-

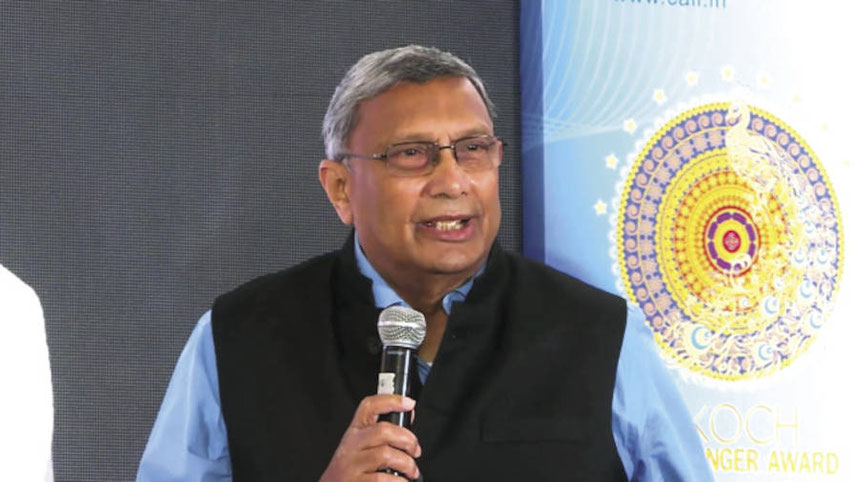

People of revdi culture will not build expressways, airports or defence corridors for you

Narendra Modi, Prime Minister, India

In 2020, at the height of the Covid pandemic, Mundle teamed up with Satadru Sikdar, a faculty at the NIPFP, to argue in an article that large fiscal deficits and even larger public-sector borrowing requirements are a regular feature of the fiscal landscape in India. In this context, they have argued that rationalisation of the prevailing large volume of non-merit subsidies should constitute a major component of fiscal reforms in order to free up fiscal space needed to address the challenge of declining growth.

While there is no official figure or calculation available for the Central and state subsidies being doled out now, it is clear that the central government’s plan to reduce subsidies (at least on food and fertilisers) is not working. The government food subsidies alone are likely to increase by 30 per cent over the Rs2.07 lakh crore to almost Rs3 lakh crore, estimated in the budget for the current fiscal. As for fertilisers, according to industry sources, the bill could rise to as much as Rs2.5 lakh crore, due to the sharp rise in international prices of fertilisers and raw materials like LNG.

Freebies galore

Among the states, Telangana seems to be leaving other state governments behind. SBI Research, while analysing the state budget documents of 2022-23, found that Telangana had committed 35 per cent of the state’s revenue receipts to finance several populist schemes. Also, Rajasthan, Chhattisgarh, Andhra Pradesh, Bihar, Jharkhand, West Bengal and Kerala have all committed 5-19 per cent of their revenue receipts towards such schemes in their Budgets for 2022-23, informs Soumya Kanti Ghosh, group chief economic adviser, SBI.

The state election in Himachal Pradesh and Gujarat is over and nine more state elections will follow in 2023. More promises will be made, more freebies will be doled out. And watch out for 2024, when all parties will compete with each other in wooing the electorate.

While the BJP has accused the Congress of being duplicitous on the NPS, as it was the Congress government in Himachal Pradesh, led by Virbhadra Singh, that had first adopted the NPS in 2004, it was said to be worried over the domino effect of the Congress move. The labour wing of the RSS, the Bharatiya Mazdoor Sangh (BMS), which was part of a pre-Budget meeting of trade union representatives with Nirmala Sitharaman, Union finance minister, on 28 November, has demanded that the government bring back the OPS for government employees, echoing what AAP promised to do in Punjab, Himachal Pradesh and Gujarat.

The BJP may call itself a ‘fiscally responsible’ party but look at what it was forced to do in Himachal Pradesh when it found that the promise of restoring back the OPS was finding traction with the government employees. In fact, Prem Kumar Dhumal, former CM and one of its own stalwarts in the state, had suggested that the government should consider OPS for Class IV employees.

The BJP however remained steadfast in its stand on the issue. However, in its manifesto, the party promised Rs2,500 every month to 5,000 girls in government schools with best performance in class 12 throughout their graduation. Also, all school girls will get bicycles and college girls scooties. While promoting female education is a laudable enterprise, one may wonder if freebies are the best way to do that.

