-

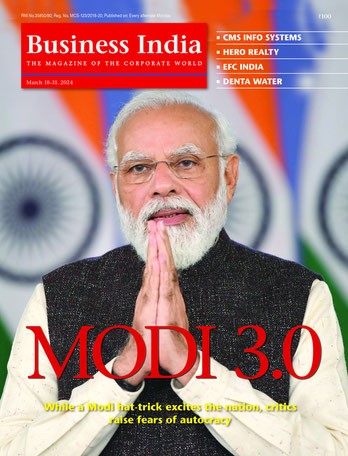

Modi addressing Indian diaspora in Germany: Indian farmers are coming forward to ‘feed the world’

The government also scaled down its wheat procurement target. Till 4 May, wheat procurement in the ongoing marketing season was seeing a precipitous drop, with the Centre procuring just17.5 mt of wheat. This could at best touch 19.5 mt, when the season ends. In the last marketing year, the government had purchased 43.3 mt of wheat from farmers, and this year it had set a target of 44.4 mt.

Indeed, the sudden spike in temperatures from the second half of March – when the crop was in grain-filling stage, with the kernels still accumulating starch, protein and other dry matter – had taken a toll on yields. Admitting that the total wheat production for 2021-22 might fall short of the target, Sudhanshu Pandey, Union food secretary, cites the early onset of summer as a reason for the decline in wheat yield to 105 mt.

Private estimates vary from official ones. Ajay Vir Jakhar, chairman, Bharat Krishak Samaj, an association of farmers, expects yields to drop by an average of 15 per cent across India due to the heat. That estimate would bring down last year’s yield to less than 100 mt. Indeed, in some wheat-growing areas – barring Madhya Pradesh, where the crop is harvest-ready by mid-March – farmers have reported up to 30 per cent decline in per-acre yields.

With the heat waves singeing the country’s cropland, doubts began creeping in about New Delhi’s newfound role in exporting wheat to help fill global grain stores from Egypt to Bangladesh depleted by the war in Ukraine. Yet, the government put up a brave face and, till last fortnight, has put forward claims that, up to 8 mt of wheat will still get exported. Contracts had been finalised for the export of 4.5 mt of wheat, of which 1.46 mt were shipped out in April and 1.5 mt will be done in May.

This was a steep climb down from the middle of April, when Commerce Minister Piyush Goyal was exuding confidence that India’s wheat exports in the current fiscal will breach the initial target of 10 mt and may even touch 15 mt. There was talk of the government activating its economic diplomacy channels with countries that are potential buyers of wheat in order to explore trade opportunities. Modi, on his recent overseas tour, carried the optimism to foreign shores. He told the Indian diaspora in Germany that Indian farmers are coming forward to ‘feed the world’ as many big nations are struggling to meet wheat supplies.

Wheat exports have witnessed a quantum jump in recent years – from just 2,17,000 tonnes in 2019-20 to 2 mt in 2020-21 and more than 7 mt in 2021-22 (half of which was to Bangladesh) – on the back of bumper harvests. The export prospect for 2022-23 has been brightened by the offer of a large buyer like Egypt to purchase wheat from India. According to M. Angamuthu, chairman, Agricultural & Processed Food Products Exports Development Authority, India aimed to supply 3 mt of wheat to Egypt alone in 2022-23, after Cairo has added New Delhi to the list of wheat import destinations.

Till recently, the government was reluctant to comment on the fallout of the damage done by the heat waves. Officials in the food ministry merely said that that an assessment was being done. Later, as wheat and atta prices shot up, the government realised that the matter could not be kept under lid.

In a meeting with flour millers, Sudhanshu Pandey revealed that the government could impose stock limit on wheat if the price situation turns ‘alarming’. One of the strategies being contemplated was setting a minimum export price so that wheat cannot be shipped overseas below this level. This way, without outrightly banning it, the government can boost domestic supply and keep a check on prices.

-

Goyal: wheat exports may touch 15 mt

But, with the situation turning more alarming, an inter-ministerial committee was informally set up, headed by Amit Shah, Union home minister, to take a call whether export curbs are needed to ensure domestic availability. It was Shah who smelt the political dangers of wheat inflation and led the government towards the ban.

The decision to ban exports has been described as ‘a stitch in time’ by official sources. However, even these sources concede that more than just a ban is the need to have a coordinated approach to address the looming wheat crisis. It is necessary for the government to take a clear stand about production, procurement, prices and export. With procurement by official agencies suffering and the final procurement figure sure to fall far short of the initial target, this will tighten wheat availability after August with potential for prices to rise further.

Political rivals of the Bharatiya Janata Party are now saying that chief among the factors that sent the monthly retail average price of wheat flour to a 12-year high was the carte blanche given to market forces. This led to prices of wheat crossing the MSP in many parts of India. But there were other factors at play.

