authority shares a portion of the total project cost during the construction phase. As a mix of EPC and annuity models, HAM reduces the financial burden on a concessionaire during the project construction phase and provides assured revenue in the form of fixed predetermined annuities, interest on the reducing balance of completion cost (BCC), and O&M payments linked to inflation in the operational phase. Annuity payments eliminate the risk of income fluctuations resulting from changes in traffic volume, he says, and explains: “All of our initial portfolio assets have been receiving regular semi-annual annuities from the NHAI since 6 January, 2021. The aggregate annuity received until 30 June, 2024, is Rs464.35 crore. The residual terms of the concession agreements range between 10.3 years to 14.01 years as of 30 June, 2024.” “The roads and highways sectors play an important role in the overall economy of India,” says Rakesh Kumar, founder and executive director of Gawar Construction. Phase I of Bharatmala Pariyojana envisages the construction of about 24,800 km of highways under the following categories: National Corridor (North-South, East-West, and the Golden Quadrilateral), economic corridors, inter-corridor roads, feeder roads, international connectivity, border roads, coastal roads, port connectivity roads, and expressways. “We believe that the Government’s focus on infrastructure and sustained increases in budgetary allocations for the sector, as well as the development of comprehensive infrastructure policies, will be beneficial to our business in terms of bringing in more opportunities for the acquisition of assets,” adds Kumar.

-

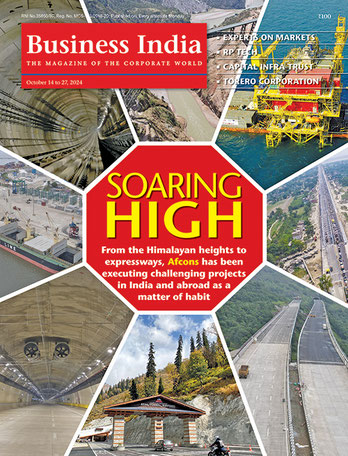

Kiratpur project: significantly reducing travel time between Shimla and Mandi