-

We will give freebies. You give your ministers freebies, we give to the public

Arvind Kejriwal, CM, Delhi

Opposition onslaught

The Congress, which has restored OPS in the three states ruled by it (Rajasthan, Chhattisgarh and Jharkhand) is already scoring brownie points against the BJP. Ashok Gehlot, chief minister, Rajasthan, recently demanded that the OPS, which is being implemented in Rajasthan, should be implemented across the country. Addressing the state-level teacher`s conference in Jaipur, Gehlot alleged that BJP was ‘against’ the OPS.

Moreover, Tamil Nadu, Kerala and Andhra Pradesh are reportedly considering a switchover to OPS. As with the demand for One Rank One Pension (OROP) by retired service personnel, the return to the OPS is being driven by serial protests among government employees, an important political constituency, who prefer the visibility of a defined – or assured – benefit scheme such as the OPS over the relative opacity of the defined-contribution NPS. Matters have reached a pass where the Controller & Auditor General of India is now assessing the impact of OPS on finances.

The Modi government is watching the development with concern. Clearly, the government does not want anything to queer the fiscal math. But, with the Centre’s own subsidies on fertilisers and food set to touch a record level of nearly Rs5.6 lakh crore in the fiscal year ending March 2023, overshooting the earlier estimate by a third, there is not much it can do. Government sources, however, maintain that higher-than-expected tax revenue will offset the impact of these hikes on the fisc to an extent.

However, somebody will have to draw a line on subsidies and make a definitional demarcation of merit and non-merit subsidies or freebies that is acceptable to all states. But, with the 2024 election approaching, will political parties agree to swear by fiscal prudence? Modi should have attempted such a consensus at the beginning of his term, not so late.

For this, it will have to evolve a political consensus. The problem also is that there is no updated version of all kinds of subsidies that are now given – Union, state, production, consumption, implicit, explicit. The last time these subsidies were systematically quantified was the NIPFP study. “We have asked NIPFP to update their study,” says Bibek Debroy, chairman, PM’s Economic Advisory Council (PM-EAC).

Instead of waiting for NIPFP to come up with a study, the Centre can go by a white paper based on inputs like the comprehensive risk analysis of state finances done by seven experts in RBI’s monthly bulletin for June 2022. In it, subsidies given by state governments have been categorised as public or merit goods, and non-merit goods. Expenditure on what brings economic benefits, such as public distribution system, employment guarantee schemes, states’ support for education and health are merit goods.

Provision of free electricity, free water, free public transportation, waiver of pending utility bills and farm loan waivers come in the second category, which undermine credit culture and distort prices through cross-subsidisation, thereby eroding incentives for private investment and disincentivising work at the current wage rate, leading to a drop in labour force participation.

The Centre will have to set an example. Major subsidies offered by the Centre – food, fertiliser and petroleum – increased from Rs3.36 lakh crore in BE (budget estimate) 2021-22 to Rs4.33 lakh crore in RE (revised estimate) 2021-22. The main reason has been the extension of free food grain scheme PMGKAY and additional outgo on fertiliser subsidy to protect farmers from the adverse impact of price rise. In Budget 2022-23, allocation towards major subsidies was around Rs3.18 lakh crore. But this has gone up two-fold.

-

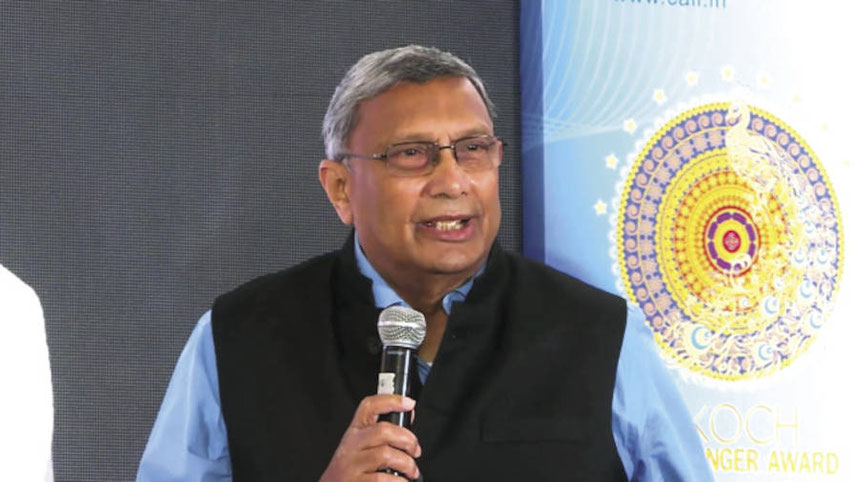

Let us first recognise the quantum of freebies

Bibek Debroy, Chairman, PM-EAC

Why NPS matters

NPS was introduced by the BJP-led NDA government of Atal Bihari Vajpayee in 2003 as the OPS had become uniquely burdensome on the fisc. In addition to inflation indexation through dearness allowance adjustments, it was wage indexed to pay-scale revisions prescribed by successive pay commissions.

