-

Lopez: global strength matched by local expertise

Awards and accolades

Having bagged several accolades for its innovations and offerings in the past, the company was named India’s ‘Co-location Service Provider of the Year’ at the 18th Frost & Sullivan India ICT Best Practices Awards 2020. This was the third year in a row that the company has won this award.

“With about one-third of the market share, STT GDC India has been a dominant leader in the Indian colocation market, propelled by its extensive data centre footprint, eminent data centre facilities, and excellent customer service,” remarks Apalak Ghosh, Associate Director, ICT, Frost & Sullivan. “The company has become a preferred colocation service provider for hyper-scalers, service providers, and large enterprises in India.In 2019, STT GDC India demonstrated exceptional innovation prowess, with investments in automation system and green data centres. This is a well-deserved recognition for STT GDC India, supported by its robust financial performance, strong parentage, visionary road-map and undisputed leadership in the Indian colocation market.”

“We are delighted to receive the prestigious ‘Colocation Service Provider of the Year 2020’ award by Frost & Sullivan,” acknowledgesSumit Mukhija, CEO, STT GDC India. “It is an honour for the entire team at STT GDC India to be recognised for our efforts, diligence and customer-centric approach. Even amidst the prevailing global challenges, our team hasstrived to ensure business continuity for our customers. Winning an award of this stature validates our in-depth understanding of customer needs, coupled with our unwavering commitment to deliver for them, and our strong local expertise. We are inspired to remain as the leader in the Indian data centre industry.”

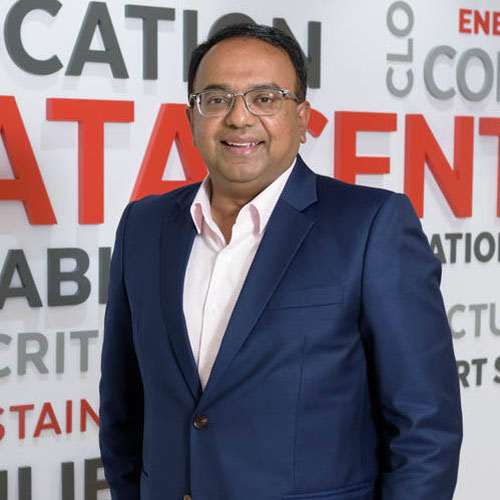

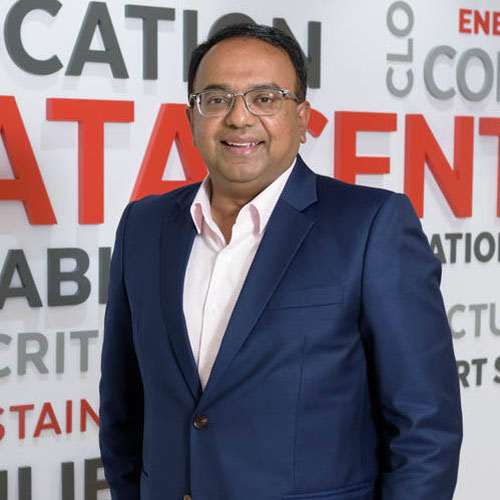

“The STT GDC group of companies has a global strength, matched by our local expertise, with teams on the ground, which know their home markets best and ensure that every data centre is developed and operated consistently according to global standards no matter where it is located,” says Bruno Lopez, president & group CEO, ST Telemedia Global Data Centres. “Notably in India, STT GDC has become a dominant leader in the Indian colocation market propelled by an extensive footprint and a broad-based customer portfolio, including global cloud service providers and content providers, as well as large local companies across diverse industries. We are pleased with the outcomes to date and are committed to continue expanding in the local market as we grow with our customers.”

Headquartered in Singapore, ST Telemedia Global Data Centres is one of the fastest-growing data centre providers in the world. Since its establishment in 2014, STT GDC, the wholly-owned subsidiary of ST Telemedia, has expanded its portfolio through inorganic and organicmeans. STT GDC manages a portfolio of over 110 data centres,with an aggregate IT load of 1.2 GW and a net floor area of over 580,000 sq m across Singapore, India, the UK, Thailand and China.