The shorter the distance to the ports, the higher the premium exporter/traders have paid over the MSP. Even in Punjab and Haryana – where the state governments charge up to 6 per cent market levies, compared to 0.5-1.6 per cent in MP, Uttar Pradesh and Rajasthan – flour millers have paid farmers Rs50-100 above the MSP of Rs20,150 per tonne.

Traders and millers weren’t the only ones stocking up in anticipation of prices going up further. Many farmers, especially the more entrepreneurial/better-off sections among them, are also holding back their crop. The government has now extended the wheat procurement season to 31 May hoping that with private traders showing less interest because of the export ban, the government procurements from farmers who had stocked up will increase.

The end-result of a heat wave-affected crop and open market prices rising closer to export parity levels could see wheat purchases by the government may slump to 19.5 mt in 2022-23 – less than half of 43.3 mt planned earlier. In Madhya Pradesh, Uttar Pradesh, Rajasthan and Gujarat, farmers sold wheat to traders-exporters at Rs21-24 per kg, which is better than the MSP rate of Rs20.15 per kg. With opening stocks of 19 mt and expected procurement of 19.5 mt, government agencies would have about 38 mt of wheat available for 2022-23.

Not all this, however, can be sold, as a minimum operational stock-cum-strategic reserve has to be maintained. The normative buffer or closing stock requirement for 31 March is 7.5 mt – providing for that will leave about 30 mt available for sale from government godowns this fiscal.

Will that quantity suffice for the public distribution system, mid-day meals and other regular welfare schemes, whose annual wheat requirement is around 26 mt? The last two years – 2020-21 and 2021-22 – have also witnessed substantial off-take under the Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY) scheme (10.3 mt and 19.9 mt respectively). This is the vast food subsidy scheme that feeds some 800 million people as part of its pandemic response. With open market sales to flour mills (2.5 mt and 7.1 mt in 2020-21 and 2021-22 respectively) also growing, there’s clearly not enough wheat for these.

This explains the Centre’s recent decision to slash allocation under the PMGKAY from 10.9 mt to 5.4 mt for April-September 2022. Meeting even this requirement may not be easy, leave alone supplying to millers and other bulk consumers to moderate open market prices during the lean months after October. To ease the pain, the government is reducing the wheat component of its scheme with rice.

-

Traders and millers weren’t the only ones stocking up in anticipation of prices going up further. Many farmers, especially the more entrepreneurial/better-off sections among them, are also holding back their crop

There is talk that is wheat prices keep on firming up, one might see a rerun of what happened in 2006-08. That period, too, saw a worldwide agri-commodity price boom and production shortfalls, causing reduced procurement and depletion of stocks. However, the relatively tight supplies in wheat this time is compensated for by the comfortable public stocks of rice. At over 55 mt as on 1 April, these were more than four times the required buffer of 13.6 mt.

In a crunch situation, rice can compensate for atta. But what about the larger issues at stake? Indeed, when the world was relying on India to alleviate a global wheat shortage, the freak March/April heat really threw a spanner in the works. But the fault doesn’t totally lie with Putin’s aggression or Zelensky’s dogged resistance in Ukraine. India will henceforth have to factor in the vagaries of climate change in its food security calculus.

The inflation that was brewing for some time had been ignored by the Reserve Bank of India and the authorities. It is only now when inflation is surging that the RBI has raised key interest rates last fortnight, sending bonds and stocks tumbling. Shaktikanta Das, governor, RBI, said that persistent inflation pressures are becoming more acute, particularly on food, adding there’s a risk that prices stay at this level for ‘too long’.

Just 25 days ago, in its scheduled monetary policy statement, the RBI had decided to continue its ‘accommodative’ policy to support growth by keeping the benchmark repo rate unchanged at 4 per cent. Now, the RBI has chosen to reverse its stand and came down with a sledgehammer to not only raise the repo rate by 40 basis points, but also withdraw about Rs87,500 crore immediately from the banking system by raising the Cash Reserve Ratio (cash banks have to mandatorily keep with RBI) by half a percent.

Clearly, the central bank had miscalculated the extent of inflation. The RBI projected consumer price inflation at 5.7 per cent for 2022-23 in its early April statement. But the monthly retail inflation number for April is now 7.8 per cent. This is a huge underestimation. Also, for 2022-23, the RBI had projected inflation at 6.3 per cent in Q1, 5.8 per cent in Q2, 5.4 per cent in Q3 and 5.1 per cent in Q4. All this would have to be overhauled.

There is also not much that the government may be able to do to douse the fires of food inflation. Edible oil prices are on fire. But it is wheat we are talking about. With the private sector buying off of much of the stock from farmers, the deficit in government wheat procurement will certainly lead to higher wheat prices, unless the government’s rearguard action works.