NPS was one of the many market-driven reforms carried out during the Vajpayee era. State governments had shifted along with the Central government to the NPS, because they saw economic sense in it. This shift happened in all states barring West Bengal (then ruled by the Communist parties) at various points during 2004.

Like pension systems elsewhere in the world, NPS is based on the amounts contributed by the employee and employer over the working life of the employee, and the market yield obtained on the consolidated pension fund. The NPS is regulated by the Pension Fund Regulatory and Development Authority (PFRDA). Pensions for defence personnel, paid by the Central government, were the sole exemption from this shift, and continue to be paid on the defined-benefit system.

In contrast, the OPS, by virtue of benefits (by definition) unrelated to past contributions of pensioners during their working lives, needs financial support from contributions of current working employees. Like all such pay-as-you-go schemes, as the number of pensioners and benefits due to them grow, relative to the numbers paying in, it could reach a point where the alternatives are defaulting on pensions due or unsustainable borrowing.

Before the Congress released its Himachal manifesto, the three state governments that had already notified the PFRDA of their switch to the OPS were Chhattisgarh and Rajasthan (with effect from 1 April 2022), and Jharkhand (1 October 2022). Chhattisgarh and Rajasthan both have Congress governments, and Jharkhand has a coalition led by the Jharkhand Mukti Morcha (JMM), which includes the Congress party.

For the JMM, it was a poll promise, but the Congress party in the other two states did not promise the OPS in their manifestos for the previous 2018 state elections. Yet, it bowed under populist pressure of the powerful government employees’ lobby to change the system.

The stampede towards an exit from the NPS was probably triggered by the victory in March 2022 of the AAP in the Punjab state election, which was attributed to AAP’s promised return to the OPS, among other things. As elections are not a one-issue referendum, the AAP manifesto for Punjab had promised many things, including an increase in the limit of old age, as well as pensions to the handicapped and widows which carried traction with the ordinary Punjab voter. Other poll promises were free medical facilities and freeing farmers from debt.

No effective counter

Does reverting to the OPS carry widespread voter appeal? For the median voter, copybook economists argue, the OPS should be a red flag since it squeezes the exchequer from which welfare benefits flow to the common person. The OPS benefits only retirees, and should not even enthuse current employees, because the state government is likely to become insolvent by the time their defined benefits become due. The BJP could have launched a campaign on this plank, yet it seems strangely defensive.

When the new AAP government assumed power and presided over the sorry state of Punjab finances, even the payment of current employee salaries was a challenge. Hence, an exit from the NPS was not immediately notified. It was finally announced in October 2022, perhaps to lend credence to the AAP poll promises for Himachal Pradesh and Gujarat.

-

It is imperative for the states to rationalise their spending priorities in accordance with revenue receipts

Soumya Kanti Ghosh, Group Chief Economic Adviser, SBI

If the move to scrap OPS gains momentum, it would give a boost to populism in our politics. There have been suggestions that the Election Commission (EC) should require any party manifesto promise with financial implications to quantify its impact on state finances. Even if the EC introduces a fresh set of disclosures that political parties will have to make in relation to the promises in election manifestos, the problem is that the EC had tried to enforce this before through the election manifesto guidelines of 2014, but without much success.

The EC cannot sit in judgment over those numbers, or penalise non-compliance, but a requirement of that nature can be a powerful disciplining force. Even if a party fails to quantify its promises, a rival party can do the calculations and mount a more effective electoral challenge. The electoral debate will become more meaningful than it presently is.

Economists aver that return to the OPS is not the only damaging promise coming out of the political arena. The AAP manifesto for Punjab promises to abolish property tax, the only significant source of own revenue leviable by municipalities. Municipalities and panchayats in India are subject to legislation passed at the state level. Unless third-tier governments receive compensating transfers from the state exchequer, roads and sanitation, municipal school teacher salaries and public health services are all in danger of cutbacks.