The S$4.1 billion ST Telemedia group is an active investor in the communications, media and technology space. It started operations in 1994 and has built a portfolio of complementary assets and businesses across Asia, Europe and the Americas. It is a portfolio company of the Singapore government’s investor arm – Temasek Holdings.

-

Pabla: In India, the colocation data centre market will continue to grow exponentially

Looking at the emerging opportunities, STT re-entered the data centre market in 2014,with its investment in GDS Services (GDS), a leading provider of advanced and high-availability data centre services in China. This was followed by acquisition of stakes in VIRTUS Data Centres in the UK in 2015; a strategic partnership with Tata Communications to expand the data centre business in India in 2016; and a strategic partnership with Frasers Property Thailand in 2018. Apart from these inorganic strategies, STT has continued to ramp up its footprint through investments in greenfield projects in various geographies.

Comprehensive strategy

“Our progression has been quite remarkable,” affirms Mukhija. “While India is one of the fastest growing data centre markets in the world, we have grown faster than the market and maintained our leadership position. Going ahead, we have a comprehensive strategy and plan to retain this leadership. In a market where multiple players are vying for a pie of this hugely potential market, we derive the desired strength from our parentage across two major organisations –ST Telemedia and the Tata group. In fact, we have a distinct edge in terms of various aspects of this business, which is not only highly capital incentive but also calls for domain expertise and capabilities.” Mukhija is firmly of the view that a data centre is not just a real estate play as perceived by many, even as the whole pie is big enough to accommodate multiple players.

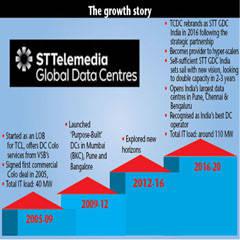

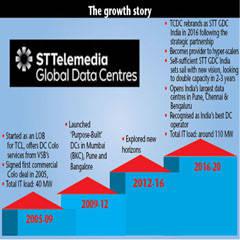

Mukhija has been CEO, STT GDC India,since October 2016, when the company came into being after ST Telemediacompleted its acquisition of a 74 per cent stake in the Tata Communications’ data centre arm– Tata Communications Data Centers. ST Telemedia entered into a strategic partnership with the Tata group company in May 2016 to pick up majority stake in the latter’s data centre business, following its decision to re-enter the global data centre market in 2014.

Leading from the front, Mukhija has been instrumental in the company’s phenomenal growth in the last four years, as the company has grown at 25-30 per cent CAGR and created a leadership position for itself in the rapidly growing Indian DC market. Mukhija joined Tata Communications in 2014 (when the total IT load of the business was 40 MW; today, it is 110 MW) and held various senior positions, including head, solution sales for data centre services, eventually moving on to head Tata Communications Data Centre services as its CEO.

Mukhija holds a master’s degree in management from XLRI, graduating with distinction (his areas of interest were international business and strategic management). He also holds a bachelor of engineering in electronics and communications from Gulbarga University. He has been at the forefront of innovations in the regional data centre market for close to three decades, having held leadership positions in organisations including Cisco, Microsoft and Brocade. Before joining Tata Communications and STT GDC India, Mukhija served as director,solutions sales, at Microsoft,and was responsible for driving the solutions sales for Microsoft’s Cloud business and application platform. At Cisco, he was responsible for driving the overall data centre solutions business in India.

-

STT GDC Chennai DC: expanding in key micro markets

India, the second largest DC market in the APAC region, after China,is alsothe fastest growing data centre market in the world. According to industry estimates, the data centre outsourcing market in India, pegged at close to $2 billion, is projected to grow at 25 per cent CAGR to reach $5 billion by 2023-24. The global colocation market is growing at about 12 per cent and, with the advent of digital technologies, businesses across India – large to small and mid-sized enterprises – are undertaking rapid digitisation and transitioning to cloud-based solutions. According to a Gartner report, 80 per cent of enterprises are expected to migrate away from on-premises data centres to the cloud by 2025.

