Bringing truant market participants to book and meting out punishment sufficient to deter other adventurous ones is one of the primary duties of the regulator. However, the speed at which malpractices are spotted and action taken is of the essence if the objective is to put the fear of God and the regulators in other participants. The capital market regulator, Securities and Exchange Board of India, does go after errant participants, but somehow it has failed, time and again, in bringing about the speedy closure of cases and meting out strong punishment. There are several instances of inordinate lapses. The more notable ones being the case of Satyam and the action taken towards its auditor, Price Waterhouse. SEBI banned the audit firms from conducting audits for two years, nearly 10 years after the case came to light. The order was quashed by the appellate body on the grounds of non-jurisdiction. However, the point of inordinate delay in speedy delivery of punishment continues. The recent order passed in the Kirloskar case also smacks of the tardy action taken by the regulator. Nearly a decade after the alleged transactions of insider trading were spotted, the Securities and Exchange Board of India recently penalised Atul Kirloskar, Rahul Kirloskar and the other promoters of the listed entity Kirloskar Industries Ltd (KIL) for insider trading. The issue pertained to an alleged case of insider trading in which Kirloskar Brothers Ltd had offloaded 10.72 million shares of KBL of the value of Rs375 crore to a group company, Kirloskar Industries. Several irregularities/violations were noticed in the transaction, including the withholding of price sensitive information. The Kirloskars argued that the share purchase and sales were part of the arrangement to divide the businesses amongst Atul and Rahul on the one hand and Sanjay, on the other. This was part of the separation within the Kirloskar group. Some of the directors were barred from trading for a six-month period. The promoters and family members of Kirloskar may appeal against SEBI’s order on the grounds of inordinate delay. While the Securities Appellate Tribunal may or may not set aside the penalty, the point is: can SEBI really take advantage of vague notifications which do not provide time limits for taking actions against errant promoters? Surely it cannot take 10 years to pass an order in an open and shut case as is made out by SEBI’s whole-time director. Insider trading is the most prominent stock market malpractice and any regulatory leniency will prove to be an ineffective deterrent for insider trading and fraudulent trades in India. SEBI has been issuing notices for violation by intermediaries, promoters and to investors after a gap of 10 to 12 years, It is not possible for either intermediary or investor to keep records for so long when the statutory requirement for keeping records is only eight years. If intermediary or investor do not give details then they are either debarred or fined heavily. There is little point in issuing such an order after so much time has elapsed. And the promoters may well have accessed the capital market during this interim period.

-

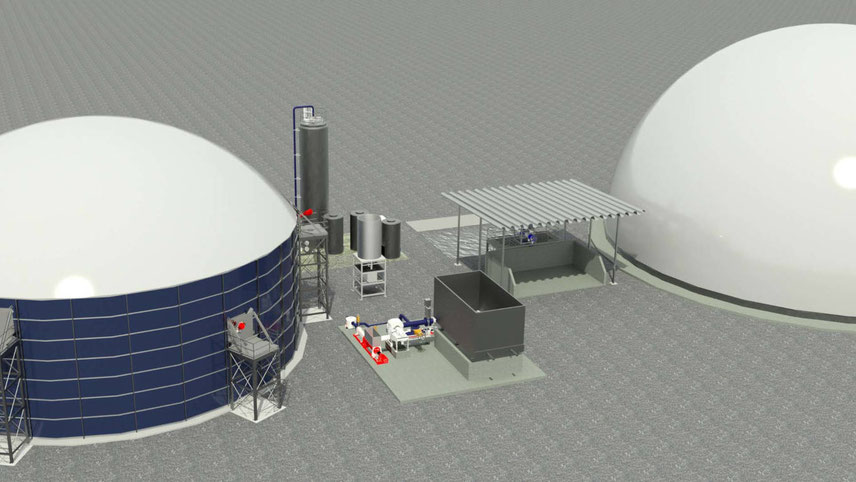

Illustration: Panju Ganguli