Haldia Petrochemicals Limited (HPL), once the showcase project of Bengal’s industrialisation push during the Communist regime had witnessed several disruption and obstacles. However, things began to change when The Chatterjee Group (TCG) acquired its controlling stake in 2016 from the newly elected Trinamool government. HPL is now the flagship company of the Purnendu Chatterjee-promoted TCG. The petrochemical major now has been running efficiently and sends positive vibes to the industry.

Recently HPL, along with an international partner Rhone Capital, has acquired the US-based Lummus Technology at an enterprise value of $2.75 billion (approximately Rs20,590 crore) from McDermott International. This is one of the biggest overseas acquisitions by an Indian company. HPL, with its two decades of experience in manufacturing polymer products and downstream chemicals would partner with Lummus in evolving technological improvements for these segments. HPL has 57 per cent stakes in Lummus and the rest is with the Rhone Capital. Lummus Technology under the new dispensation will function as a ‘standalone’ autonomous entity and will have required flexibility and agility to further develop its core competencies.

HPL is one of the largest petrochemical companies in India, situated at Haldia, 125 km from Kolkata. It manufactures commodity polymers like high-density polyethylene (HDPE), linear low-density polyethylene (LLDPE), and polypropylene (PP), as well as chemicals/fuels like benzene and butadiene with intermediates sourced from its naphtha cracker capacity of 700 KTA of ethylene. HPL has been using several process technology suppliers including Lummus for its various units at Haldia. The company is the fourth largest player in the domestic polyolefins market after Reliance, Indian Oil and ONGC Petro Additions.

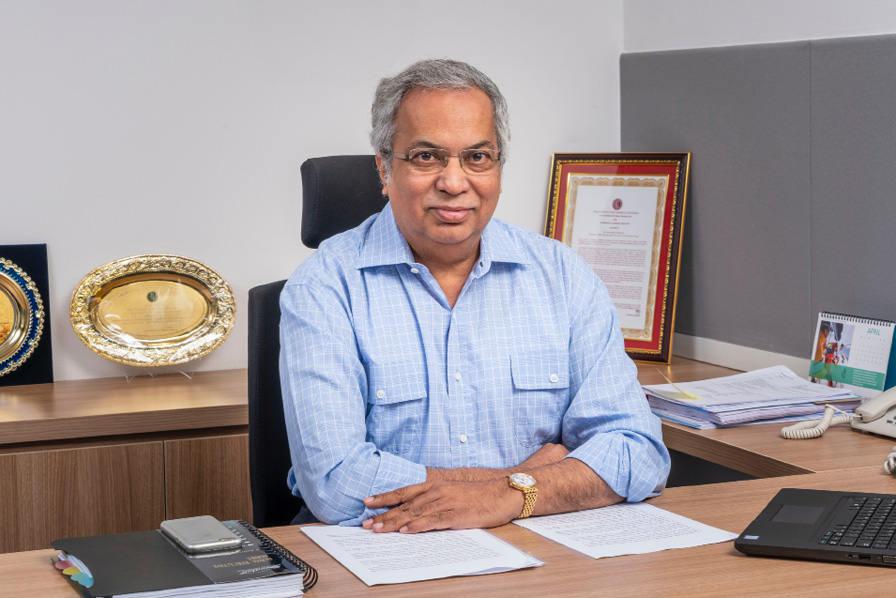

Armed with a B. Tech from IIT-Kharagpur; M.Sc and PhD in Operation Research from University of California, Berkeley, TCG’s founder chairman Purnendu Chatterjee commented, “Our investments are both strategic and long term, most of which span across 25-30 years. We have primarily focused on knowledge-based enterprises, and Lummus is a great addition to our portfolio.” Leading with innovation, Lummus delivers sustainable value to clients in the area of materials technology. HPL being a long-term client of Lummus can share its customer experience and collaborate with Lummus to co-create innovations for the benefit of the industry, adds Chatterjee.

TCG founded in mid-80s with its headquarter in the US, has an enviable track record as a strategic investor, with businesses in many sectors. The group focuses on knowledge-based industries, owns and controls companies as long term investments in several sectors including petrochemicals, pharmaceuticals, biotech, financial services, real estate and technology, serving the global markets.

A subsidiary of McDermott, Lummus Technology with a heritage spanning 110 years, is a leading master licensor of proprietary technologies in refining, petrochemicals, gas processing and coal gasification sectors, as well as a supplier of proprietary catalysts, equipment and related engineering services. Lummus Technology has around 130 licensed technologies and more than 3,400 patents and trademarks.

An important milestone

Welcoming this development, Leon de Bruyn, head, Lummus Technology said, “For our customers, employees and partners this is an important milestone. We would be able to focus exclusively on providing world class technologies and solutions and developing long term strategies that will allow Lummus to lead and shape the future of our industry.” McDermott has been facing financial difficulties. Hiving off the technology business was part of the group’s restructuring process. It is believed that Chatterjee has been watching the company for last three years. This landmark development will significantly accelerate India’s progress towards ‘Self Reliance’ in materials technology space.

-

The Haldia Petrochemical plant. Photo credit: Sajal Bose