-

Despite these constraints, the company has generated free cash flow of Rs2,313 crore during FY20, including a net surplus of Rs397 crore

Their decision to focus more sharply on the Indian market, while striving to maintain their grip on exports, is quite significant because their domestic sales in FY20 was Rs2,894.6 crore (just 19.5 per cent of their total sales, though it is up 11 per cent from the previous year).

Compared to this, the North America sales was 41 per cent of the topline, despite all the challenges faced by Indian companies in the past five years – regulatory hurdles, price erosion, consolidation of the bulk purchasers, etc.

While Dr Reddy’s entered into the deal for an inward shift and a greater share of revenue from the Indian market, Wockhardt hived off this portfolio of products, so that they could shift from acute therapy areas to the treatment of chronic medical conditions. One area of strength for Wockhardt for the past many years has been its canvas of diabetes treatments including various forms of insulin.

Robust growth

The latest sale of these business divisions will enable Wockhardt to have adequate liquidity for robust growth in international operations and investments in biosimilars for the US market, augment its remaining significant domestic business and re-focus towards chronic segment with differentiated product portfolio.

Besides, it will make the money available for the ongoing clinical trials in its new antibiotic for which Wockhardt holds the patent rights. Thus the stated purpose of both companies in entering the transaction is somewhat similar!

There is also no denying the fact that FY20 has been a challenging year for Dr Reddy’s. While its gross revenues have climbed by about 13 per cent over the previous financial year (Rs15,385 crore in FY19), the PBT has actually declined early 20 per cent from Rs2,244 crore in the previous financial year to Rs1,803 crore in the year just ended.

Company officials point out that this negative growth in PBT has been on account of impairment charges of Rs1,677 crore during FY20. But for that, the PBT would have recorded a healthy 55 per cent growth.

