-

Chiripal: formidable position

Bouncing back

During FY22, the company bounced back strongly after its revenue dipped to Rs967 crore in FY21 from Rs1,297 crore in the previous year. At Rs1,547 crore, revenue was up 60 per cent YoY, while PAT at Rs69 crore was up 281 per cent in FY22. The company’s processing unit at Narol, Ahmedabad has contributed around Rs250 crore to the total revenue.

The 105-million metre capacity processing unit undertakes dyeing, printing and processing of fabrics of its own (including group companies) as also on a job-work basis. The plant has the capacity to print, dye and process a wide range of fabrics, namely cotton, polyester, viscose and man-made & blended fabrics suitable for men’s wear, women’s wear, home furnishing and many other applications.

While expanding its capacity, the company consciously focusses on bringing down operation costs. Towards this end, it has recently commissioned a captive power plant of 4.9 MW at a total investment of Rs33 crore. Besides, the company is also putting up 1 MW of rooftop solar power facility. It has also put in place a hedging mechanism to effectively face the brunt of the fluctuating price of the primary raw material – cotton yarn.

As the steep rise in cotton prices pushed yarn prices up by over 60 per cent in the last couple of years, the company is now also involved in value engineering by blending other fibres like polyester and Lycra. In fact, it has also increased the share of such blends to around 8-9 per cent from 5 per cent earlier as part of a cost reduction measure. Moreover, VFL has also managed to pass on this hike to its customers by increasing 20-25 per cent of denim fabric prices in the last two years.

“The company has been able to successfully pass on the additional cost to the customers. Our continuous efforts to keep operating expenses under control helped in maintaining margins. To deliver superior outcomes to all of our stakeholders, we reaffirm our continuous focus on quality, production efficiency, on-time delivery, design, and innovation. While the short-term headwinds may persist, we continue to be optimistic on the growth opportunities for the Indian textile industry on a long-term basis and our ability to increase utilisation levels and increase our revenue and market share,” saysThadani, 35, who joined the Chiripal group of companies in 2017 and is currently advancing his services as CEO of VFL.

He shoulders the primary responsibility for planning, implementing and managing the company’s finance activities, long-term financial planning business development, client relationship and improving the efficiency and effectiveness of the businesses.

Always passionate about meaningful change, he has advanced the company’s investments, capital structure, cost and benefit analysis and played a vital role in the financial success of the organisation. Thadani joined the company as part of the group’s move to hire professionals at the helm of affairs and is a member of the Institute of Chartered Accountants of India.

Being a practising Chartered Accountant for the initial period of four-and-a-half years of his career, he has rich and varied experience in the field of debt syndication, audit, treasury, tax planning, management consultancy, capital market operations, SEBI-related matters and other corporate laws.

-

Thadani: supreme performance

The genesis of VFL dates to 1985 when it was initially engaged in trading fabrics. During 1999-2000, the company took over the units of associate concerns Bhushan Petrofils Pvt Ltd and Prakash Calendar Pvt Ltd (both located at Narol, Ahmedabad) on a lease basis and started the processing of fabrics.

Over the years, with a view to expand the installed capacity and broad-base the market of its products, it put up its own plant and machinery. In 2003, a captive 2.3 MW powerplant was set up. In 2005, the company increased its processing capacity by installing a wider width unit, which enabled it to process fabrics of upto a width of 120 inches.

Enhancing capacity

In 2011, the company further enhanced its processing capacity by setting up a continuous bleaching range unit, which enabled it to process up to 80,000 metres of fabric per day as compared to 2,000-8,000 metres in other machines. For FY14, its revenue stood at around Rs205 crore and went up to Rs374 crore by FY17.

In August 2014, the company came up with its IPO (raised Rs80 crore) and got listed on the BSE SME platform. As the revenue soared in the following years with its entry into denim fabrics manufacturing, the company was shifted to the main platform of the stock exchange.

The last few years have been quite remarkable as it successfully positioned itself in the denim fabrics market. The denim market, which faced many challenges during the initial phase of the Covid pandemic, has now bounced back. In fact, denim is the fastest recovering market segment post the pandemic outbreak and according to a recent projection by Research and Markets, a leading market research agency, the global market for jeans valued at $63.5 billion in 2020, will see a revised size of $87.4 billion by 2027, growing at a CAGR of 4.7 per cent over the period 2020-2027.

India has been a leader in denim fabrics and of late, the domestic jeans market has also been growing steadily, in fact faster than the global growth rate. Various market studies suggest that the Indian domestic market for denim has been maintaining an average CAGR of 8-9 per cent for last few years and is expected to reach $12.27 billion by 2028.

Experts believe that the growing denim market, both internationally and nationally, is the main reason why leading mills optimistically believe that denim will continue to tap growth in the years to come, at a rate more than the current one, and if projections are an indicator, growth will touch 10-12 per cent on a CAGR basis. What is encouraging is that while the bigger and well-known mills continue to consolidate, younger companies are looking at growth and have plans for expansion.

As far as the recent surge in demand of denim is concerned, experts are of the view that there are multiple factors behind the surge in demand, the major one being there were no inventories left with anyone across the supply chain and so demand is piling up. After a lull, the economy is growing because money is back in the market, and ‘revenge buying’ is also happening, resulting in booked capacities in mills. The versatility of denim is also a reason that’s helping this demand to be sustained in the longer term.

-

VFL has emerged as a pioneer in the industry by producing wider-width fabrics

“It is heartening to see demand for denim clothes coming in not just from Tier-1 and Tier-2 cities but also from the less urbanised regions of India. In India, denim consumption is increasing as it is now penetrating to the bottom level of the consumption pyramid,” says Thadani.

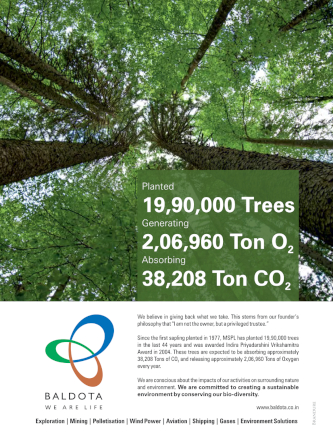

Being one of the mainstream sectors in the fashion industry, denim mills are now steadily implementing circularity in their production processes. Indian denim brands are taking strong steps in the direction of creating more responsible denim fabrics that reduce the gap between fashion and sustainability. Towards this end, VFL has also started a series of initiatives to make its manufacturing more sustainable.

The company is installing 1 MW of rooftop solar panel facility this year and looking to significantly increase the share of renewable energy in total energy consumption. It has also installed a zero discharge effluent treatment plant that treats the liquid discharged from the manufacturing process and makes it reusable.

With all these developments in place, VSL is positioning itself strongly in the market. In a short span of time, the company has managed to make good inroads in this business. Through Nandan Denim and other group companies, the Chiripal group has been in the textile manufacturing space for quite some time now. Being part of the Chiripal group has helped the company immensely. Moreover, the denim market is growing and will continue to grow going forward, as the penetration of denim is increasing.

Moreover, denim is a versatile fabric and hence is making its way to semi-urban and rural geographies in a big way. In global markets too, India has emerged as a major supplier of denim after China. In fact, with buyers the world over adopting the China Plus One strategy, Indian manufacturers will have a distinct edge and will be able to increase their share in the global market. Against this backdrop, VFL is ramping up its capacity and is all geared up to leave its mark in the market.