-

Jakhar: a 15 per cent yield drop is expected

What should the government have done? Experts feel that the government should have stepped in earlier to monitor closely the wheat availability situation as well as the rake movements to ports and ships booked for exports and the contracts signed by the private trade for exports in future. While it may be a good time for Indian wheat exporters and farmers to earn from high global prices, farm experts like Siraj Hussain, former agriculture secretary, believe that government just needed to hark back to 2004-05, when lack of information on private trade contracts resulted in much larger quantities of wheat exports than intended by the government, resulting in depletion of central pool stock to 2 mt (that was half of the buffer stock norm of 4 mt on 1 April 2006). This had to be followed up by imports in the following years. In the intervening period, wheat prices in the open market shot up.

Some similar worrisome signs have surfaced. The fall in production and higher demand from private buyers, thanks to the government’s encouragement to wheat exports, has seen wheat prices in the open market hovering above the MSP of Rs2,015 per quintal announced for the current rabi marketing season.

The all-India monthly average retail price of wheat flour, which goes into our daily bread, was Rs32.38 per kg in April, the highest since January 2010. Atta prices have been rising as both production and stocks of wheat have fallen in India, and demand has risen outside the country. According to data reported by State Civil Supplies Departments to the Union Ministry of Consumer Affairs, Food & Public Distribution, the all-India average retail price of wheat flour on 7 May was Rs32.78/ kg – 9.15 per cent higher than the price (Rs30.03 per kg) a year ago.

The food ministry data show wheat stocks stood at 19 mt at the beginning of 2022-23, which, with the 1.95 million tonne procurement in the current season, is expected to rise to 3.85 million tonnes. Taking into account the allocations for distribution under the National Food Security Act (NFSA), 2013; Other Welfare Schemes; and PMGKAY, 2022-23 is expected to end with a balance of 8 million tonnes of wheat in government stocks – a little more than the minimum stocking norm of 7.5 mt as on 1 April.

In view of the lower opening stock and lesser procurement, the government has begun to rework its wheat math by revising the states’ allocations under the PMGKAY, under which 5 kg of food grains per month are being provided free to individual beneficiaries covered under the NFSA. After the revision, wheat allocation under PMGKAY will come down to 0.7 mt per month from the 1.8 mt per month now, enabling the government to save about 5.5 mt of wheat during the remaining five months of PMGKAY, which is scheduled to run until September.

-

The fall in production and higher demand from private buyers, thanks to the government’s encouragement to wheat exports, has seen wheat prices in the open market hovering above the MSP of Rs2,015 per quintal announced for the current rabi marketing season

While the NFSA and PMGKAY have provided a cushion to about 800 million beneficiaries, a large number of people living just above the poverty line are not covered under any food grain scheme of the Centre or states. This group of people is likely to be hit the hardest by the rising prices of atta and bread.

The government now faces a dilemma. Curbing exports is bound to hit India’s and Modi’s image of India increasingly playing a global role. The move would also add to a wave of crop protectionism around the world as governments seek to protect their own food supply amid soaring prices and fears of shortages. That has the potential to worsen global food inflation, which is already at a record and surging at a rampant pace.

The fall in production also raises concerns for the domestic market, as millions depend on farming as their main livelihood and food source. Weaker output will hurt farmers’ incomes. As the government also buys wheat for its welfare programme, which provides subsidised food to two-thirds of the population, food security has an economic and political angle. If disrupted, it can create the perfect storm. The Modi government is hoping that its belated action, though knee-jerk, will deliver the right results.

-

The RBI projected consumer price inflation at 5.7 per cent for 2022-23 in its early April statement. But the monthly retail inflation number for April is now 7.8 per cent. This is a huge underestimation

The perfect storm

* According to a report by the World Food Programme, the ‘unfolding war in Ukraine’ is likely to ‘exacerbate the already severe 2022 acute food insecurity forecast’ in many countries.

* India is the second-largest producer of wheat in the world, with China being the top producer and Russia the third-largest. Ukraine is the world’s eighth-largest producer of wheat.

* After five straight years of a bumper wheat output, India has had to revise downwards its estimated production to 105 mt.

* Unprecedented heat waves across the north, west and central parts of the country, and March and April being the hottest in over 100 years, have caused substantial loss to the yield.

* Government’s wheat purchase has seen a dip owing to several reasons from lower yield to higher market prices being offered by private traders.

* Wheat/atta inflation turns alarmingly high.

*Farmers are holding on to some quantity of wheat, expecting higher prices for their produce in the near future. This may further act as fuel to food inflation.

*Government swaps wheat with rice for the food security programme.

* Ban imposed on wheat exports.