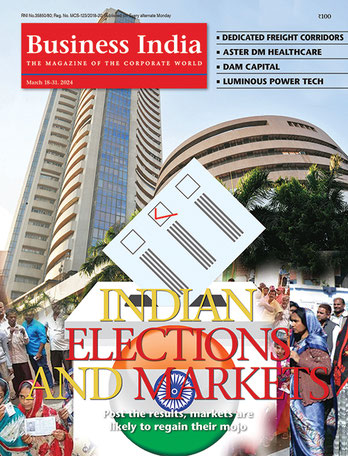

Industry body CII has called upon the government to create a special fund that would underwrite the timely payment of generation, transmission, and renewable companies’ dues for the next six months. Renewable energy, a sunrise industry, has seen at least two ongoing deals reach conclusion last month. On 7 April South Africa's Total SA completed an investment of Rs3,707 crore in a 50:50 joint venture with the BSE-listed Adani Green Energy through a step-down subsidiary. Adani Green operates a 2,148 megawatt (MW) solar power portfolio spread across 11 Indian states. On 27 April, Shapoorji Pallonji Infra sold 317 MW of operational solar assets to investment firm KKR for Rs1,554 crore. An estimated three gigawatt (GW) of wind and solar projects are facing payment delays and potential cost overruns due to disruptions in the supply chain as well as the workforce.

But industry players say that these negotiations were ongoing and from before Covid-19 and lockdown directions. India's daily power demand has since declined by 25-28 percent, driven by factory and office closures in the commercial and industrial sectors. A halt in economic activity has led to stalled payments by distribution companies, with some considering the 'force majeure' clause to tide over the crisis.

In its report titled "Sustaining India’s Power and Renewable Energy Sector in the Wake of COVID19", CII has recommended that instead of stopping payments to power producers, the distribution companies should raise working capital and pay the producers instead. "This is better than individual IPPs raising the same working capital," it adds.

Renewable energy generators were owed Rs10,000 crore from distribution companies pre-lockdown, and further payment delays are likely to result in a strain on cash flows from ongoing projects. About 20-25 per cent of debt owed by renewable energy projects also comes from overseas lenders, to whom the Reserve Bank of India's three-month moratorium does not apply.

-

File picture of a solar power plant in Telangana