-

Vaghasia: ahead of the curve

The stringent regulatory landscape of the European Union further underscores the entry barriers in the industry. Since 2018, chemical drugs imported, marketed, and sold in the EU need to be registered under the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) Regulations. Ami Organics holds a REACH registration for several of its products, which acts as a significant entry barrier.

Apart from upping its ante on the quality front, Ami recently completed the acquisition of two additional manufacturing facilities operated by Gujarat Organics Ltd. This expansion has enhanced Ami’s product portfolio to include preservatives and other specialty chemicals. “Since the acquisition, we have efficiently integrated production operations, transitioning them to our Jhagadia facility. As a result, we have successfully improved their previously negative margin, raising it to 11 per cent. With the ongoing merger process, where Gujarat Organics is now 100 per cent owned by Ami Organics, we aim to further enhance profitability and increase the margin to 19 per cent within the next 18 months,” says Patel.

As a result, Ami now boasts manufacturing infrastructure across three facilities located in industrial strongholds in Gujarat. The Sachin Facility, spread over an aggregate land area of 8,250 sq m, has an installed capacity of 2,460 MTPA, while the Ankleshwar Facility covers an area of 10,644 sq m with an installed capacity of 1,200 MTPA. Lastly, the Jhagadia Facility, covering an aggregate land area of 56,998.35 sq m, has an installed capacity of 2,400 MTPA. The Ankleshwar and Jhagadia facilities were acquired from GOL.

Chetankumar Vaghasia, Co-Founder and Whole-Time Director, AMI Organics Ltd. says, “I am happy to witness the remarkable growth trajectory of AMI Organics since its inception. With over two decades of experience in the chemicals industry, our relentless dedication, unwavering commitment, and pursuit of excellence have been the driving forces behind our success. Today, AMI Organics stands as a testament to our team’s hard work, innovation, and unwavering focus on customer satisfaction. Our emphasis on research and development, process optimization, and operational efficiency enables us to stay ahead of the curve. The chemical industry is witnessing rapid advancements and evolving demands, presenting us with immense opportunities for growth. We are well-positioned to leverage our expertise, expand our product portfolio, and explore new markets and collaborations.”

“Our operations have expanded significantly, and we continue to excel in manufacturing and supplying high-quality products to our clients in Europe and India,” says Ram Lokhande, Operations Manager at Ami Organics.

R&D: the excellence factor

In addition to its manufacturing prowess, Ami Organics heavily invests in research and development activities. Its dedicated in-house R&D facility, located in GIDC, Sachin, has earned its stripes and is certified by the Department of Scientific and Industrial Research, Ministry of Science and Technology of India.

Ami pursues product development through process innovation, achieving cost and product efficiency. The company proactively develops new products, gaining the advantage of being a first-mover. This approach enables the firm to garner 50-90 per cent share in key product offerings.

Ami has actively targeted new molecules, particularly those nearing patent expiration. Early on, Patel and his team focused on therapeutic areas related to chronic conditions. The firm aimed to identify daily dosage forms that would ensure consistent demand. “We targeted a specific molecule and started producing intermediates for it during the later stages of clinical trials, typically in phase two or phase three. Our understanding of the regulated generic pharma industry’s cycle became clear. If a patent was set to expire in 2020, we needed to start preparations as early as 2010, a decade before others, which influenced our business model,” says Patel.

Ami initiates intermediate production using non-infringing methods and multiple synthesis routes. This approach ensures that the company caters to various business needs and doesn’t miss out on opportunities. The firm’s focus lies in the generic regulated market, referred to as ‘Model 2’ internally. With this strategy, Ami has developed a wide range of molecules, with about 450-500 falling under the generic category. As these molecules have patent expiry dates extending until 2039, Ami possesses a substantial pipeline to work on.

-

Ami’s state-of-the-art facility

According to an Elara Securities report, “Ami, through its strong R&D team, constantly develops potentially successful products under patents that are likely to create large markets when off-patent. Through this strategy, Ami has developed 350-400 products, of which each year, 10-12 are expected to go off-patent and bring in sizeable growth. Other regular products may yield a 6-7 per cent CAGR”.

Analysts point out that there are over 380 products in Ami’s pipeline set to go off-patent until FY2037E, and the company has secured its position in its customers’ API drug master file (DMF), indicating strong revenue visibility.

Ami boasts a team of over 120 professionals, including ones with PhD and master’s degrees, forming an enviable pool of scientists that keeps the firm a step ahead in research. Due to its dedicated focus on innovation, Ami has filed for 12 process patents for its products, with one granted, seven published, and four in the assessment stage. The company has also been allocating approximately Rs6.5 crore to Rs9 crore in recent years, accounting for about 1.4 per cent of its total revenues.

Ami has also developed a unique method of acquiring simple chemicals and converting them into more complex derivatives with small benzene ring components. For example, if chlorobenzene is needed, the company will purchase straightforward benzene and add the required chloro-compound through chlorination. This strategy aligns with the principles of green chemistry as it aims to minimize the generation of hazardous substances during the conversion process.

In the past two years, the company has managed to transform several batch processes into continuous ones, effectively reducing most of the associated risks. Ami has trimmed down the reaction time of one process from a staggering 48 hours to a mere 3 minutes, thanks to the optimal addition of reagents.

Ami has also prioritised reducing its environmental impact, investing in an in-house wastewater treatment facility. “Over the past decade, we have achieved remarkable results, maintained a zero-discharge facility and attained 100 per cent compliance with environmental regulations. This outstanding performance is evident in our track record of zero violations and no sub-course notices, a rarity in our industry,” says Patel.