Cloud market grows fast

Giant public cloud players such as Amazon Web Services, Google Cloud, Alibaba Cloud, Microsoft Azure and Oracle are already geared up, and as these hyper-scalers and large internet giants look for hosting their data at third party locations, the demand for data centres is spiralling. According to BCG, the public cloud market in India is expected to grow at 25 per cent CAGR to be worth $8 billion by 2023, from $2.6 billion in 2018. The consulting firm reports that India is on its way to becoming a global leader in the cloud domain. As per the Internet and Mobile Association of India (IAMAI), India has more than 500 million active internet users (second only to China, which is at about 900 million).

The Covid-19 crisis has accelerated the whole process considerably. The government’s Digital India mission has already been propelling this growth trajectory for some time now and lending some much-needed support to create a robust digital ecosystem in the country. Fuelling part of this demand are recent changes in the regulatory environment. In April 2018, RBI had mandated that all data of financial transactions should be stored on servers located in the country. And, now, with the government approving the Personal Data Protection Bill and paving the way for the enactment of the much-talked-about legislation, localisation of data will gain further momentum.

Experts are of the view that India is going to be a big hub for colocation and cloud computing activities, which change is likely to fuel the demand for data centres and related infrastructure. All stakeholders across the value chain will have to scale up their capabilities in a big way to meet the exponential demand in the overall data market.

“The data centre industry in India is vibrant with robust demand,” observes Sharad Sanghi, leader designate, NTT, India. “India is the fastest-growing market in Asia and is also among the top five to six markets in the world. With mandatory data localisation and protection rules coming into force, data centres will be the new growth engines for 21st-century businesses. The Covid-19 pandemic has further accelerated the demand. Businesses with a focus on growth and consolidation of their core competencies stand to gain big by outsourcing their digital and IT infrastructure to data centre service providers. Going forward, India is set to become the preferred destination for global multinationals to serve as a data centre hub in Asia.”NTT India is also betting on the Indian DC market.

Other data centre (colocation) players like CtrlS, Sify and Nextra Data (Bharti Airtel) are also ramping up their capacities, while foreign players like Capital Land and Colt DCS have already announced their intent to invest and create colocation spaces in India. As per sources, even the world’s numberone player, Equinix of the US, is also exploring various options to enter the Indian market.

-

STT GDC Bengaluru DC: ramping up operations in the country

Leading real estate players, Hiranandani Group, Salarpuria Sattva as well as the Adani Group, have also rolled out significant investment plans for building data centres in India. According to experts, while most of the traditional segments in the real estate market are under pressure, data centres have emerged as a promising segment, attracting a good deal of attention from real estate players and investors.

Colliers International India says that India’s colocation data centre stock is likely to more than double by 2023 to about 20 million sq ft, from the current 9 million sq ft. The thrust on DCs is led by increasing digitisation and growing adoption of cloud and IoT devices. Further, Indian government regulations to localise data and the Reserve Bank of India’s aim to increase digital transactions by 10x are strongly driving the demand for DC assets in Indian real estate. Colliers notes that India has about 1.2 MW per user of colocation DC capacity at present, as compared to Europe’s 19.1 MW per user DC capacity, whichprovides a huge opportunity for DC operators and investors in the country.

“With the continuing clamour of investors for stable assets in India, the data centre business in India is likely to provide steadiness and diversification in the income profile,” estimates Piyush Gupta, managing director, capital markets & investment services, Colliers International India. “The ecosystem for the business in India is fast evolving with experienced operators’ entry into the market, large developers building world class assets and proactive legislative support. The DC business is likely to provide investors focussed on India across infrastructure, technology and real estate, a unique investment opportunity over the next few years.”

Ramping up capabilities

“In India, the colocation data centre market will continue to grow exponentially, driven by cloud, digitisation, data localisation, IT infrastructure outsourcing and internet growth,” observes Jatinder Singh Pabla, VP, sales & marketing, STT GDC India. “The demand for data centres is likely to increase and it would be crucial to simplify and centralise remote maintenance. An increasing number of businesses are migrating to the digital space with customised needs and are looking towards data centres for solutions. Industries and business houses have been compelled to migrate to digital domains and this has skyrocketed the demand for DCs with the sector serving as an essential backbone.”