Financial stability

Many believe that, with the 2024 election approaching, the Modi government will continue to dither on this issue, as well as on other populist demands. Hence, only the top court, through a body like the Election Commission, can ensure that fiscal responsibility becomes an election issue. “There is a tug-of-war underway, one side restraining inflation, the other side pulling not to restrain gross domestic product (GDP), in India as elsewhere,” notes Indira Rajaraman, an economist. “In these circumstances, it is important to head off developments which could endanger financial stability in the medium term.”

In July this year, when Prime Minister Narendra Modi criticised the revdi (freebies) culture, saying it could be dangerous for development, it was seen as an attack on the Aam Aadmi Party and the Congress. “Today, in our country, attempts are being made to collect votes by distributing free revdis. This revdi culture is dangerous for the development of the country… People of revdi culture will not build expressways, airports or defence corridors for you,” Modi said while speaking at the launch of the Bundelkhand Expressway in UP.

The first to react to Modi’s comments was Arvind Kejriwal, AAP leader and CM of Delhi, who saw it as an attack on his policies of offering free health and education, in addition to free electricity and drinking water, as well as his promises to the voters of Gujarat. “We will give freebies. You give your ministers freebies, we give to the public,” Kejriwal had said.

Nirmala Sitharaman, finance minister, shot back saying that health and education are not considered as ‘freebies’ and no government can deny those services to its citizens. Making provisions for freebies without understanding a state’s financial status will burden future generations, she said.

-

Bringing back the OPS is one of the biggest revdis that are now being invented

Montek Singh Ahluwalia, Former deputy chairman, Planning Commission

Finance ministers and leading lights of opposition-ruled states then jumped into the fray. T.M. Thomas Isaac, former FM, Kerala, argued that states have been fiscally responsible while the Union government has behaved imprudently. Palanivel Thiagarajan, FM, Tamil Nadu, said it was the prerogative of the elected government to distribute the money in a manner it deemed fit.

Within three months, the Supreme Court admitted a bunch of civil writ petitions on the issue. The petitions before the apex court and the ongoing debates raise two questions. First, can the practice of promising freebies in election manifestos to influence voters be restricted and if so, then how? How can the ‘quality’ of freebies that are promised and delivered irrespective of elections be ensured so that they were either welfare measures or developmental in nature, and not a drain on public resources?

“I think what the Prime Minister rightly called out the system of revdis and there are many more revdis than what we thought,” observes Montek Singh Ahluwalia, former deputy chairman of Planning Commission, trying to steer clear of politics but supporting what Modi had said. “Bringing back the OPS is one of the biggest revdis that are now being invented.” Ahluwalia had enthusiastically backed the NPS along with his then boss, Manmohan Singh, during the UPA years.

Never-ending debate

For years, India has debated the extent and nature of subsidies the government should provide. An attempt to bring down the subsidy bill to close to 2 per cent of GDP had prompted the unwinding of subsidies on fuel products like petrol and diesel. As a result, the share of fuel in the government’s total subsidy bill has reduced to 3.9 per cent as of the budget estimates of 2021-22. While this has led to high petrol, diesel, LPG and ATF prices and caused hardship to the people, it has stabilised the fisc to some extent.

While Modi was speaking of the revdi culture, the Reserve Bank of India’s monthly bulletin (June 2022) was highlighting the increase in non-merit freebies offered by state governments and its direct linkage to fiscal pressure. In the not so recent past, some three decades ago, a paper published by the National Institute of Public Finance and Policy (NIPFP) on Central and state government subsidies had tried to categorise goods and services offered by governments into non-merit and merit offerings and argued that non-merit freebies (also referred to as undesirable freebies in today’s context) do not deserve those subsidies.

Impact on GDP

To understand the subsidies question, it is important to compare merit subsidies and unwarranted or non-merit subsidies. Some economists limit the definition of merit subsidies to four items – food, primary and secondary education, health and water supply and sanitation. They consider all other subsidies unwarranted or non-merit. Mundle and Sikdar noted in a follow-up analysis published in 2019 that the share of merit subsidies had increased from around 36 per cent in 1987-88 to over 44 per cent in 2015-16, which meant that non-merit subsidies still accounted for 56 per cent of total subsidies.

Merit subsidies are mainly for social services, were mostly provided by states. However, the share of merit subsidies is slightly lower than non-merit subsidies for states because a major portion of it, such as food subsidy, is provided by the Central government. Incidentally, both the Centre and state governments do not define merit and non-merit subsidies.