Diversified globally

Needless to say, Ami has become a sought-after destination for clients from various parts of the world. Operating in 50 countries, the company has established a well-diversified presence that mitigates risks associated with relying on just a few nations. With both domestic and multinational pharmaceutical firms on its sales roster, Ami Organics has carved a niche for itself in the large, fast-growing markets of Europe, China, Japan, Israel, the UK, Latin America, and the USA. Over the years, revenues from exports have consistently constituted a significant portion of the total operations revenue.

Ami’s top customers have been with the company for three years or more. The customer loyalty earned over the years clearly underlines the firm’s ability to secure additional business from both existing and new clients. Some of its domestic customers include Laurus Labs and Cipla, while its export customers include Organike s.r.l.a Socio Unico, Fermion Oy, Fabbrica Italiana Sintetici SpA, Chori Co. Ltd, Medichem SA, and Midas Pharma GmbH.

-

Quality control gets priority

Ami Organics boasts a formidable financial track record. The company’s balance sheet is debt-free, marking a significant milestone in financial stability. “Paired with superior return ratios and a lean working capital cycle of 90-100 days, along with better asset turnover mix, the firm’s financials are further expected to grow well in the coming years,” points out an analyst.

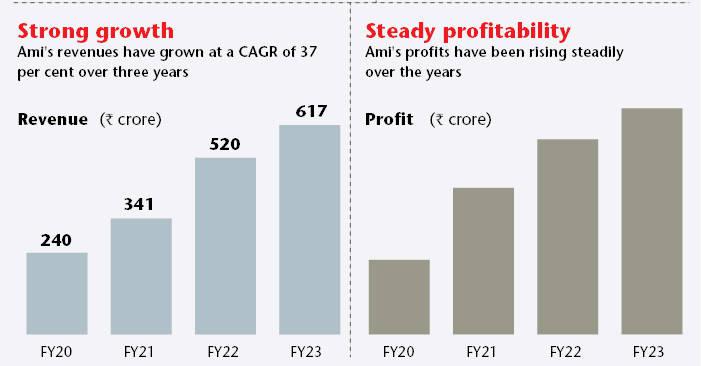

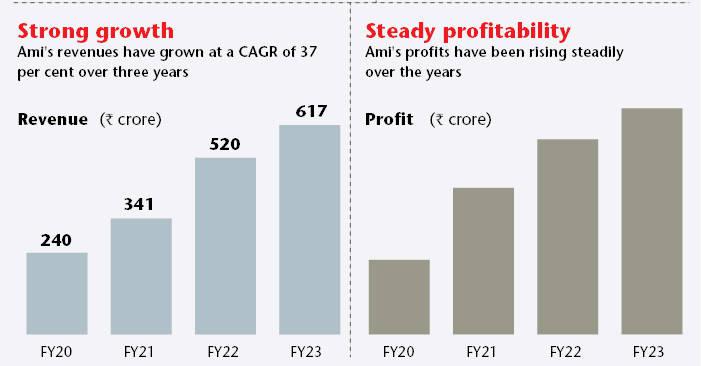

The financial performance in FY23 has been remarkable, with revenues increasing by 18.6 per cent to Rs616.7 crore. Simultaneously, operating margins (EBITDA) expanded by 16.6 per cent to Rs122.6 crore, and profit after tax soared by 22 per cent to Rs112.2 crore. According to analysts, the company is on track to achieve a healthy compound annual growth rate (CAGR) of 25 per cent from FY22 to FY28E.

This growth is projected to be fuelled by technological advancements, improved product mix, and economies of scale, leading to an expansion of both EBITDA margin and return on equity and capital employed (ROE and ROCE) above 20 per cent even in worst-case scenarios.

A vital driver for the company’s anticipated strong performance over the next few years will be the revenue mix skewed towards pharmaceutical intermediates. With a projected sales CAGR of 27 per cent, along with capacity additions in specialty and pharma intermediates expected to grow 2.5 times.

Concurring with this outlook, Haitong states in its recent report: “Going forward, we expect a topline CAGR of 22 per cent over FY23-25E, primarily driven by a robust scale-up in intermediates for anti-coagulants (Apixaban, Rivoroxaban) and Darolutamide, along with additional sales from the BFC business. The added contribution of the BFC business, with an expected EBITDA margin of 40 per cent, should offset the gross margin compression, leading to a 130-bps expansion of the base biz. EBITDA margin over FY23-25E.”

A promising landscape

The pharmaceutical and chemical industry in India stands at the precipice of a promising future. Significant investments in infrastructure design and cutting-edge technology foster enhanced implementation and valuable learning experiences. Indian pharma’s prowess in pharmaceutical API manufacturing has outshone even major players like China. Given the current trajectory, India could surpass Europe in the future.

-

Regarding chemical production, India’s strength is undeniable. A discernible shift in volume from China to India is taking place, reinforcing the country’s standing in the specialty chemicals sector. India’s significant build-up of industrial infrastructure, along with ongoing developments and considerable capital expenditures, places the Indian chemical industry on a promising trajectory.

Ami Organics has shown remarkable resilience amidst changing circumstances. Over the past decade, it has successfully reduced its imports from China, from 72 per cent to just 18 per cent, through the production of its own intermediates and collaboration with reliable Indian manufacturers. It even weathered the disruptions of the pandemic when many of its competitors struggled with delayed consignments and restrictions from China.

“We are poised for a new era of growth, and our readiness to adapt, innovate, and lead will shape the industry. We have overcome challenges, and our innovations in the chemical industry are being proven time and again. So, even as the landscape of the chemical and pharmaceutical sectors evolves, so does Ami Organics. Our commitment to sustainability, technological advancement, and global expansion continues to set the stage for the next chapter of our growth story. This journey is far from over. In fact, we are just getting started,” concludes Patel.