-

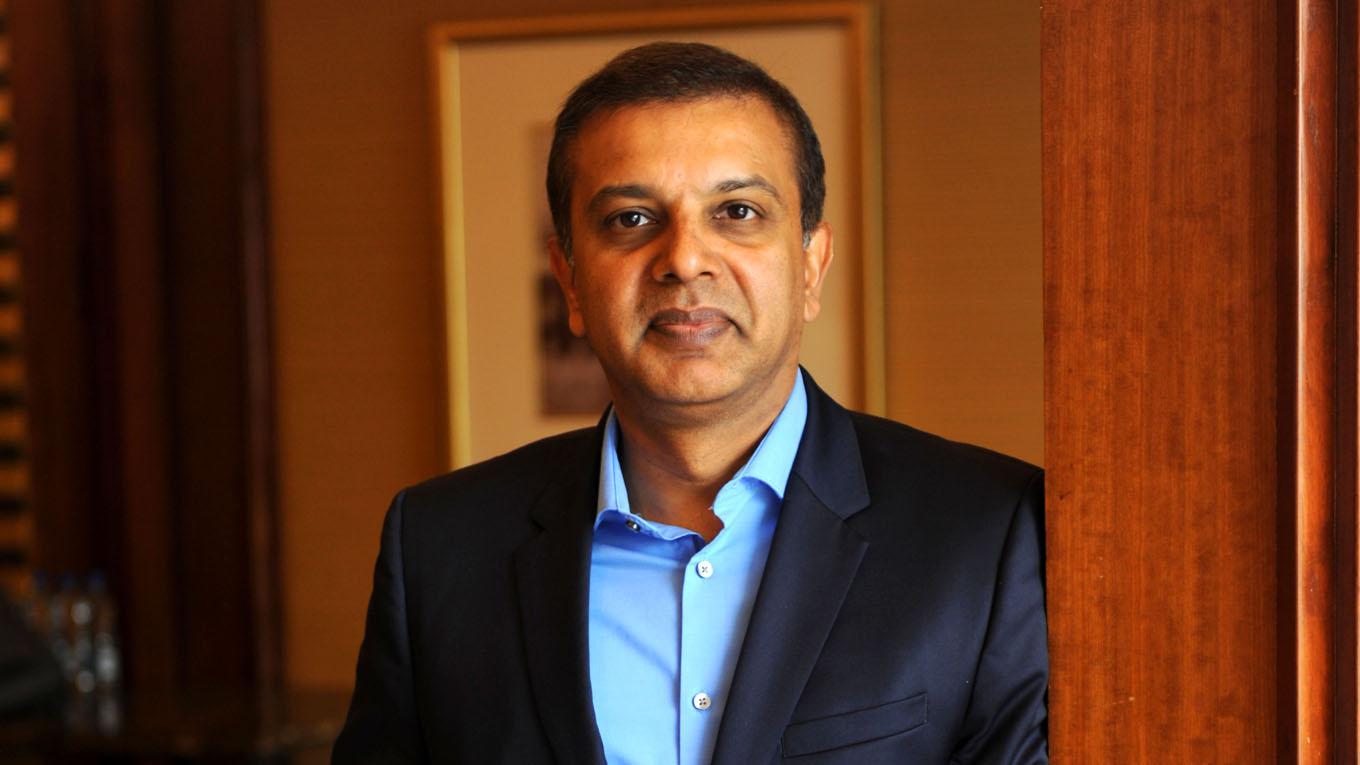

G.V. Prasad: catering to the domestic market. Photo Credit: Sanjay Borade

Despite these constraints, the company has generated free cash flow of Rs2,313 crore during FY20, including a net surplus of Rs397 crore. The total free cash flow this year is slightly lower than FY16 (Rs2,827 crore) but a little bit higher than FY19 (Rs2,165 crore).

In the intervening years, that is, FY16 and FY17, the cash flow stood at less than Rs1,000 crore. Besides, the debt on its books is less than the paid up capital of Rs83.08 crore (166.1 million shares of face value – Rs5 each). Thus Dr Reddy’s has negotiated this deal from a position of considerable strength.

In comparison, the Wockhardt news release mentions that one of its objectives in making the sale is to “strengthen the company’s balance sheet”. This is because its results for FY20 show a negative growth in topline (Rs3,325 crore this year as against Rs4,158 crore in FY19), though the PBT losses have narrowed to Rs69 crore (against Rs195 crore the previous year). No surprise that while Dr Reddy’s has an earnings per share of Rs117.4, Wockhardt has a negative EPS of Rs6.3.

Wockhardt’s lower gross revenues can be explained by a general downturn in most geographies where it operates. Thus the India business fetched sR883 crore in the year just ended (previous year: Rs1,514 crore), the US business is lower this year by Rs60 crore, and the UK by Rs100 crore. On the other hand, the company’s promising new product designated as WCK-777 is making steady progress through the US FDA regulatory system. In the latest step forward, the Zidebactam-based antibiotic received the QIDP (Qualified Infectious Disease Product) tag from the US regulatory authorities.

The impressive results posted by Dr Reddy’s have also been noticed by the investor community with its share price appreciating from Rs2,932 in April 2019 to Rs4,007 in June 2020 (closing prices), and its market capitalisation on 27 June stood at Rs66,803 crore (free float: Rs48,766 crore). While this is not quite in the same league as Sun Pharma (Rs1,16,904 crore), it compares favourably with Lupin (Rs42,365 crore) and Cipla (Rs51,524 crore), while most others are much smaller in this regard.

Dr Reddy’s is also well placed to perform equally well in the current financial year, with a series of product launches lined for the coming months. However, senior executives of the company are willing to accept that the Covid-19 pandemic has cast a dark cloud over business prospects of the next few months. “The impact would be at several levels – prescription generation would be lower because patients are still unable to visit their physicians. Movement of goods from factory to market has been severely restricted and may not return to normal for some more time. The immediate future is full of uncertainty,” says an official, while requesting anonymity. Ironically, of course, panic buying in the US in the early stages of the Covid-19 pandemic resulted in some additional sales in Q4 of FY20. But officials are quick to point out that it was a one-time upside that may not happen again.

As of 31 March 2020, they have a total of 99 applications for generic products, pending with the US FDA, including 97 ANDAs (Abbreviated New Drug Applications) and two New Drug Applications under a special provision known as 505(2).

-

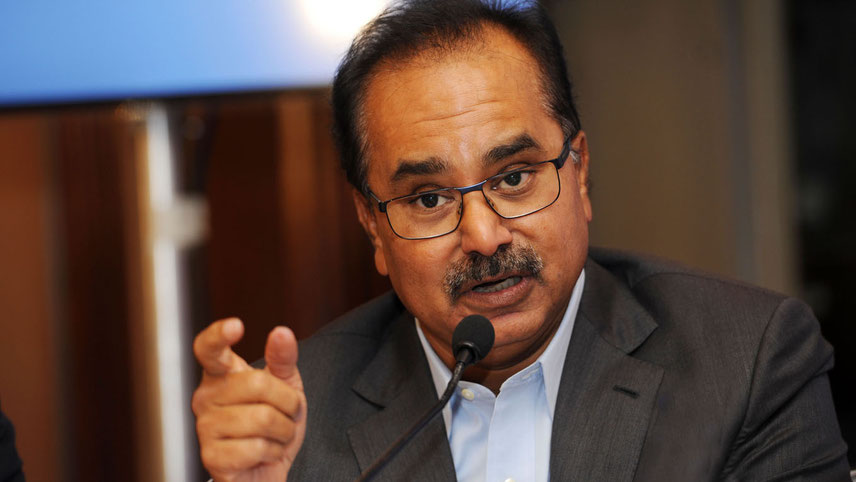

Khorakiwala: strengthening the balance sheet. Photo Credit: Sanjay Borade

An ANDA is a set of documents that have to be submitted with the FDA, giving details of quality testing, manufacturing premises, sources of ingredients and raw materials, etc. On that basis, the US authorities may grant or deny permission for marketing a generic drug in the US. This permission can be withdrawn or revoked at any stage if they find that the appropriate standards are not being complied with.