-

Not all subsidies are undesirable

Sudipto Mundle, Senior advisor, NCAER & member, XIVth Finance Commission

Soumya Kanti Ghosh of SBI believes that it is imperative for the states to rationalise their spending priorities in accordance with revenue receipts. Farm loan waivers and return to the OPS are economically unsustainable and, in that sense, non-merit subsidies. Bibek Debroy of PM-EAC says that to first start a frank debate on freebies, “Let us first recognise the quantum of freebies”.

“Besides, it has to be a general debate. We need a total of all subsidies,” Debroy continues. “For state governments, this will primarily be subsidies for power and road transport sectors. And then we need to decide which of these deserve such a treatment. Philosophically, for everything, we are looking at the Socio Economic Caste Census data. So, anyone who is deprived under SECC deserves a subsidy.”

Opposition-ruled states like Kerala say that, to resolve the subsidies imbroglio, the key question what needs to be answered is: who has been performing in a fiscally responsible manner – the states or the Union? In 2000-01, the combined revenue deficit of the Union and states had reached a dangerous level of 6.45 per cent of GDP, the Union’s deficit being 3.91 per cent and states’ deficit 2.54 per cent, argues Thomas Isaac, former state FM.

After the FRBM Act was passed, the deficit ratio came down and in 2010-11 it was 3.20 per cent, which was entirely the Union government’s contribution. In 2010-11, the Centre’s revenue deficit was 3.24 per cent, while state governments together had a revenue surplus. Since then, the average revenue deficit of states and the Centre was 0.05 per cent and 3.15 per cent, respectively, till Covid stuck.

Possible solutions

Non-merit subsidies will now have to be discouraged by all possible means. The 15th Finance Commission notified by the government in 2017, in its terms of reference (ToR), considered proposing measurable performance-based incentives for states, at appropriate levels of the government, to control or stop recurring expenditure on populist measures. Three years later, the Commission’s report said some states opposed the particular ToR on grounds that the categorisation of schemes into populist and non-populist cannot be done objectively as development requirements differ from state to state.

While an immediate consensus among political parties on the freebie issue is unlikely, it falls on the central political leadership to at least convince every stakeholder that the social security required to deal with economic and social inequalities that exist in India requires better targeting and the subsidies, if any, should be more streamlined. That would be a beginning.

-

NPS does not guarantee pension benefits to retirees but helps them create a retirement corpus

Subsidies versus freebies

A subsidy, according to most economists, is anything where the government provides services to the public and does not recover its costs. According to Sudipto Mundle, senior advisor, NCAER & member, XIVth Finance Commission, food, fertilisers and petroleum are visible subsidies, separately carved out in the budget.

Not all subsidies are undesirable. In a research paper published in September 2020 titled Subsidies, Merit Goods, and Fiscal Space, Mundle and Satadru Sikdar of National Institute of Public Finance & Policy wrote that for some goods and services, the social benefit of subsidising consumption is high. “For such items, a subsidy is socially desirable to induce private consumption beyond the level dictated by the private cost-benefit calculus at market prices.”

But, then, what is a freebie? The Modi government is providing free food grain to the poor under the Pradhan Mantri Garib Kalyan Anna Yojana (PM-GKAY) – a practice that began during the pandemic lockdown when economic activity was at a standstill across the world. The practice is still continuing, though the lockdown has been lifted. Isn’t that a freebie?

J.P. Nadda, president of BJP, recently said that PM Modi had empowered the poor people by ensuring food for them. “As a result, while all other economies of the world struggled, India withstood the pandemic. While the IMF concedes that extreme poverty in India has come down to less than 1 per cent, it’s the free ration that has had a big role to play in that.”

“We believe in empowerment,” Nadda adds. “Giving free education, LPG connections to people, and making toilets is all empowerment. But offering free electricity is an allurement.” But he also admits, “There is a thin line between freebies, allurement, and empowerment.”

Mundle and Sikdar label subsidies for primary and secondary education, health services, and food as merit subsidies. All others are treated as non-merit subsidies. As such, while food is a merit subsidy and increased bill for that may be justified.

But fertilisers subsidy is classified as non-merit and may need to be brought down. The cost of fertiliser production in India is high and a lot of these companies, including public sector undertakings, would have to shut if they had to compete with fertiliser imports.

So, how does one tackle this? Mundle suggests income transfers to farmers instead. “They are less patronising, more transparent and with fewer leakages.”