As the demand side is diversifying, DC players are also looking to ramp up their capabilities. STT GDC has also exhibited its ability and prepared itself to cater to a well-diversified customer base. Its largest segment till about three years ago was the enterprise segment, where it had large Indian and global companies which contributed more than 50 per cent of its overall revenue. But that mix is changing because of the kind of scale and the capacity that global internet players bring to the table. All this is swinging the whole mix towards a higher share in the company’s overall revenue and scheme of things for cloud and internet players.

“Today, cloud and internet players together, with content, e-commerce and CDN, would make up 60 per cent of our revenues and the remaining 40 per cent is spread evenly between government, BFSI companies, SMEs, even carriers for example, who have pan-India operations,” explains Pabla. “It is a 60:40 division between the internet and non-internet players, in that sense.”

-

In his 24 years of experience, Pabla has led the journey of transformation of organisations like Microsoft, Wipro, HP and Convergys. Before joining STT GDC India in October 2018, he had spent over 13 years in Microsoft.And, in his last role, he was leading the Office 365 business for India. He is an active contributor on LinkedIn and discusses topics such as machine learning, hybrid cloud and organisational analytics.

To support the exponential growth of India’s digital ecosystem and the demand for quality DCs, STT GDC India is undertaking the construction of new data centres and also expanding existing facilities. In the last nine months or so, the company has launched two new facilities – one in Bengaluru and the other in Pune – taking its critical IT load capacity to around 110 MW, with another 30 MW operational within the next six months. Besides this, as part of its multi-megawatt capacity expansion plan, it will expand in the key micro-markets of Delhi, Mumbai, Hyderabad and Chennai and is expected to double the critical IT load capacity every two to three years, in the future.

The company provides holistic and flexible colocation solutions (rack, cage, suite, containment, bespoke solutions) that can be customised as per the desired deployment size in terms of racks, power and network. For bespoke solutions, STT GDC India not only considers optimal reliability and performance specification for the customer’s facility, but also supports customers on how to achieve it with low operational costs and cost-effective investment. Solutions can either be builttospecifications or modular and can be single-tenanted.

STT GDC India’s colocation solutions can offer up to 100 per cent uptime depending on the solution opted for by customers. In India, all its DCs are owned, purpose built or on long term lease, ensuring zero tenancy risks. Besides, these DCs are custom built for enterprise DC services with high voltage tap, dedicated substations, dual fibre paths, etc, ensuring high resiliency and availability. These DCsare also strategically located to provide site superiority and reduce the risk of natural disasters affecting them.

Given its strong commitment to ensure the highest data security protocols, the company has deployed multilayer security systems for all its data centres, through a combination of secure multi-tiered access control and 24x7 surveillance. Each data centre utilises an array of security equipment, techniques and procedures to control, monitor, and record access to the facility, including individual cages.

“Overall, at STT GDC India, we deploy a flexible approach in terms of designing redundancies as per customer requirements, which allows it to offer clients 100 per cent uptime across all sites,” states Mukhija. “Moreover, we offer a full suite of best-in-class, highly scalable and flexible data centre solutions as well as connectivity and support services that best meet customers’ current and future co-location needs. The company is considered a trusted colocation partner by large enterprises such as hyper-scalers, banks, financial service organisations, IT companies, etc.” Mukhija had recently appeared in The APAC 50, the second edition of this list by Data Economy. The APAC 50 is a list, by Data Economy, which showcases 50 personalities who lead the data centre and cloud industries across the region, through charting new innovations or technological breakthroughs, sheer investment or business acumen, or exceptional entrepreneurial skillsets.

-

STT GDC Delhi DC: The company's colocation solutions can offer up to 100 per cent uptime

STT GDC India has demonstrated exceptional innovation capabilities to further enhance its data centre expertise, customer experience and technological prowess. Its continuous focus and investments in innovation help it to be an undisputed leader in largely new territories such as ‘green data centres’ and ‘edge computing’. In India, the company is the first data centre service provider to undertake large-scale deployment of Li-Ion batteries for UPS systems requiring less floor space and floor loading capacity, thereby providing higher assurance in case of recurring power failure.