The company has also filed 59 drug master files (DMF) globally, including seven filings made in the US. The DMF is a similar docket to be submitted to the US FDA for marketing of any medicinal product in bulk drug form. Bulk drugs also known as APIs (active pharmaceutical ingredient) are sold in large quantities (hundreds of kilos or even a few tonnes) in the form of powders or liquids. These are later converted into drug formulations, also known as Finished Dosage Forms, such as tablet, syrups or injections that can be administered directly to a patient. They are also working on a few molecules related to Covid-19.

This is despite the fact that their research and development expenses have steadily declined over the past few years from Rs1,783 crore in FY16 (11.5 per cent of sales) to Rs1,541 crore (8.8 per cent) in the year just gone by.

In view of these developments within the company, several equity research houses that regularly track the performance have taken a variable stand with regard to Dr Reddy’s.

“We continue to believe that Dr Reddy’s is one of the best plays in large-cap pharma space due to its control on overhead expenses, focus on domestic business, injectable products pipeline for the US and EU, net cash on books and resolution for all major FDA issues. By FY22, they will likely see a change in business mix with high margin domestic formulation contributing more to the revenue. The management had already recognised (even earlier than its peers) about the challenging environment in the US market and accordingly reduced capital allocation,” says a report from Prabhudas Liladhar, a well-known equity research firm.

-

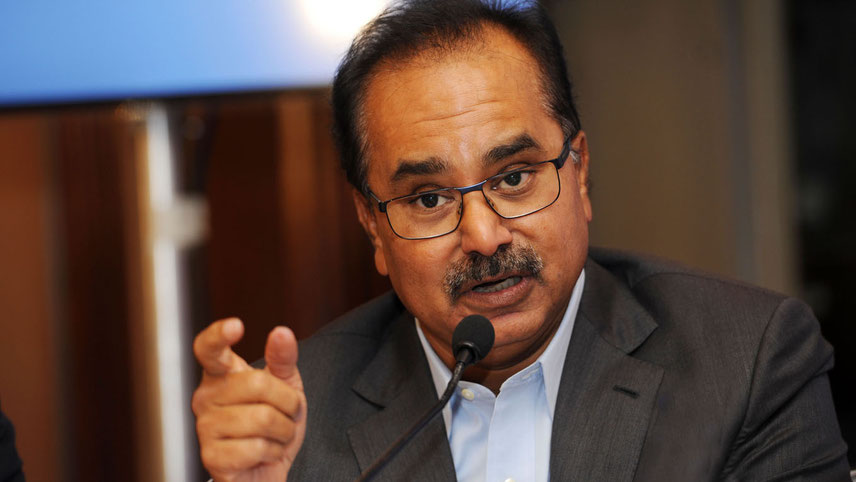

The company has also filed 59 drug master files globally, including seven filings made in the US

Their report published in May-end, when the CMP (current market price) was Rs3,915, had given a 12-month target price of Rs4,326 (the opening trade on 27 June was at Rs4,004.9). Accordingly, their advice to investors is to accumulate the scrip.

Share price erosion

On the other hand, Motilal Oswal Securities Ltd (MOSL) has taken a neutral stand because it expects the share price to see about a 3 per cent erosion (Rs3,911-3,775) over the next few months. “We expect earnings to grow at 17 per cent CAGR over FY22, led by new launches in the US, a better reach and increasing offerings in the EU, an outperforming domestic formulation segment, exercises in cost control, and improving productivity. Hence we raise our EPS estimate by 2-5 per cent for FY21 and FY22 and increase the PE multiple to 22x (from 21x earlier), arriving at a price target of Rs3,775. We believe the sharp appreciation of 50 per cent witnessed over the past two months and the current valuation would adequately factor earnings potential over the medium term,” the MOSL report says.

Nirmal Bang Institutional Equities is even less optimistic about Dr Reddys’ performance and has in fact advised its clients to sell off the scrip because it anticipates a 7 per cent downside. In its assessment, the company’s share is worth 20 times the estimated EPS for FY22, and hence it has been assigned a target price of Rs3,647.

However, all these reports were published before the Wockhardt deal was completed. Now the transaction has been completed, even though full integration of the new acquisitions may take at least the rest of the current financial year and part of the next.