Green initiatives

The company also leads the industry in terms of green initiatives and is committed to the sustainability agenda covering the entire build-and-operations lifecycle. This is indicated in the fact that 34 per cent of its power consumption comes from renewable power sources, and that its rainwater harvesting and water recycling initiatives allow it to save 336 kl of water annually. The company has been installing new green captive power generation systems that offer clean and reliable power without surges, sags or interference and can be used for directly powering the critical server load without some of the intermediate power conditioning equipment. Going forward, STT GDC also plans to invest in smaller edge DCs across Tier II and III cities to capitalise on the edge momentum driven by 4G/5G, IoT and video.

“Today, in colocation market, we are the dominant leader and will continue to maintain that position with our initiatives,” asserts Mukhija. “STT GDC India has become the preferred choice of colocation service provider for hyper-scalers and large enterprises. We have a well-formulated strategy and vision to cater to India’s high potential colocation market, with customer-centricity and capacity expansion at the core of its strategy. The company has the strategic direction to maximise performance, reliability, data security and sustainability across its data centre footprint.”

“We have two strong parents – one majority parent, which is STT GDC, and a second parent, a Tata company,” adds Mukhija. “And that has worked really well for us. The few things we’ve inherited from our parents include a strong set of ethical code and business conduct. Our code of business conduct can stand the scrutiny of any global player. Our USP lies in the highest levels of integrity and respect for confidentiality for our customers. We respect our employees and have policies to govern this, which have continued through the transition from Tatas to STT GDC.”

STT GDC has built up a leadership position in the Indian DC market, which has witnessed a phenomenal growth in the last few years and is expected to maintain this momentum going ahead as well. Backed by Temasek Holding, as also the Tata group, the company enjoys domain knowledge, as well as the capital and resources which are critical for being in the highly-capital incentive business of DCs.The company has set a good precedent,where two diverse groups and their cultures and capabilities have successfully converged tocreate a robust business, in a sector where agility and a proactive approach play a major role. In the backdrop of digital transformation, the Indian DC market will continue to grow in a robust manner and a player like STT GDC India is well-placed to leverageopportunities and retain its leadership position.

-

Today, in colocation market, we are the dominant leader and will continue to maintain that position with our initiatives

A journey begins

The genesis of STT GDC India goes back to 2004 when Tata Communications started DC operations by offering the first set of commercial colocation data centres service from some of the legacy locations in Delhi and Mumbai. At that time, it was a line of business for Tata Communications. Eventually, the company saw a lot of growth opportunities. The next wave of growth came in 2007-08, when data centres were built in other cities like Kolkata, Mumbai and Hyderabad. Then in 2009, the BKC facility, which is still running, came up.

In 2014, Tata Communications carved out its DC business into a separate company, Tata Communications Data Centres (as its wholly-owned subsidiary), since it saw a major opportunity in the commercial colocation services space in the fast-evolving Indian DC market. Since the DC service was a capex-heavy business, Tatas started looking out for strong and robust partners, who could potentially bring in the required global expertise, as well as additional capex and funding, to support the growth strategy. This involved discussions with various companies, which took place between 2014 and 2015. And, finally, in 2016, the company entered into a strategic partnership with ST Telemedia, which had re-entered the DC business in 2014 and was actively looking to get into the Indian market.

Tata Communications sold 74 per cent of its stake in its data centre business in India and Singapore to ST Telemedia Global Data Centres, a subsidiary of Singapore-based ST Telemedia. The deal valued at Rs3,150 crore (the deal was estimated at 100 per cent enterprise value) includes Tata’s 14 data centres in India and its three facilities in Singapore. With this, the Tatas were left with 27 DC facilities in the rest of the world.

Last year, in June, STT GDCacquired Tata Communications’ remaining 26 per cent stake in the Singapore business. STT GDC now own 100 per cent of the facilities in Singapore, while the strategic partnership structure remains unchanged in India, where it is betting big, as it plans to double its capacity in the next two-three years.